Stocks Drop, Bonds Jump as Trump Tariffs Sap Risk: Markets Wrap

Apr 03, 2025 by Bloomberg(Bloomberg) -- Global financial markets were hit by a sweeping selloff after President Donald Trump’s bid to remake the world trading order proved more aggressive than expected.

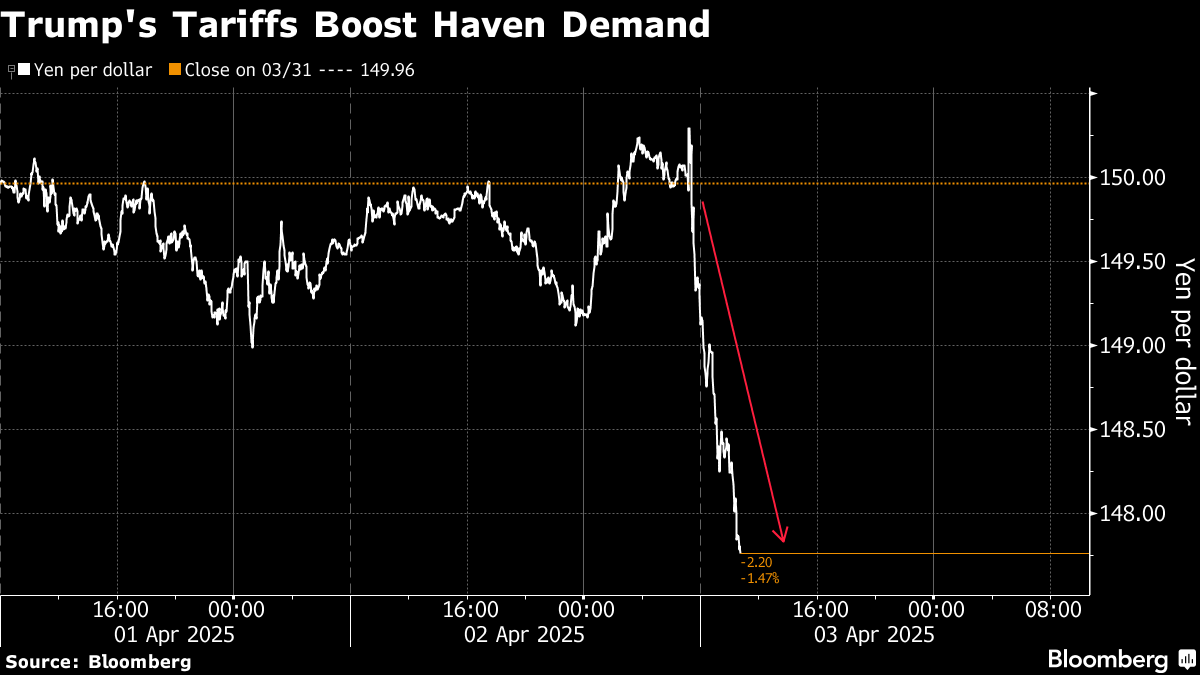

US and European equity-index futures fell along with the dollar while Asian shares tumbled with an index in Japan sinking to the lowest level in almost eight months. US 10-year Treasury yields slumped to the lowest level in more than five months with the flight to havens also strengthening the Japanese yen. Gold touched a record high. From Apple Inc. to Toyota Motor Corp. and Nike Inc., global corporations relying on international supply chains retreated.

The announcement of a minimum 10% tariff on all exporters to the US, and additional duties for its biggest trading partners including China, Japan and the European Union, spooked investors who remain wary on how the levies will impact global growth. Two months into Trump’s presidency, optimism has evaporated in the market, with equity strategists trimming forecasts for US stocks and central bankers starting to factor in potential impact on inflation.

“The tariff plans provided significantly more clarity than many investors likely had expected,” wrote Michael Zezas, global head of fixed-income research and public policy strategy at Morgan Stanley. “However, the magnitude of the tariffs announced by the White House suggest that the downside risks to global growth have increased relatively to what was already priced by markets.”

