Stocks Rise Led by Japan on Auto Tariff Reprieve: Markets Wrap

Apr 15, 2025 by Bloomberg(Bloomberg) -- Asian shares gained, led by Japan, as US President Donald Trump floated a potential pause in auto tariffs, providing further relief to the market after suspending levies on some consumer electronics.

Indexes in Japan rose more than 1% with companies such as Toyota Motor Corp. and Honda Motor Co. jumping. Shares in China and Hong Kong fluctuated while futures contracts for the US and Europe pared earlier losses. Treasuries climbed, and a gauge of the dollar edged higher to trim some of its decline on Monday.

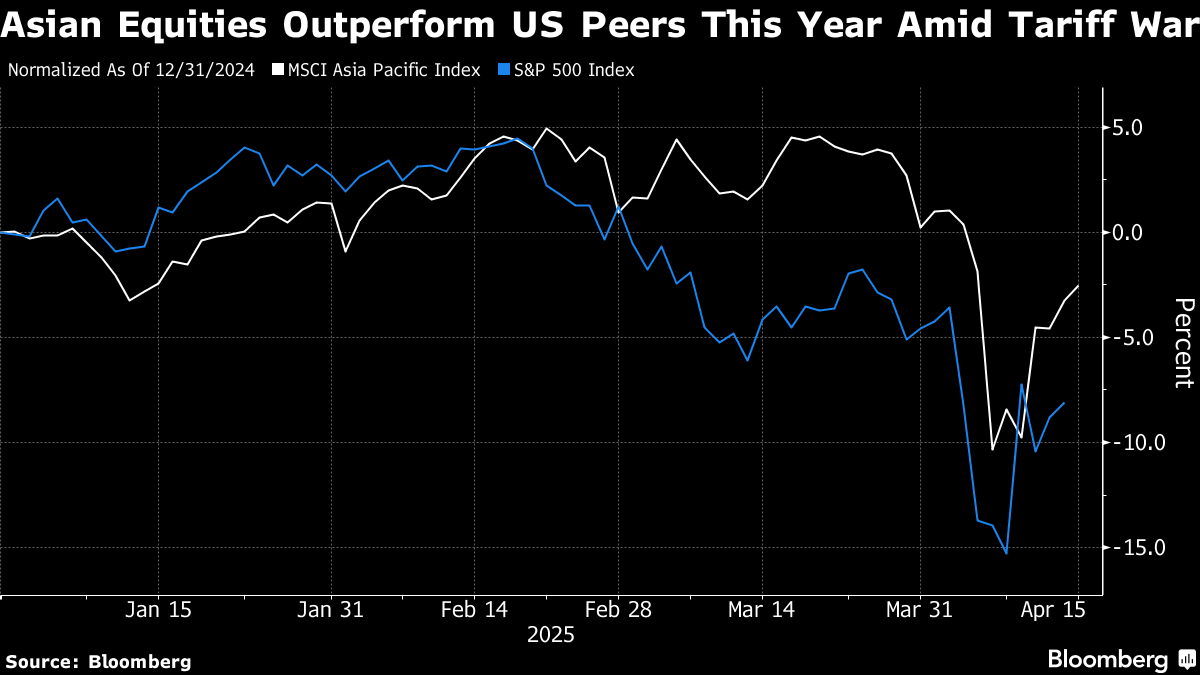

Markets are consolidating as the exemptions raised hopes there may be room for negotiations after the president’s reciprocal tariffs this month wiped $10 trillion off global equities and spurred a rout in Treasuries. Still, the flip-flops are keeping investors on edge and business leaders including JPMorgan Chase & Co.’s Jamie Dimon have warned that Trump’s effort to remake the global trading order may push the US into a recession.

“Trump’s showing signs of flexibility around his tariff policies, and that’s brought some composure back to the market,” said Yusuke Sakai, a senior trader at T&D Asset Management.

The US also pressed forward with plans to impose tariffs on semiconductor and pharmaceutical imports by initiating trade probes led by the Commerce Department. The moves threaten to broaden the president’s sweeping trade war.

In a sign that investors are worried the tariffs will send the US economy into a recession, a gauge of the dollar index declined for two weeks. Treasury yields for 10-year bonds jumped 50 basis points last week, the most in over two decades. Federal Reserve officials have lowered their outlook for growth and lifted forecasts for inflation.

Deutsche Bank Global CIO Christian Nolting said there are opportunities to buy stocks if the S&P 500 index is below 5,000 levels. The bank has reduced US equities “a little bit” ahead of the tariffs announcement, but “we have also told clients not to panic” due to volatility, he said.

“We will buy the dip in the market if it is closer to recessionary levels,” Nolting said in a Bloomberg TV interview. There is “still some potential growth rate in the US and that’s something which is still interesting for investors.”

In other moves in Asia, shares of some luxury goods makers slumped after LVMH’s sales fell more than expected in the first quarter, weighed down by weak demand for luxury goods in China and the US.

In Japan, the premium that investors demand to hold 30-year government bonds over five-year notes widened to the most in over two decades as global volatility and fiscal concerns drive up super-long yields. The move came after Japan’s super-long bonds tumbled amid speculation that authorities are preparing an extra budget to support the economy earlier than usual this fiscal year.

More Japanese companies including Tepco Power Grid Inc. halted planned yen bond sales as debt market volatility sparked by the global trade war made investors risk averse.

The Bank of Japan will probably leave aside raising interest rates for now due to the uncertainties, according to a former executive director. The Asian nation is set for talks with the US this week.

“The environment that we are in right now is an extremely tricky one,” said Christina Woon, portfolio manager at Eastspring Investments. “You’ve got a near daily change in rhetoric out of the US that makes positioning quite difficult.”

Markets Live Strategist Garfield Reynold says:

The US currency’s role as the bedrock of the global financial system is being undermined by President Donald Trump’s trade war. The damage done to the dollar’s status as a haven is so severe that the currency is likely to embark on a sustained decline.

Eyes will also be on Chinese President Xi Jinping’s first overseas trip of the year, after he landed in Vietnam on Monday, with visits to Malaysia and Cambodia also scheduled. He’s expected to present his nation as a more stable partner than the US under Trump.

Still, UBS AG added to a series of growth downgrades for China with the most pessimistic forecast among major banks, predicting the economy will expand just 3.4% this year as US tariffs choke exports.

In commodities, oil rose after a tepid session on Monday amid the prospect of looser restrictions on Iranian crude. Gold rose to trade just below a record high in demand for safe havens.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 1:42 p.m. Tokyo time

- Japan’s Topix rose 1.2%

- Australia’s S&P/ASX 200 rose 0.3%

- Hong Kong’s Hang Seng rose 0.2%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1357

- The Japanese yen was little changed at 143.02 per dollar

- The offshore yuan was little changed at 7.3120 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $85,220.1

- Ether was little changed at $1,633.43

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.35%

- Australia’s 10-year yield declined seven basis points to 4.33%

Commodities

- West Texas Intermediate crude rose 0.4% to $61.75 a barrel

- Spot gold rose 0.6% to $3,228.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By