Oil Market Gauges Signal a Glut Is Coming as OPEC+ Raises Supply

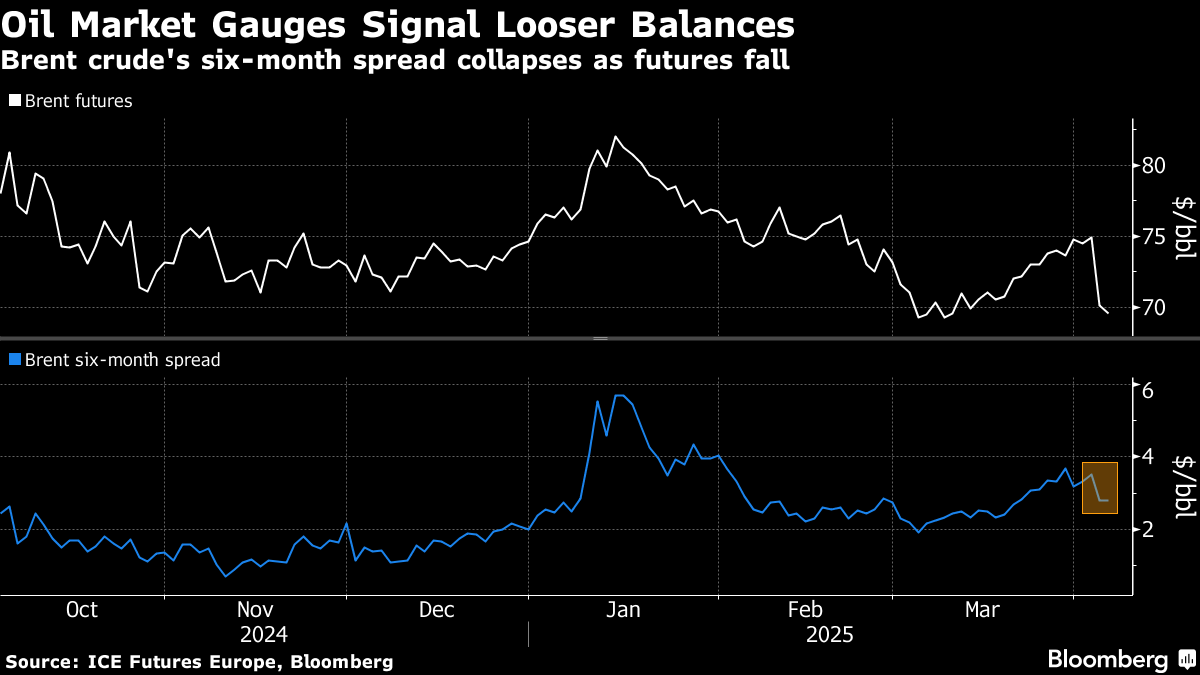

Apr 04, 2025 by Bloomberg(Bloomberg) -- Key oil indicators are signaling looser balances ahead, after OPEC and its allies shocked the market with a dramatic early supply increase just as concerns over global demand become more acute.

Timespreads across the curve for global benchmark Brent were narrower as of Thursday’s close, with the collapse more pronounced for longer-dated futures. The gap between the first and fourth month, for instance, closed at $1.84 a barrel in backwardation — where barrels for prompt delivery are more expensive than those further down the curve — compared with $2.16 just a day prior.

The six-month spread was at $2.80 a barrel in backwardation on Thursday versus $3.53 on Wednesday.

The trend holds for contracts further out too, with the one-year spread and the December-December spread — both widely watched metrics when it comes to the state of long-term balances — also lower.

The collapse in timespreads comes as headline futures are also declining. Oil suffered the biggest slide since 2022 on Thursday, losing more than 6% after President Donald Trump imposed a cascade of tariffs, news swiftly followed by OPEC’s move.

The Middle Eastern crude benchmark, Dubai, also fell, according to Bloomberg Fair Value data, shedding about $5 on Thursday’s session with prices also trending lower on Friday.

©2025 Bloomberg L.P.

By