Stocks Drop After Nvidia Curbs, Gold Hits Record: Markets Wrap

Apr 16, 2025 by Bloomberg(Bloomberg) -- A two-day rally in global stocks stalled as US trade conflicts showed no signs of abating after the Trump administration imposed new restrictions on Nvidia Corp.’s chip exports to China.

Chinese technology companies led Asian stocks lower, while equity-index futures for the US and Europe retreated along with Nvidia in after-hours trading. Treasuries were little changed after a two-day rally and gold hit a record on demand for haven assets. The dollar pared some of its Tuesday advance as the Swiss franc and the euro led gains against most currencies. Japanese long-term bonds rallied.

A brief consolidation in stocks - after the turmoil last week - is slipping as traders are again dealing with a slew of tariff headlines, including US President Donald Trump launching a probe into the need for levies on critical minerals. The flip flops have roiled global markets this month as investors struggle to take long-term positions due to the unpredictability of policy announcements from Washington.

“This move is unnerving for two reasons,” said Vishnu Varathan, Singapore-based head of economics and strategy at Mizuho Bank, referring to the Nvidia curbs. “First, it conveys the mercurial nature of Trump tariffs in so far that it has revoked earlier concessions extended to Nvidia. Second, this also suggests that the US-China undercurrents are rather abusive, even as there appears to be some calm on the surface.”

Shares in mainland China and Hong Kong held their losses even as China’s economy showed surprising strength in early 2025 with a sharp uptick in March, though the trade impasse prompted calls for stimulus to offset the tariff shock.

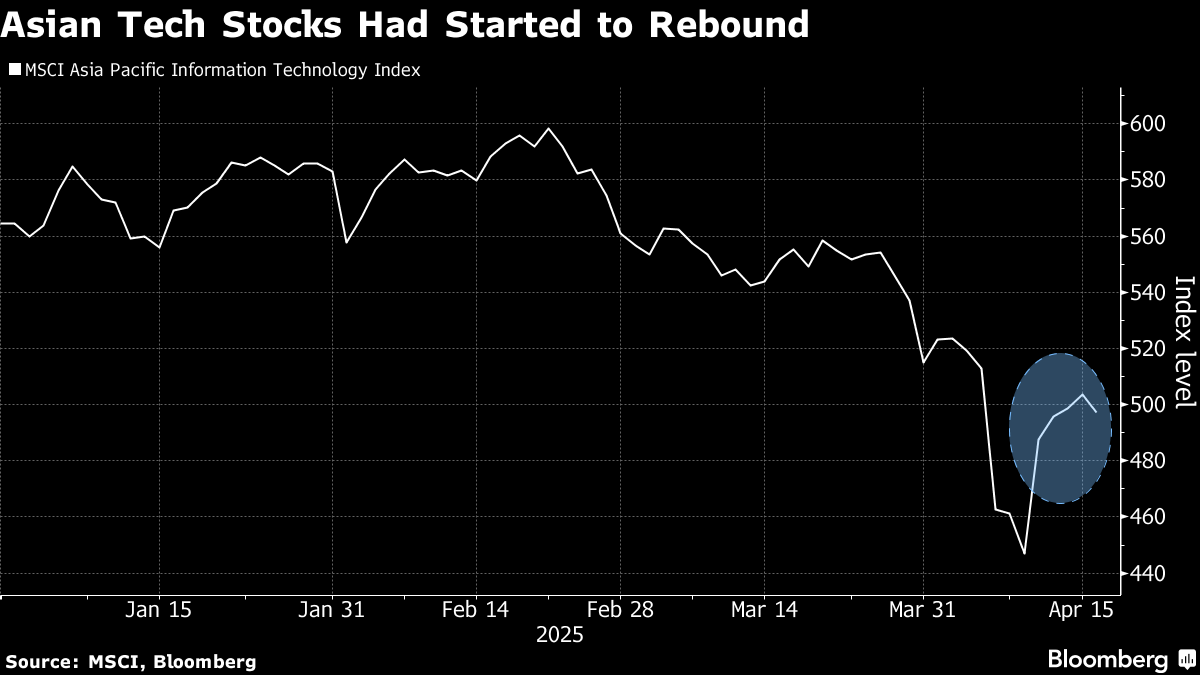

Asian technology stocks fell after Nvidia’s announcement raised concerns about how the latest curbs may expand the trade war beyond import taxes. The fallout could weigh on chip-sector earnings and set back China’s ambitions to compete on the global artificial intelligence stage.

A gauge of Chinese technology shares in Hong Kong tumbled more than 4.5%.

“The under-performance for Hong Kong stocks is driven by concerns about the US-China trade war extending to non-tariff measures such as increasing restrictions to US technology and possibly financial markets,” said Gary Tan, a portfolio manager at Allspring Global Investments.

In Japan, 30-year bonds rebounded as volatility eased in the Treasuries market and Bank of Japan Governor Kazuo Ueda suggested it may have to make a policy response to higher US tariffs. A slowing economy may impede the BOJ’s plan to gradually raise interest rates.

The yield on the tenor dropped 11 basis points to 2.705%, while the five-year yield fell 3.5 basis points to 0.845%. The moves came after Japan’s super-long yield premiums hit the highest since 2002 amid fiscal concerns and global volatility.

In after-market trading, Nvidia extended its decline to more than 6% after saying the US government will begin requiring a license to export the company’s H20 chips to China, an escalation of restrictions that the company has publicly opposed. It’ll report about $5.5 billion in charges during the fiscal first quarter from “inventory, purchase commitments and related reserves” tied to the products.

Meanwhile, the European Union and the US struggled to bridge trade differences this week as White House officials said the bulk of the US tariffs imposed on the bloc won’t be removed. Italian Premier Giorgia Meloni is also due to land in Washington to meet with Trump.

Japan’s chief negotiator will visit Washington April 16-18 to kick off formal talks with his counterparts.

Trump urged China to reach out to him in order to kick off negotiations after the nation ordered its airlines not to take any further deliveries of Boeing Co. jets. The Trump administration may use tariff negotiations to try to pressure trading partners to limit dealings with China, the Wall Street Journal reported, citing people with knowledge of the conversations.

Investors are also gearing up for Federal Reserve Chair Jerome Powell’s comments on the economy later Wednesday.

In commodities, oil steadied after a modest decline on Tuesday.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.9% as of 1:42 p.m. Tokyo time

- Japan’s Topix fell 0.7%

- Australia’s S&P/ASX 200 rose 0.4%

- Hong Kong’s Hang Seng fell 2.5%

- The Shanghai Composite fell 0.9%

- Euro Stoxx 50 futures fell 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.5% to $1.1344

- The Japanese yen rose 0.4% to 142.63 per dollar

- The offshore yuan was little changed at 7.3315 per dollar

Cryptocurrencies

- Bitcoin fell 0.7% to $83,469.84

- Ether fell 1% to $1,579.44

Bonds

- The yield on 10-year Treasuries was little changed at 4.33%

- Australia’s 10-year yield was little changed at 4.35%

Commodities

- West Texas Intermediate crude fell 0.2% to $61.22 a barrel

- Spot gold rose 1.4% to $3,275.71 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By