Asian Stocks Bounce Back After Worst Day on Record: Markets Wrap

Apr 08, 2025 by Bloomberg(Bloomberg) -- Shares in Asia rebounded after posting a historic loss, as Japan led gains on expectations that it will get priority in US trade talks. Treasuries gained after Monday’s sharp selloff.

Benchmark gauges in Japan rose more than 5%, along with futures contracts for the US and Europe. Equities in Hong Kong and China advanced as state-linked funds scooped up assets and the central bank promised loans to help stabilize the market. Oil gained while gold climbed for the first time in four days. The dollar slipped against major peers.

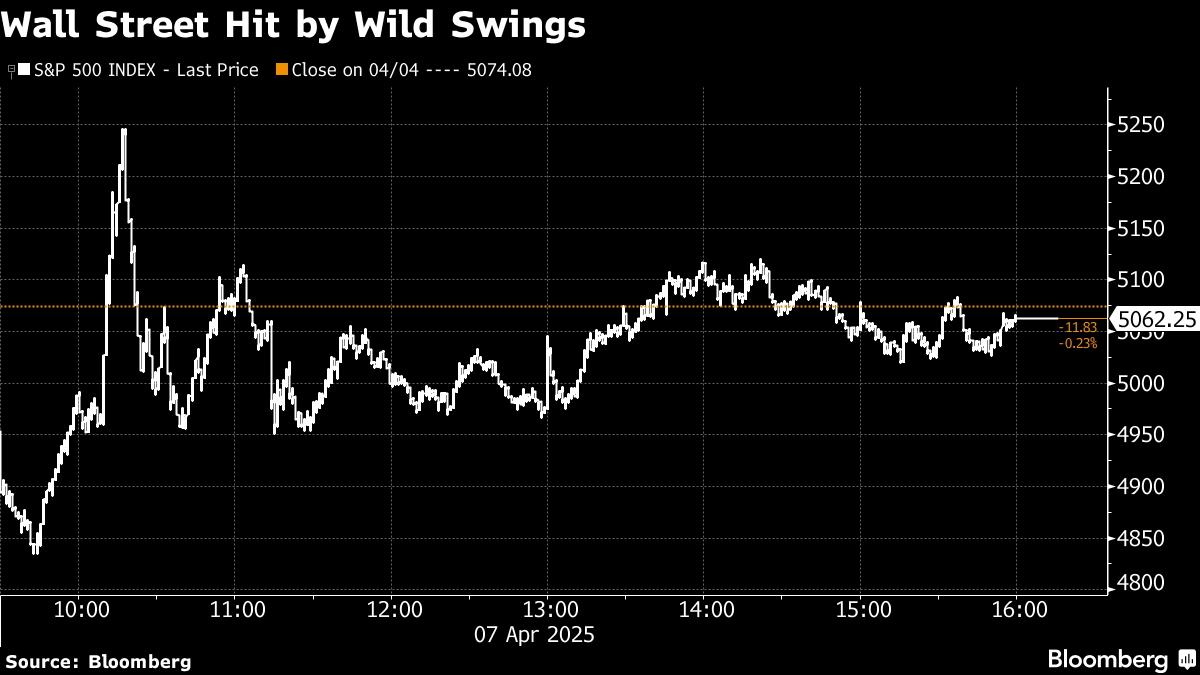

Volatility has surged with $10 trillion wiped off global equities after the US unveiled sweeping tariffs last week. As fears of a global recession and escalating trade war mounted, investors have been left clinging onto any signs of respite. For now though, President Donald Trump has threatened to slap an additional 50% tariffs on China, while dangling the prospects of some negotiations.

“It’s too early to say that we have turned the corner particularly with Trump still floating the idea of additional tariffs on China,” said Tim Waterer, chief market analyst at KCM Trade. “There are lots of moving parts and a recession remains in the equation as a possibility whiles the US continues to play hardball with tariffs.”

Japanese shares jumped as Trump assigned two members of his cabinet to kick off bilateral trade talks after a call with Prime Minister Shigeru Ishiba. Japan appeared set to get priority over other US trading partners in talks on tariffs, putting Tokyo at the head of a long queue of nations seeking to roll back the levies.

