Fed Reprieve, Trade Talks Help Set Up Relief Rally: Markets Wrap

Apr 23, 2025 by Bloomberg(Bloomberg) -- Stocks jumped and the dollar edged up as the Trump administration defused some of the tension that had rattled financial markets in recent sessions.

A gauge of the dollar advanced for a second day and Treasuries rose after President Donald Trump said he doesn’t plan to fire Federal Reserve Chair Jerome Powell. Asian shares gained along with equity-index futures for Europe and the US as optimism grew about tariff discussions with India and Japan and a de-escalation of trade tensions with China. Tesla Inc. shares rose in after hours as Chief Executive Officer Elon Musk said he will step back “significantly” from the Department of Government Efficiency.

Trump’s comments on the Fed chief late Tuesday is a walk back from opinions expressed in the past week that sparked concerns about the US central bank’s independence, and reinforced a ‘Sell America’ trade. Signs of progress in some trade talks also helped improve market sentiment with Trump and Treasury Secretary Scott Bessent saying that a standoff with China will ease.

“While it is still early days, the mood in the market is evidently shifting,” wrote Chris Weston, head of research at Pepperstone Group Ltd. in Melbourne. “What was a strong ‘sell America’ vibe flowing through markets yesterday has in part reversed.”

Trump — frustrated that the central bank hasn’t moved to lower interest rates — posted on social media last week that Powell’s “termination cannot come fast enough! Rebuke of the Fed and comments from officials that Trump was studying whether he could fire Powell had sent the dollar to the lowest level since December 2023.

On Tuesday, Trump said he had no intention of firing Powell despite his frustration with the Fed not moving more quickly to slash interest rates.

While Trump backing off on Powell and progress in tariff negotiations alleviated some immediate worries, it doesn’t fix concerns about how the levies will impact inflation and put the US economy into a recession. Also, China hasn’t yet officially responded to Trump administration’s latest comments on trade talks.

“While the financial markets may initially react favorably to Trump’s remarks, distrust toward his policies remain deep,” wrote Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities. “Trump’s comment that he has no intention of dismissing the Fed chairman may reflect some attempt to calm markets, but this may not be enough to dispel the accumulated distrust in the market.”

Trump said he plans to be “very nice” to China in any trade talks and that tariffs will drop if the two countries can reach a deal, a sign he may be backing down from his tough stance on Beijing amid market volatility. The US president also said that final tariffs on China wouldn’t be “anywhere near” the 145% level set.

“It will come down substantially but it won’t be zero,” Trump said. “We’re going to be very nice and they’re going to be very nice, and we’ll see what happens.”

The US also said it’s made “significant progress” toward a bilateral trade deal following talks between Vice President JD Vance and Indian Prime Minister Narendra Modi.

“We are looking at more successful trade negotiations with key trading allies,” Stuart Kaiser, head of equity trading strategy at Citigroup Inc., said on Bloomberg Television on Tuesday. “I put Europe, India, Japan, South Korea, Australia in that category. I think we will see good progress there and that is good for markets.”

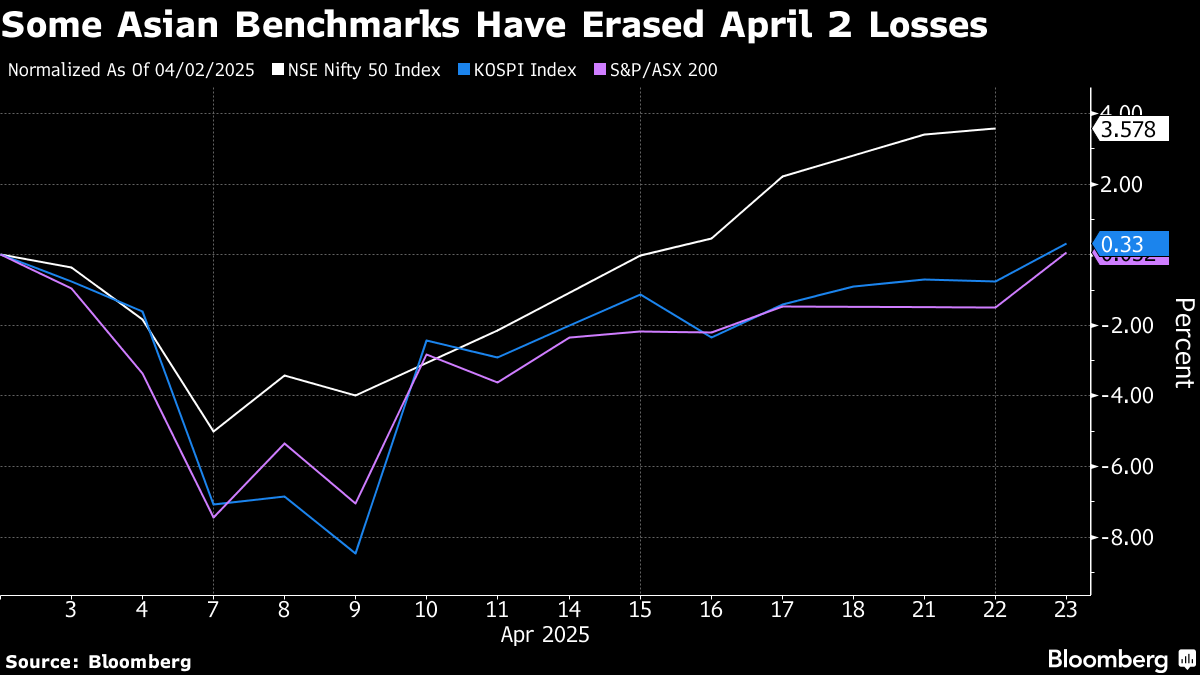

One by one, equity benchmarks in Asia are recouping the losses they suffered since Trump’s announcement of his wide-ranging reciprocal tariffs on April 2. India, which has emerged as a relative safe haven amid the tariff wars, was the first major global market to wipe out such declines last week. South Korean and Australian stock gauges did so on Wednesday.

Haven assets such as gold and the Japanese yen sold off Tuesday while Treasuries rallied, led by the far-end of the curve. Investors keen for early insight into whether China and other foreign governments remain eager to keep buying US Treasuries are turning to this week’s slew of bond auctions.

Meanwhile, the International Monetary Fund sharply lowered its forecasts for world growth this year and next, along with a warning that the outlook could worsen because of the trade war.

The unease around US assets that sparked a selloff in long-term government bonds and sent yields soaring is showing up in the options market, where premiums to protect against even bigger losses are at their highest since the “flash crash” of 2021.

Bitcoin advanced above $90,000 for the first time since early March, fueling optimism that the biggest digital token is finally breaking free of a longstanding tendency to move in the same direction as US tech stocks.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 1.6% as of 1:39 p.m. Tokyo time

- Japan’s Topix rose 1.8%

- Australia’s S&P/ASX 200 rose 1.4%

- Hong Kong’s Hang Seng rose 2.4%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 1.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.1386

- The Japanese yen fell 0.3% to 142.01 per dollar

- The offshore yuan rose 0.2% to 7.2979 per dollar

Cryptocurrencies

- Bitcoin rose 2.2% to $93,184.98

- Ether rose 5.4% to $1,788.41

Bonds

- The yield on 10-year Treasuries declined five basis points to 4.35%

- Australia’s 10-year yield was little changed at 4.25%

Commodities

- West Texas Intermediate crude rose 0.8% to $64.21 a barrel

- Spot gold fell 1.1% to $3,342.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By