Oil Leads Commodity Rally After US-China Truce as Gold Retreats

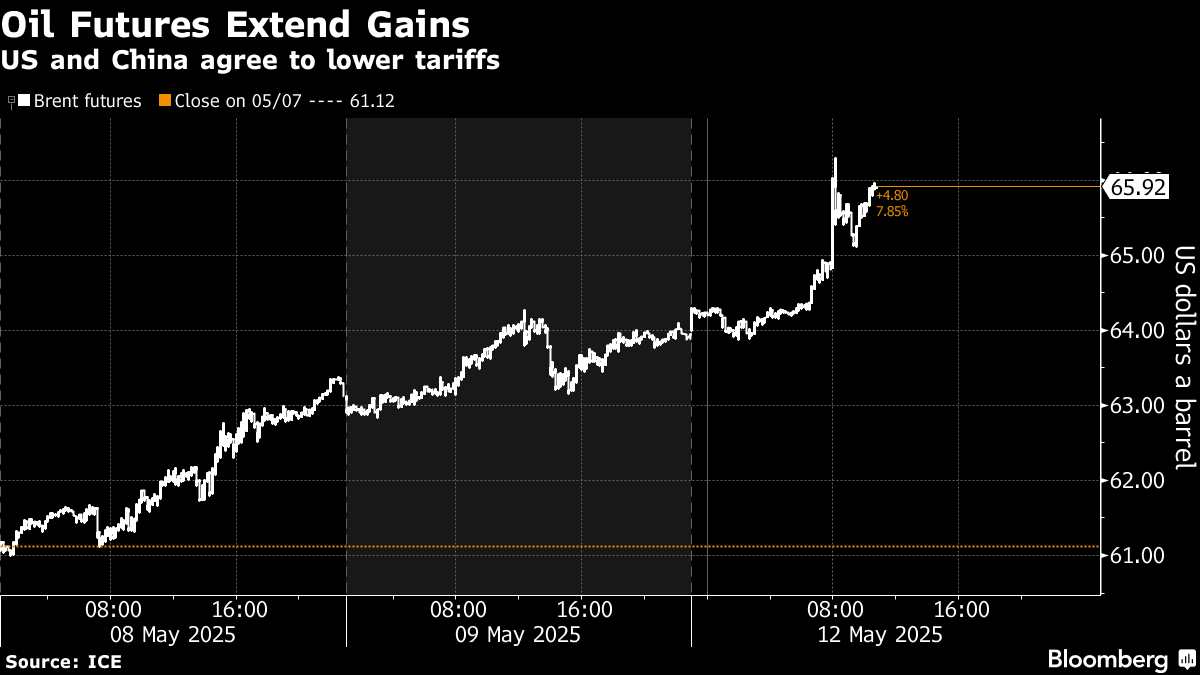

May 12, 2025 by Bloomberg(Bloomberg) -- Oil powered higher with most other commodities, while gold fell, after China and the US agreed to lower tariffs on each other, following a weekend of trade talks.

Brent crude added as much as 3.7% in London and copper rose 1.4%. European natural gas, soybeans and iron ore also rallied. Shares of the top mining companies surged, while bullion lost ground as haven demand eased.

The truce between the world’s two largest economies brings relief to commodity markets roiled by prohibitive tariffs that dented the outlook for global growth in past weeks. Oil watchers have been slashing their demand forecasts and there have been signs that the trade war is already hitting the amount of goods arriving in the US.

China will reduce its tariffs on US goods to 10% from a level that climbed to 125% when the two nations placed retaliatory restrictions on one another. The reduction will last for 90 days, while the US will reduce its own curbs to 30% from 145%.

At a briefing after the talks, US Treasury Secretary Scott Bessent said neither nation wanted their economies to decouple. In a statement, the two countries said they would establish a mechanism to continue discussions about economic and trade relations.

The announcement came after a weekend of talks in Geneva involving Bessent, US Trade Representative Jamieson Greer and a Chinese delegation led by Vice Premier He Lifeng.

The lower levies are “reducing fears of a prolonged economic fallout hurting demand,” said Ole Hansen head of commodities strategy at Saxo Bank. “The key question is whether today’s news marks peak optimism, given the low likelihood of a full US retreat from its stance on China.”

Commodities have been volatile ever since Trump first announced reciprocal tariffs in early April. Oil prices are still down 13% since then as the crude market also contends with rising supplies from the Organization of the Petroleum Exporting Countries and its allies.

Companies Rally

Shares of top miners including Glencore Plc and Rio Tinto Plc rose more than 5% in London. Miners also led gains in Europe’s equity markets. Oil and energy companies also climbed.

Copper prices, which fell sharply after tariffs were first announced, have rebounded strongly on signs that demand is holding firm in China for now.

Soybean futures in Chicago also extended gains after the announcement, trading at the highest since late February. China is the world’s top soybean buyer and the thaw could help re-open stalled crop flows between the nations. Cotton futures jumped, rising as much as 3.4%.

Meanwhile, declines in gold were compounded by a de-escalation of military hostilities between India and Pakistan. A ceasefire between the two nations appears to be holding after four days of clashes that brought the two nuclear-armed nations close to a full-blown war.

©2025 Bloomberg L.P.

By