Trump made a litany of comments Monday about his planned duties on worldwide trading partners. Yet the president offered little clarity about what he is seeking in exchange for lowering duty rates — or whether he’s willing to offer relief at all.

“I don’t think we’ve progressed any further in terms of getting clarity on where this trade negotiation lies,” said Peter S. Kim, investment strategist at KB Securities. “The market has been very surprised by the intensity and the scale of the trade war, and weaponizing of it.”

(Get the Markets Daily newsletter.)

On Tuesday, China slammed the US for threatening to raise tariffs and pledged to retaliate if Washington followed through.

“The US threat to escalate tariffs on China is a mistake on top of a mistake, which once again exposes the blackmail nature of the US,” the Chinese Ministry of Commerce said. “If the US insists on its own way, China will fight to the end.”

Meanwhile, in signs that Beijing is gearing up for prolonged trade tension, its state-backed funds pledged to buy local equities and exchange-traded funds. The central bank said it will provide support to a sovereign fund when it’s necessary, in order to safeguard the stability of capital markets. It also allowed the yuan to weaken through a lower reference rate.

Taiwan stocks moved further into bear territory Tuesday, with the equity benchmark falling as much as 5.4% to the lowest level in 14 months, bucking a rebound in regional peers. The selloff pressure weighed on the local market after over 900 stocks hit a limit down on Monday.

In the bond market, Treasuries fell Monday, erasing a portion of their biggest weekly advance since August. The yield on the 10-year rose 19 basis points as investors liquidated profitable trades to cover equity losses. They dropped four basis points on Tuesday.

“Last night’s price action was more about de-risking and taking profit on those trades which are in the money to cover losses on other assets such as equities,” said Damien McColough, Sydney-based head of fixed income research at Westpac Banking Corp.

Traders’ bets on how much the Federal Reserve will lower US interest rates this year have been fluctuating. At least three reductions are now reflected in overnight interest-rate swaps this year, with the first fully priced in for June. Fed Chicago President Austan Goolsbee said there’s a lot of anxiety among business leaders that tariffs could spark widespread supply disruptions and renew inflationary pressures.

An increasing number of prominent finance executives have spoken out about the risks of Trump’s tariff policy, with billionaire Ken Griffin calling it a “huge policy mistake” by the administration.

Back in Asia, the MSCI Asia Pacific Index jumped as much as 2.6%, bouncing back from the 8.7% tumble Monday, the worst on record. The 14-day relative strength index for the gauge fell below 30 on Monday, a level some investors consider as oversold.

“The market is finding a temporary bottom, which could lead to a new probe of the downside before stabilizing,” said Rajeev De Mello, global macro portfolio manager at Gama Asset Management. “Investors are waiting for President Trump to blink. The pressures on him to explain to the public and investors what is the endgame are mounting. He will not want to capitulate too fast, but we are close.”

In Asian corporate news, shares of Chinese auto giant BYD Co. jumped more than 7% in Hong Kong after saying its first-quarter net income will jump. Samsung Electronics Co. gained as much as 4% after profit beat expectations on Galaxy S25 smartphone and legacy DRAM chip sales.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 1.2% as of 1:42 p.m. Tokyo time

- Japan’s Topix rose 5.3%

- Australia’s S&P/ASX 200 rose 1.7%

- Hong Kong’s Hang Seng rose 1.6%

- The Shanghai Composite rose 0.9%

- Euro Stoxx 50 futures rose 2.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.6% to $1.0975

- The Japanese yen rose 0.2% to 147.58 per dollar

- The offshore yuan was little changed at 7.3383 per dollar

Cryptocurrencies

- Bitcoin rose 1.7% to $80,296.21

- Ether rose 1.6% to $1,595.51

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.15%

- Australia’s 10-year yield advanced 13 basis points to 4.23%

Commodities

- West Texas Intermediate crude rose 1.4% to $61.56 a barrel

- Spot gold rose 0.4% to $2,996.37 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By