Stocks, Treasuries Slip in Countdown to Tariffs: Markets Wrap

Apr 02, 2025 by Bloomberg(Bloomberg) -- Asian stocks edged down as traders grappled with how to position themselves in the countdown to President Donald Trump’s sweeping tariffs announcement.

A regional gauge declined as indexes in Japan and South Korea dropped, while Hong Kong fluctuated. Treasury yields advanced after a multi-day drop as traders weighed the odds of Federal Reserve policy easing. US and European equity-index futures fell, indicating stocks may remain under pressure. The dollar was little changed against its major peers and gold traded just short of its record.

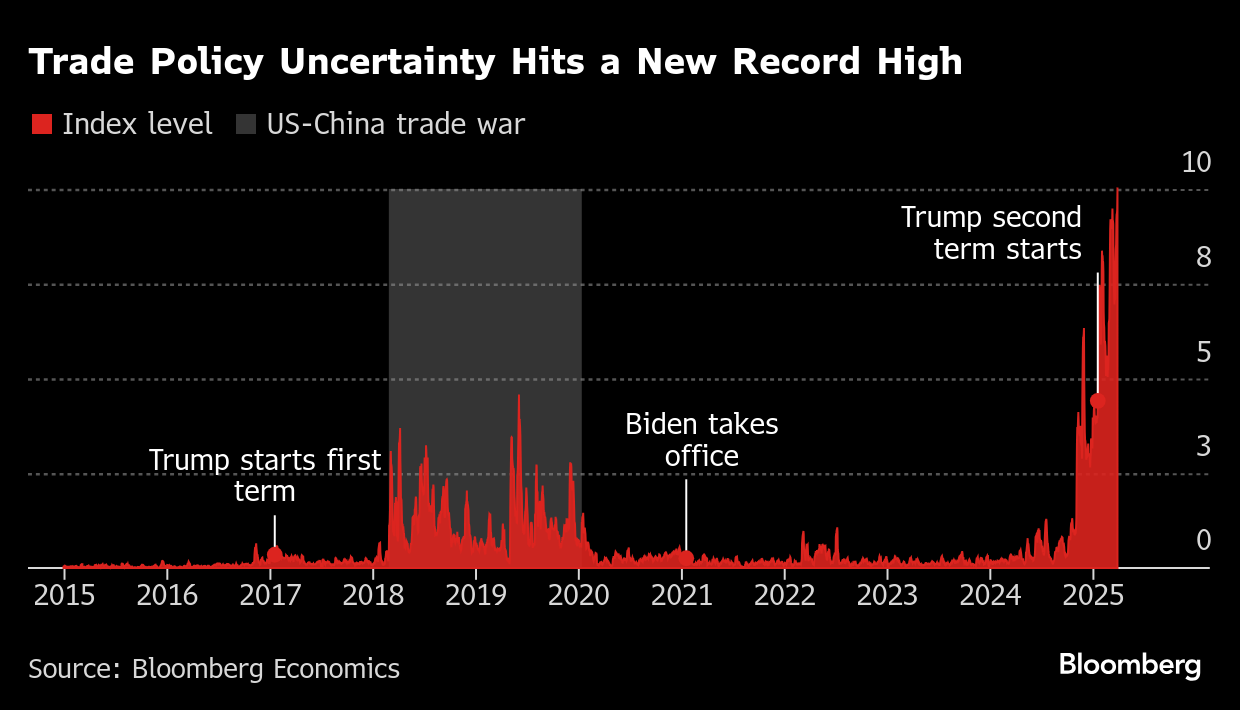

Trump’s deliberations over his plans to impose reciprocal tariffs are coming down to the wire, with his team said to be still finalizing the size and scope of the new levies he is slated to unveil. That unpredictability has shaken markets, prompted economists to cut their growth forecasts and forced central bankers to factor in the potential inflationary impact of import costs.

The tariffs will take immediate effect after they are announced in the event that’s due to start from 4 p.m. New York time on Wednesday.

“Asian market saw a generally quiet trading session,” said Wee Khoon Chong, senior Asia-Pacific market strategist for Bank of New York Mellon Corp. “There’s some nervousness, driven by uncertainties surrounding US ‘Liberation Day’ tariffs announcement and the potential retaliatory tariffs that come after.”

Trump is set to impose so-called reciprocal tariffs and other levies on what he has labeled “Liberation Day” — a move expected to cover a broader swath of trade than the 1930 Smoot-Hawley duties that have long served as a cautionary tale about protectionism. It’s part of Trump’s wider project to dismantle the global trading system the US helped build out of that era’s wreckage, on his belief that Americans got a raw deal.

(Get the Markets Daily newsletter.)

Tariffs and retaliation will take place until the middle of the year and eventually “some deals are going to be struck,” Hartmut Issel, head of APAC equities and credit at UBS Wealth Management, said in a Bloomberg TV interview. “So negotiations, discussions and then finally some solutions are also on the table, we think for the second half.”

Some investors see an opportunity in the current environment. Shifting some investment outside the US is one, Ali Dibadj, CEO of Janus Henderson Investors, said in a Bloomberg TV interview. “We see enormous opportunity in Europe” due to supply chain changes and political developments, he said.

Goldman Sachs picked the yen as the top hedge against US recession and risks from tariffs.

Rising potential for a US recession has Pacific Investment Management Co. touting the attractiveness of “stable sources of returns” in global bonds. The bond manager warned that Trump’s aggressive trade, cost-cutting and immigration policies stand to slow the world’s biggest economy by more than previously expected.

In commodities, oil paused last month’s rally as traders positioned themselves for the tariff announcements.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 2:07 p.m. Tokyo time

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 rose 0.1%

- Hong Kong’s Hang Seng rose 0.1%

- The Shanghai Composite rose 0.2%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0788

- The Japanese yen fell 0.2% to 149.92 per dollar

- The offshore yuan was little changed at 7.2784 per dollar

Cryptocurrencies

- Bitcoin fell 0.9% to $84,450.2

- Ether fell 2.2% to $1,871.1

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.20%

- Australia’s 10-year yield was little changed at 4.42%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By