Trump’s announcement came after three days of gains for the S&P 500 index amid hopes that the tariff program would have a lighter touch. Traders across asset classes must now brace for what promises to be a grueling stretch of trade negotiations, against an economic backdrop that has shown signs of softening as companies and consumers adjust to Trump’s offensive.

Meanwhile, the 25% tariff on US auto imports took effect shortly after midnight in Washington in a move expected to dramatically increase costs and upend industry supply chains.

(Get the Markets Daily newsletter.)

Yields slumped in Japan, Australia and New Zealand while bond futures jumped in Europe and Canada. The turmoil spread to all corners of the market with the cost to insure the region’s companies against default set for the biggest day of widening since 2023, according to a key index.

Continued uncertainty will feed into the US recession narrative, which should be an additional headwind for risky assets and a positive for rates, Citigroup Inc. strategists wrote, upgrading Treasuries to overweight and staying overweight on bunds. A gauge of the dollar posted its biggest drop in a month.

Markets Live Strategist Garfield Reynolds says:

Markets across Asia are mostly consolidating in the wake of President Trump’s reciprocal tariffs and the message so far seems to be that the levies will deliver more pain to the US than anywhere else. The dollar is dropping while Asian equity benchmarks are suffering smaller declines than US index futures — with Japan’s stocks the exception that proves the rule thanks to the impact there of a stronger yen.

Reacting to the US tariffs announcement, China said it’s firmly opposed to the levies and vowed to take countermeasures to safeguard its own interests. Earlier, China had taken steps to restrict local companies from investing in the US, according to people familiar with the matter. The move could give Beijing more leverage for potential trade negotiations with the Trump administration.

The European Union, the US’s largest trading partner, vowed to retaliate.

“President Trump’s announcement is a major blow to the world economy,” European Commission President Ursula von der Leyen said in a video address Thursday. “We’re preparing for further countermeasures to protect our interests and businesses if negotiations fail.”

Treasury Secretary Scott Bessent urged US trading partners against taking retaliatory steps. “As long as you don’t retaliate this is the high end of the number,” Bessent told Bloomberg Television.

“While the tariff measures announced were more severe than expected, the question over how long these tariffs will remain in place is more open-ended due to Trump’s inclination to be a deal maker,” said Tim Waterer, chief market analyst at KCM Trade in Sydney.

Shares of companies linked to sectors that will be hardest hit by the new round of levies were sharply lower in late New York trading. Nike, Gap Inc. and Lululemon Athletica Inc. all fell at least 7% after hours. They rely on goods and factories from Vietnam. Apple, whose supply chain is heavily dependent on China, declined 7.1%. Chipmakers such as Nvidia Corp. and Advanced Micro Devices Inc. were down, as were multinationals Caterpillar Inc. and Boeing Co.

In commodities, oil dropped. Copper, aluminum and zinc all slumped as metals joined a rush from risk on fears that the sweeping new tariffs will end up crushing demand for industrial commodities. Bullion rose after it was one of the few commodities exempted from the tariffs.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 2.7% as of 1:53 p.m. Tokyo time

- Japan’s Topix fell 3.5%

- Australia’s S&P/ASX 200 fell 0.9%

- Hong Kong’s Hang Seng fell 1.6%

- The Shanghai Composite fell 0.5%

- Euro Stoxx 50 futures fell 1.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 0.5% to $1.0909

- The Japanese yen rose 1.2% to 147.51 per dollar

- The offshore yuan fell 0.2% to 7.3133 per dollar

Cryptocurrencies

- Bitcoin fell 2.4% to $83,591.42

- Ether fell 2.3% to $1,838.44

Bonds

- The yield on 10-year Treasuries declined seven basis points to 4.06%

- Australia’s 10-year yield declined 15 basis points to 4.27%

Commodities

- West Texas Intermediate crude fell 2.3% to $70.05 a barrel

- Spot gold rose 0.2% to $3,141.35 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By