Stock Rally Loses Steam After Mixed Tariff News: Markets Wrap

Apr 24, 2025 by Bloomberg(Bloomberg) -- Asian stocks snapped a five-day winning streak as a brief global relief rally gave up momentum after mixed signals from the Trump administration on its plans for China tariffs.

A regional gauge of stocks fell 0.3% as market enthusiasm got curbed after Treasury Secretary Scott Bessent cast doubt on a timely resolution to the US-China trade war. Shares in Hong Kong dropped 1.2%, the first time in four days, while equity-index futures for the US and Europe declined. The yen flipped after two days of losses and the dollar weakened. Gold jumped 1.2% in increased demand for the safe-haven asset.

The global rally in stocks on Wednesday - after wild gyrations earlier this month - came on signs US President Donald Trump is rethinking the most-aggressive elements of his stances on trade and the Federal Reserve. Still, investors find it hard to forecast where the markets are headed amid a slew of headlines from various officials in the administration and frequent back-and-forth by Trump on his tariffs.

“It’s his negotiation style,” said Joshua Crabb, head of Asia Pacific equities at Robeco Hong Kong Ltd. “Key is to stay focused on the fundamentals and what is in the price on a scenario of outcomes. Margin of safety is more important now.”

Trump signaled that the US is going to have a fair deal with China, adding late Wednesday that the country may receive a new tariff rate in the next two to three weeks. The administration is also considering whether to reduce certain tariffs targeting the auto industry that carmaker executives have warned would deal a severe blow to profits and jobs.

Bessent said that Trump hasn’t offered to take down US tariffs on China on a unilateral basis. Asked if there was no unilateral offer from the president to de-escalate, he said “not at all.”

The Treasury secretary said that the administration is looking at multiple factors with regard to China beyond just tariffs — including non-tariff barriers and government subsidies. He also said that the strongest relationship between Washington and Beijing is at the top, and that there was no timeframe for engagement. A full re-balancing of trade might take two to three years, he said.

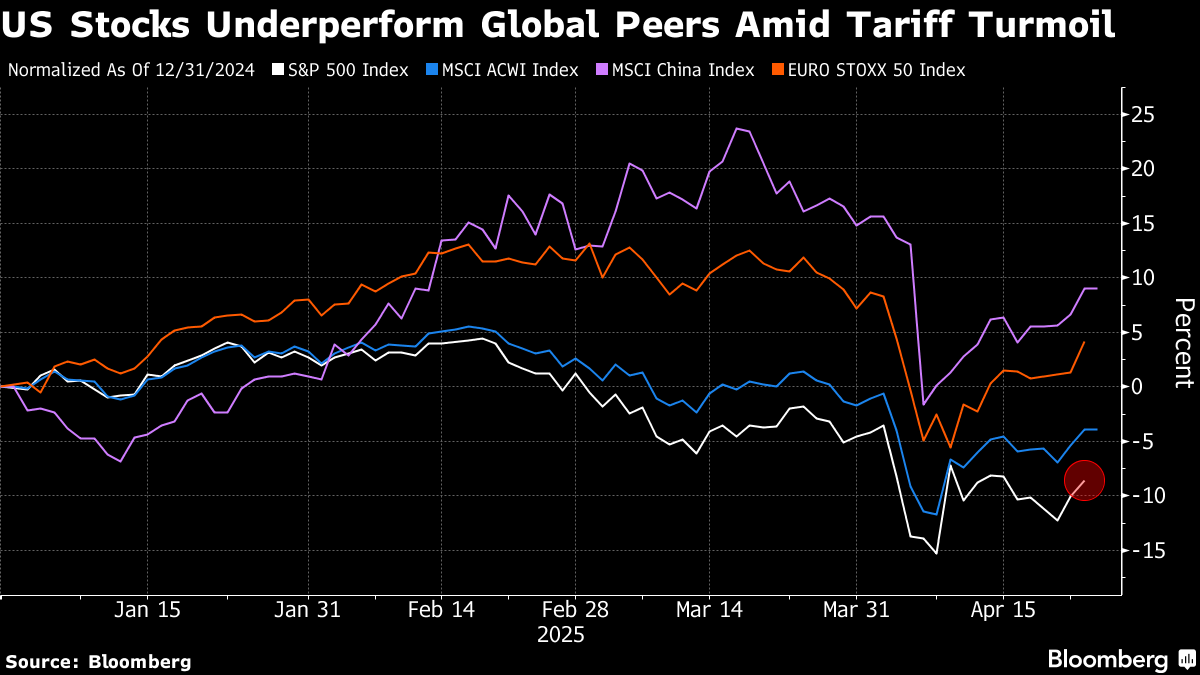

Investors should consider adding Chinese, Indian and European assets to re-balance their portfolios as the US stock market value has reached its peak and further corrections in equities, Treasury bonds, and the dollar are likely, according to the global head of equity strategy at Jefferies Financial Group Inc.

The bearish view on US markets echoes the pessimism spreading across world markets that the era of American exceptionalism is ebbing with Trump’s chaotic tariff rollout.

A critical signal gleaned from market participants in recent days is the clear sensitivity of the Trump administration to the financial markets, wrote Kyle Rodda, senior market analyst at Capital.com. He cited the 90-day tariff pause and the backflip about firing Fed Chair Jerome Powell as examples

“For all of his clumsy policy making and erratic behavior, President Trump remains aware of the massive damage a financial meltdown would do to US power and economic growth,” Rodda wrote. “It doesn’t remove the risk of a painful growth slowdown and slower stock prices. But it markedly reduces the odds of a catastrophic tail event.”

In European news, car sales returned to growth last month for the first time since December, with gains in the UK and robust demand for electric vehicles making up for weaker sales in Germany and France.

In Australian news, the country’s fiscal policy is likely to be more expansionary under the center-right opposition than the ruling Labor Party, based on campaign pledges ahead of a May 3 election, Goldman Sachs Group Inc. economists said in a research note.

Meanwhile, China issued the first batch of special sovereign bonds for the year as part of the stimulus announced by authorities to soften the blow from simmering trade tensions with the US.

In commodities, oil held a decline as investors weighed the prospect of more OPEC+ supply and the fallout from trade tensions between the US and China.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 1:52 p.m. Tokyo time

- Japan’s Topix rose 0.4%

- Australia’s S&P/ASX 200 rose 0.8%

- Hong Kong’s Hang Seng fell 1.2%

- The Shanghai Composite fell 0.1%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.1335

- The Japanese yen rose 0.5% to 142.79 per dollar

- The offshore yuan fell 0.2% to 7.2991 per dollar

Cryptocurrencies

- Bitcoin fell 1.1% to $92,699.78

- Ether fell 1.5% to $1,770.03

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.35%

- Australia’s 10-year yield declined three basis points to 4.24%

Commodities

- West Texas Intermediate crude rose 0.1% to $62.35 a barrel

- Spot gold rose 1.1% to $3,326.15 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By