Asian Shares Start Week Cautiously, Futures Drop: Markets Wrap

Apr 28, 2025 by Bloomberg(Bloomberg) -- Asian shares had a modest start to the week as investors awaited progress in US trade negotiations with the region and signs of further stimulus from China before taking risky bets.

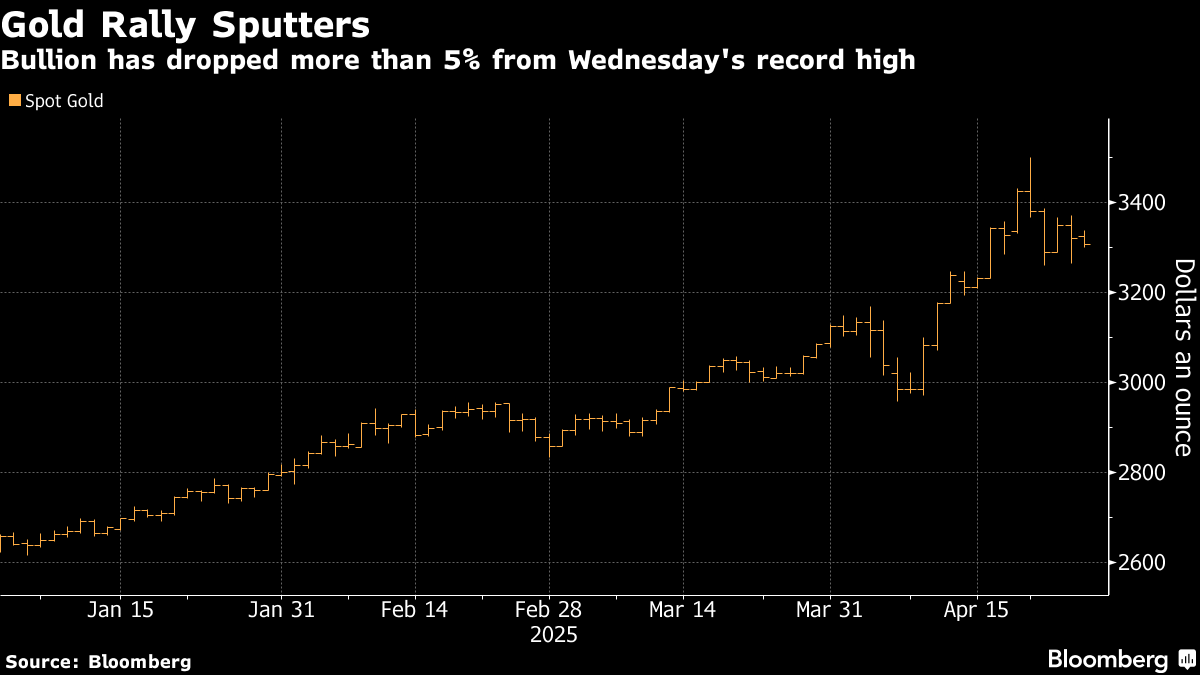

A regional gauge advanced 0.7% while futures for the S&P 500 declined 0.6%, indicating a four-day US equities rally may snap. Gold dropped as much as 1.6% as traders unwound positions on signs the metal’s advance may have run too far and too fast. Treasuries and the dollar were steady.

Amid Asia’s busiest earnings week this season, investors will focus on key economic data- the Bank of Japan’s rate decision, and US jobs report and gross domestic product data - to see if the recent steadiness in markets will continue as tariff tensions tamp down. Traders are also taking some comfort from hopes that the Federal Reserve may reduce interest rates earlier than expected.

The “market is getting more sanguine in recent weeks, but I’m more inclined to stay defensive, and stay more oriented to domestic plays across markets,” said Xin-Yao Ng, a fund manager at Aberdeen Investments in Singapore. “The environment will remain highly uncertain and volatile throughout the year, with constant tension around tariffs and geopolitics.”

Investors will be on watch for any signs of progress in US trade negotiations after President Donald Trump suggested another delay to his higher tariffs was unlikely. Asian economies geared for exports and facing some of the highest US “reciprocal” tariffs are leading the way over their western counterparts in trade negotiations with the administration.

To help manage the next steps, the Trump team has drafted a framework to handle negotiations with about 18 countries, including a template that lays out common areas of concern to guide the discussions.

US Treasury Secretary Scott Bessent said the Trump administration is working on bilateral trade deals with 17 key trading partners, not including China. Bessent reiterated the administration’s argument that Beijing will be forced to the negotiating table because China can’t sustain Trump’s latest tariff level of 145% on Chinese goods.

“Ultimately, we have to think about what is the steady state tariffs from the US to the rest of the world,” said Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International on Bloomberg TV. “How does the rest of the world, especially China and Europe, cope with that. So there’s a lot of uncertainty and that makes obviously planning very, very difficult for businesses.”

Equities in China and Hong Kong fluctuated between gains and losses Monday.

Some investors also doubt that Wall Street’s history of quick resurrections will repeat. They’re sweating over categories of high-frequency data that, while far from front-page news, may provide clues as to whether April’s policy disruption will cause lasting economic pain.

Meanwhile, China’s finance minister Lan Fo’an said the nation will adopt more proactive and effective policies to achieve its growth target and “bring stability and impetus to the global economy,” in a statement posted on the ministry’s Website on Saturday.

Chinese officials on Monday reiterated their plan to strengthen support for employment and the economy. The country is confident of reaching economic targets this year, officials said. The People’s Bank of China also said it will maintain ample liquidity in the markets and will cut banks’ reserve requirements and interest rates in a “timely manner.”

In Japan, Toyota Industries Corp. is poised to surge by the daily limit even as investors scrambled to interpret what Toyota Motor Corp. Chairman Akio Toyoda’s proposal to buy out the company would mean for corporate governance at Japan’s largest business group.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.5% as of 2:09 p.m. Tokyo time

- Japan’s Topix rose 1%

- Australia’s S&P/ASX 200 rose 0.6%

- Hong Kong’s Hang Seng rose 0.1%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1376

- The Japanese yen rose 0.2% to 143.44 per dollar

- The offshore yuan was little changed at 7.2956 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $94,111.84

- Ether fell 0.7% to $1,790.6

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.25%

- Australia’s 10-year yield declined seven basis points to 4.17%

Commodities

- West Texas Intermediate crude rose 0.5% to $63.31 a barrel

- Spot gold fell 0.7% to $3,297.63 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By