Oil Traders Lurch From Praying for Volatility to Drowning in It

Apr 19, 2025 by Bloomberg(Bloomberg) -- Until recently, oil traders complained that it was almost impossible to wring profits out of a listless and rangebound crude market. After the events of the past two-and-a-half weeks, this may have been a case of “careful what you wish for.”

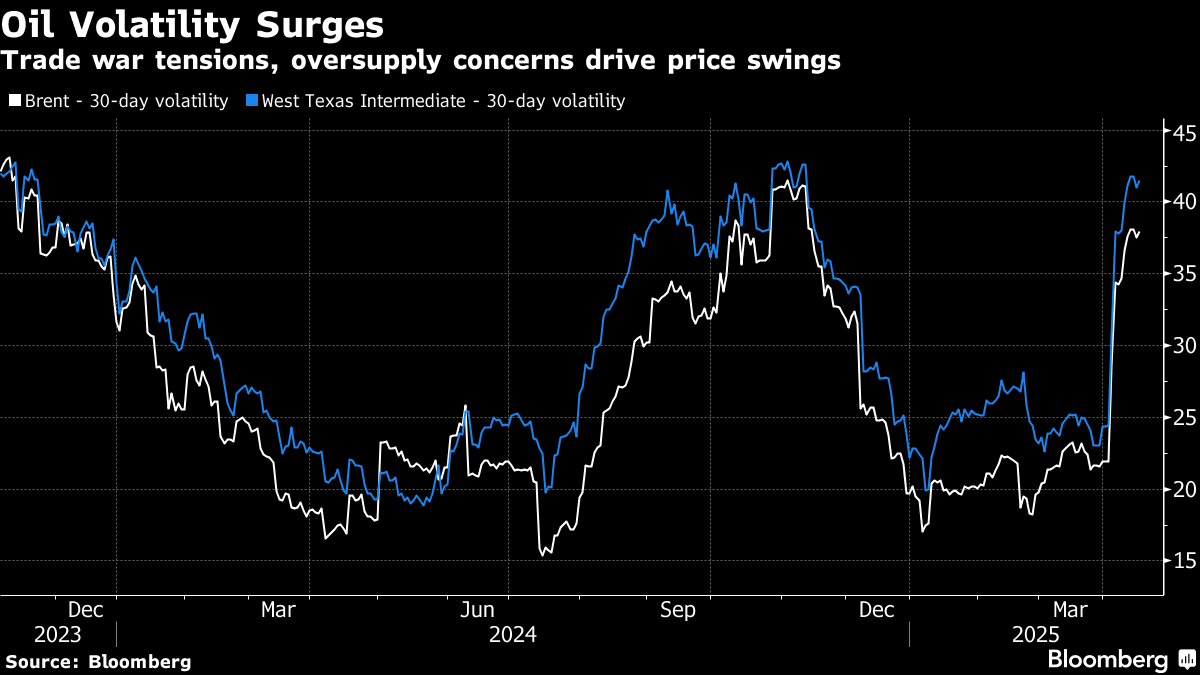

In that brief period, the oil market went from flatlining to experiencing huge price moves. The trigger was US President Donald Trump’s April 2 unveiling of sweeping tariffs, escalating a trade war. Less than a day later, OPEC+ stunned markets with plans to boost output at a faster-than-anticipated rate. The dual shocks sent US crude futures down almost 7% for the biggest decline since Russia’s invasion of Ukraine, while a key gauge of volatility rocketed to a six-month high.

But traders say the turbulence that has since gripped the market is proving equally hard to make money from, with contradictory, rapid-fire developments unpredictably buffeting prices.

“It’s not the kind of volatility you can have a medium-term view on, because it changes day to day,” said George Cultraro, global head of commodities at Bank of America Corp. “A 25% tariff can turn into a 10% or 5% or 2% tariff, or get put off altogether. It has made pricing and managing risk a bit more difficult.”

Brent Belote, chief investment officer of Cayler Capital, was among the traders who earlier this year had been pining for a rebound in volatility. Market conditions had even pushed him to hunt for profits in other commodities markets for the first time in his career, including by starting a metals trading arm.

The sudden turbulence caught him off-guard, resulting in losses on some bets.

“Well, I stepped in it,” Belote said in a note to clients. “Not a little misstep, not an ‘Oops, missed by a hair’ call, this was me running full speed into a brick wall. I genuinely believed Trump’s new round of tariff talk would be modest.”

