Stocks, US Futures Advance on Auto Tariff Reprieve: Markets Wrap

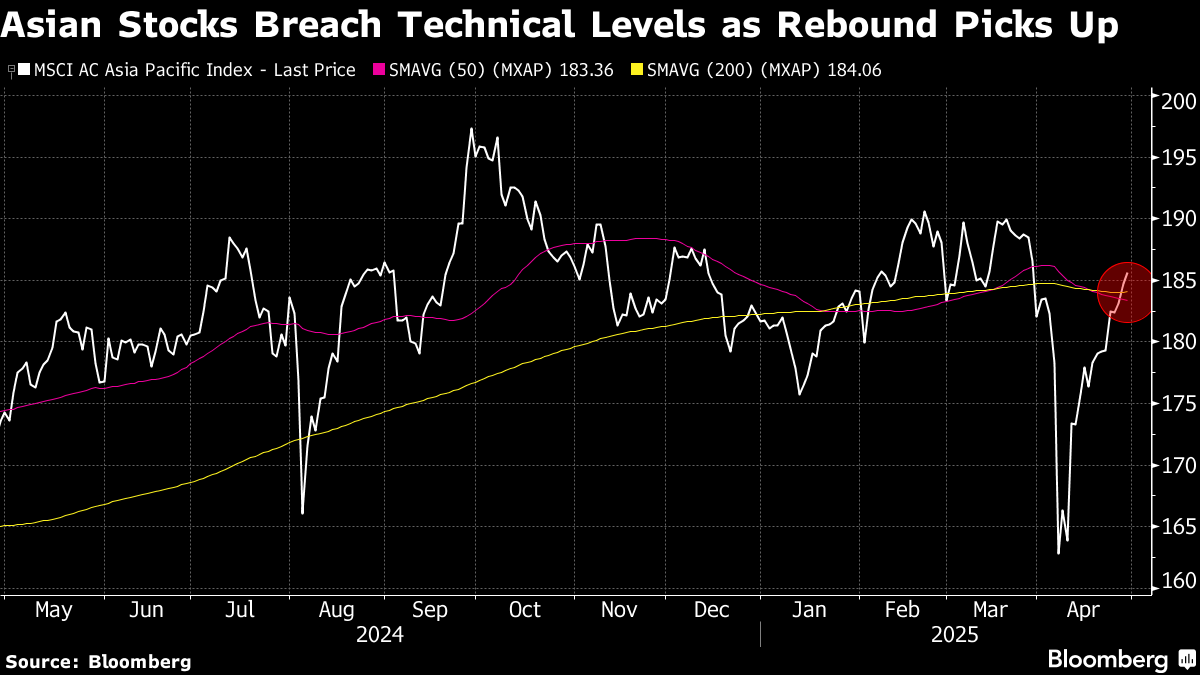

Apr 29, 2025 by Bloomberg(Bloomberg) -- Asian stocks rose to the highest level in a month on expectations President Donald Trump will ease the impact of his auto tariffs, boosting hopes for further dialing down of trade tensions.

A regional index advanced 0.4% while futures for the S&P 500 gained after a White House official said imported automobiles would be given a reprieve from separate tariffs on aluminum and steel. Hyundai Motor Co. led gains among South Korean automakers. A gauge of the dollar strengthened 0.2% while gold dropped as much as 1.1%. There’s no trading of cash Treasuries in Asia as Tokyo is closed for a public holiday, and they will open at the start of the European session.

A five-day rally in US stocks, the longest advance since November, faces a significant test this week amid US data from jobs to inflation and economic growth, as well as earnings from some of the biggest technology companies. Some calmness has returned to financial markets in the past week after the Trump administration’s trade policies had sparked volatile trading in stocks and bonds and prompted traders to sell American assets, including the dollar.

“You have to be a bit more careful when it comes to how to position the portfolio at the moment,” Ken Wong, Asian equity portfolio specialist at Eastspring Investments, said in a Bloomberg Television interview. “Every single day we’ve been getting conflicting news around what’s happening around tariffs. So as a result, we have to take a bit more of a wait-and-see approach.”

In European news, HSBC Holdings Plc announced a fresh buyback for shareholders despite an increasingly fragile geopolitical backdrop.

Tariffs continued to dominate headlines with Treasury Secretary Scott Bessent telling CNBC the US has put China to the side for now as it seeks trade deals with between 15 to 17 other countries. He also said it’s up to Beijing to take the first step to de-escalate the tariff fight.

China is also pushing back hard with the People’s Daily, the flagship newspaper of the Chinese Communist Party, saying in a commentary Tuesday that the US should stop its wrongdoing of imposing tariffs. Foreign Minister Wang Yi also said if nations choose to remain silent, compromise and retreat, it will only lead to the bullies making further advances.

China also said the US tariff hike disrupted global air transport market and both its airlines and Boeing Co. have been severely affected, the country’s Ministry of Commerce said in a statement in response to Chinese carriers rejecting new jets from the US plane manufacturer. The country is also willing to continue to support the normal cooperation between Chinese and US firms, it said.

“Overall, I think the news flow gets better from here,” said Jitania Kandhari, Morgan Stanley IM Solutions and Multi-asset group CIO, said in a Bloomberg TV interview. “But on the long-term impact we are still watching what that means for economic growth and inflation.”

In Canada, the Liberal Party won a fourth consecutive election, giving a mandate to former central banker Mark Carney. The Canadian dollar weakened against the greenback on speculation Carney’s party will achieve only a narrow election victory.

Meanwhile, global funds are returning to India’s stocks, signaling that this month’s rally in Asia’s best-performing equity market likely has more legs. Foreigners are coming back amid growing optimism that a domestically-driven economy will make the South Asian nation withstand the global trade war better than most peers.

In commodities, oil steadied after a drop with signs of strain in the US economy. Gold dipped slightly ahead of key economic data this week.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:47 p.m. Tokyo time

- Australia’s S&P/ASX 200 rose 0.9%

- Hong Kong’s Hang Seng rose 0.1%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.4% to $1.1377

- The Japanese yen fell 0.4% to 142.58 per dollar

- The offshore yuan rose 0.1% to 7.2744 per dollar

Cryptocurrencies

- Bitcoin was little changed at $94,503.31

- Ether rose 0.4% to $1,794.31

Commodities

- West Texas Intermediate crude fell 0.8% to $61.57 a barrel

- Spot gold fell 1% to $3,310.27 an ounce

This story was produced with the assistance of Bloomberg Automation.

(An earlier version of this story corrected the 2nd paragraph to show Tokyo is closed for a holiday.)

©2025 Bloomberg L.P.

By