Bonds Rally as Weak Retail Sales Bolster Fed Bets: Markets Wrap

Feb 14, 2025 by Bloomberg(Bloomberg) -- Asian equities advanced Friday as markets reacted positively to signs reciprocal US tariffs may be weeks from coming into effect, raising the prospect for negotiations that could make them less punitive.

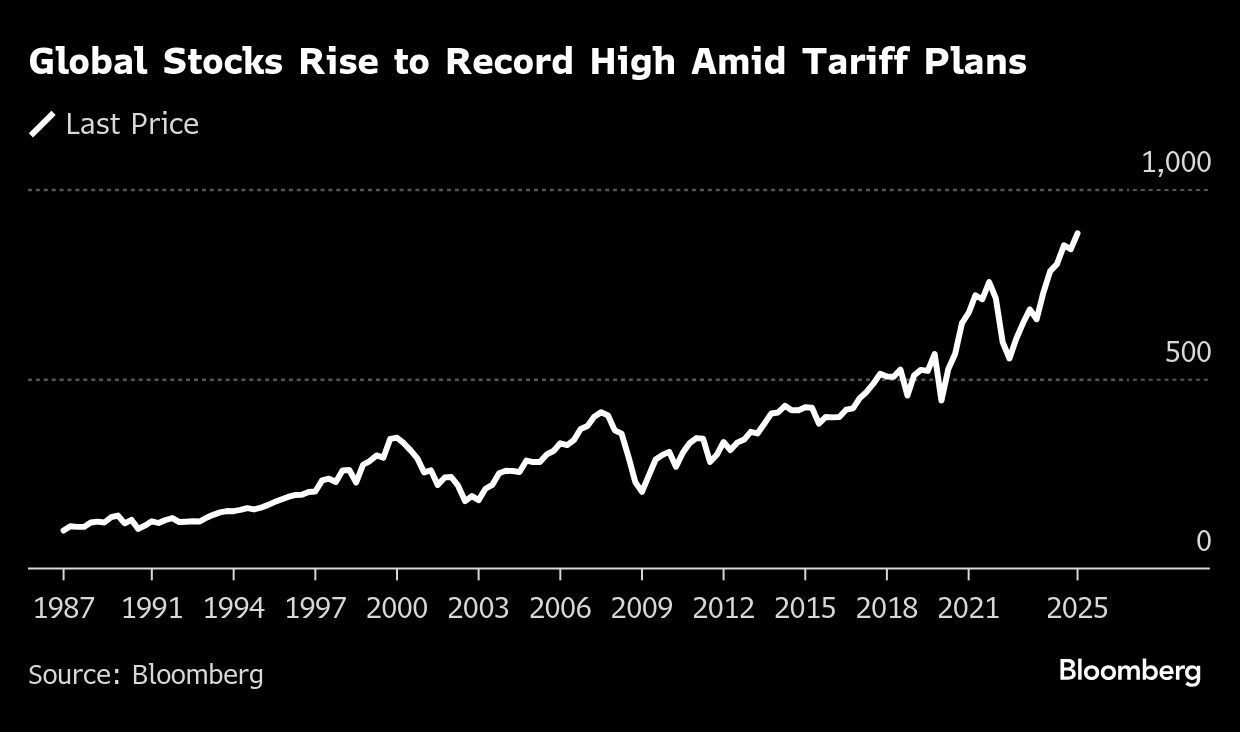

A benchmark of Asian shares gained for a third day, while US equity index futures also ticked higher. That was after the S&P 500 climbed toward a record on Thursday, helping propel a measure of global shares to an all-time high. The South Korean won strengthened, while a gauge of the dollar held near a two-month low.

The support for equities suggests investors have focused on speculation the talks may blunt the impact of the tariffs, echoing the response to delays on those leveled at Canada and Mexico earlier this month. The Bloomberg Dollar Spot Index has dropped about 2.5% from February’s high as investors wind back bets that Trump is determined to ramp up global tariffs as part of his “America First” policy.

“The fact this is a slow burn approach from Trump, with the chance many of the tariffs will be extinguished, is supporting market sentiment,” said Kyle Rodda, senior market analyst at Capital.com.

The work required to propose reciprocal tariffs will occur on a country-by-country basis and could take until April to complete, said Howard Lutnick, Trump’s nominee to lead the Commerce Department.

The comments followed news that Trump had ordered his administration to consider reciprocal tariffs on numerous trading partners, singling out Japan and South Korea as nations that he believes are taking advantage of the US.

As much as 92% of 153 respondents to a Bloomberg survey expect US tariffs of some sort to be implemented within six months. More than half of the participants expect the US to place tariffs on at least some economies and over a third expect universal levies to be enacted as well.

An index of the dollar was little changed Friday after its biggest drop in three weeks in the prior session. Growing speculation that new tariffs are a negotiating tool is undermining the popular trade of betting on the dollar.

“This is just the start of the dollar unwind,” said Charu Chanana, chief investment strategist at Saxo Markets Pte in Singapore. “Dollar gains have been driven by tariffs threats and US exceptionalism. It is very clear now that tariffs will be targeted rather than broad, with the underlying motives of national security and trade fairness.”

Treasuries were little changed in Asian trading after a rally in the prior session.

Read more on tariffs: Trump Is Promising Reciprocal Tariffs. What Are They?: QuickTake

In Asia, Chinese stocks in Hong Kong extended a recent rally as the nation’s growing capabilities in artificial intelligence boosted optimism over the market’s outlook. The Hang Seng China Enterprises Index jumped as much as 2.9% on Friday, getting closer to topping an October peak following a stimulus blitz. Apple Inc. is working to bring its AI features to China by the middle of this year.

In Japan, JX Advanced Metals Corp., a key global supplier of semiconductor materials, set the indicative share price in what would be the nation’s biggest such deal since 2018.

In India, Jefferies Financial Group Inc. warned retail funds flowing into the nation’s equity mutual funds is at risk of abating as market returns decline. The ongoing decline in Indian shares has erased more than $600 billion in market value since hitting a peak in late September. The benchmark BSE Sensex index rose for the first time in eight sessions on Friday.

Trump and Indian Prime Minister Narendra Modi agreed to begin negotiations to address the US trade deficit, with US president seeking to reduce import taxes and Modi focused on growing overall trade between the countries.

Gold fluctuated, still trading near a record high. The precious metal has gained higher this year, powered by haven demand, setting successive records with potential to line up a test of $3,000 an ounce.

Elsewhere in commodities, oil steadied as the market digested the fallout from Trump’s order of potential reciprocal tariffs on US trading partners.

Key events this week:

- Eurozone GDP, Friday

- US retail sales, industrial production, business inventories, Friday

- Fed’s Lorie Logan speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 2:03 p.m. Tokyo time

- Japan’s Topix fell 0.1%

- Australia’s S&P/ASX 200 rose 0.3%

- Hong Kong’s Hang Seng rose 2.5%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1% to $1.0454

- The Japanese yen rose 0.1% to 152.61 per dollar

- The offshore yuan fell 0.2% to 7.2835 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $96,831.86

- Ether rose 1.2% to $2,700.39

Bonds

- The yield on 10-year Treasuries was little changed at 4.53%

- Australia’s 10-year yield declined six basis points to 4.41%

Commodities

- West Texas Intermediate crude rose 0.2% to $71.45 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By