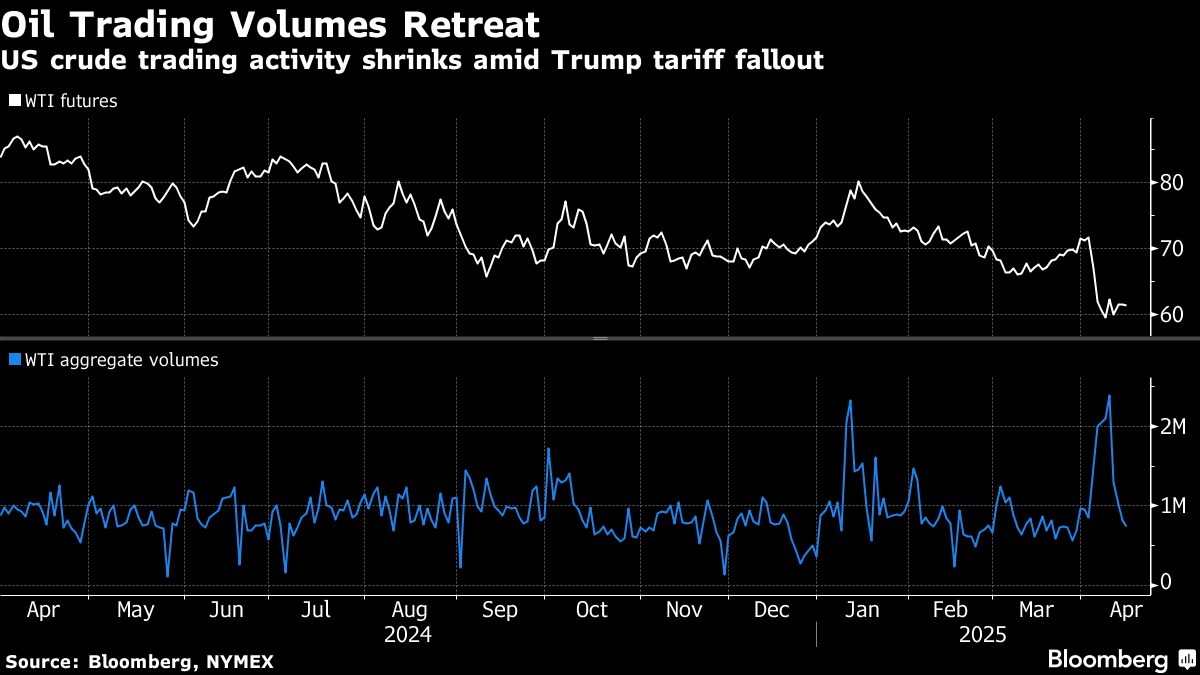

The resurgence in volatility, while providing a short-term boost in trading volumes, threatens the market’s liquidity over the longer term.

Investors pulling out of crude and fuel markets triggered a $2 billion net outflow in the week ending April 11, JPMorgan Chase & Co. analyst Tracey Allen wrote in a note to clients. Volumes across the futures curve have retreated to late March levels and WTI’s open interest is fading after the initial spike as investors bail rather than test their luck predicting Trump’s next tariff salvo.

“This headline-driven volatility is typically not good for liquidity as bids and offers get wider and volumes smaller as market participants retreat,” said Ryan Fitzmaurice, a senior commodities strategist at Marex. “This often creates a feedback loop with more volatility, forcing deleveraging from systematic funds that adjust position sizes based on how much the market is moving.”

The fast-evolving trade war has forced investors to overhaul their entire market view in a matter of days on several occasions. Hedge funds reversed their position on Brent oil at the fastest pace on record in the week ended April 8, figures from ICE Futures Europe show. Meanwhile, long-only bets on West Texas Intermediate fell to the lowest since 2009, compared with a six-week high a week prior, according to the Commodity Futures Trading Commission.

Since that data was calculated, Trump announced a 90-day halt on higher tariffs against dozens of nations, as well as an increase in duties on China to 145%.

While fleeing outright bets on crude, traders have been taking more spread positions, which offer more limited risk. Speculators added the largest number of spread bets in WTI since 2007 last week, while the equivalent positions in Brent climbed the most since 2020.

Signs also are emerging that oil consumers are seeking to avoid the volatility by locking in their single largest costs. Swap dealers added the most long positions in Brent and ICE gasoil on record last week, typically an indication of consumer hedging, as industrial buyers sought to sidestep the risk of heightened volatility in the longer run.

Another complicating factor for traders is that while big price drops may begin with a fundamental driver like tariffs, they can soon spiral further thanks to other factors like options markets and the positioning of trend-following funds.

Those funds, known as commodity trading advisers rushed to turn 100% short in WTI during the five days following the tariff-induced market meltdown, according to data from Bridgeton Research Group. Just prior to that swing, those firms had been looking to initiate long positions after steadily turning more bullish since March 28, the researcher added. That’s the most dramatic shift in positioning since the collapse of Silicon Valley Bank in 2023.

The months after the bank’s breakdown offered oil traders multiple opportunities to profit, with crude first plunging almost 20% before rebounding 40% to new highs for the year.

“Sideways-trending markets get boring,” said John Kilduff, a partner at Again Capital. “But where we’re at right now, there’s a new level of difficulty. If you’re a person who likes pain and tumult, you’re going to love this.”

©2025 Bloomberg L.P.

By