Stocks Slide on Weak Economic Data as Bonds Rally: Markets Wrap

Feb 21, 2025 by Bloomberg(Bloomberg) -- Chinese technology shares led gains in Asian stocks after Alibaba Group Holding Ltd. reporting its fastest pace of revenue growth in more than a year boosted optimism toward the sector. The yen weakened past 150 per dollar.

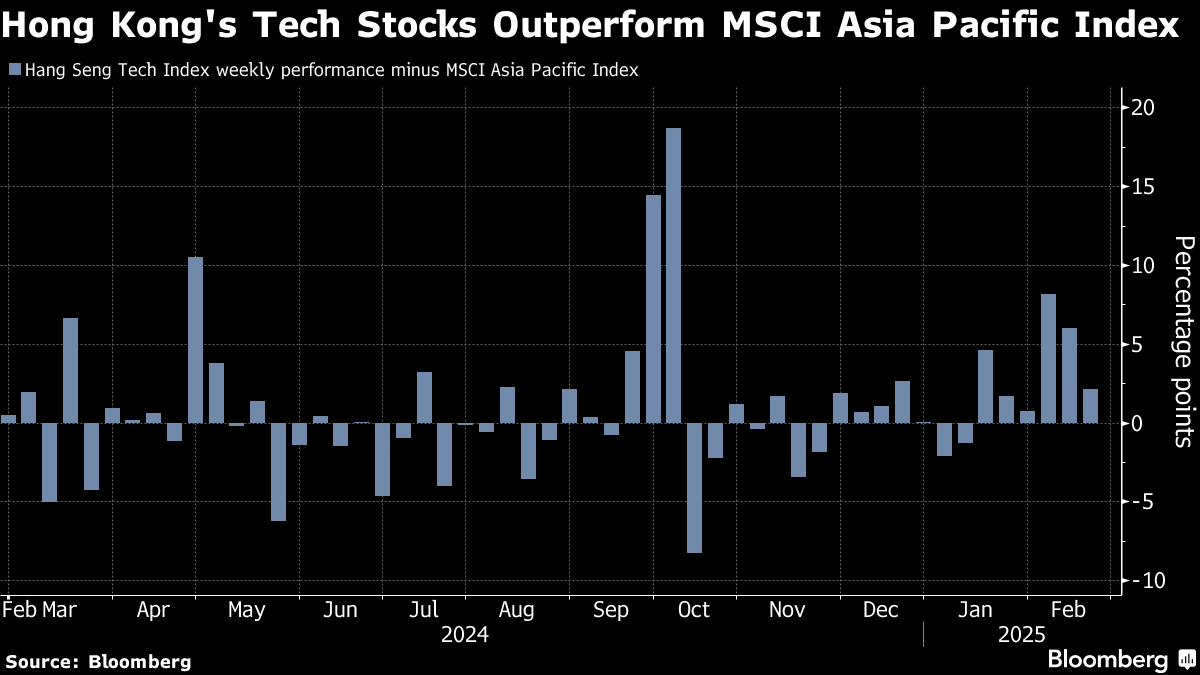

Equities in Hong Kong and a gauge of Asian shares advanced after Alibaba surged as much as 11% on the back of its earnings. Japanese stocks were flat. Gold held near a record and Treasuries were little changed after US equities dropped from a record. Asian stocks are in line to notch a sixth straight weekly gain, the longest winning streak in almost a year.

While investors remain nervous about rising geopolitical tensions and a widening tariff war, Alibaba and other Chinese technology shares have surged in recent weeks on enthusiasm over DeepSeek’s artificial-intelligence model. Global funds piling into that surge have driven a $1.3 trillion rally in Chinese stocks.

“My conviction is until China makes major structural reforms, those growth spurts are gonna be short-lived,” said Ron Temple, chief market strategist at Lazard Asset Management. “You want to trade those rallies. It’s a ‘rent don’t own.’”

Alibaba Chief Executive Officer Eddie Wu said the pursuit of artificial general intelligence is now the company’s “primary objective.” The company aims to continue to develop models that “extend the boundaries of intelligence,” he told investors on a call after earnings.

The earnings and the company’s capital expenditure plans surprised the market significantly, Morgan Stanley’s chief China equity strategist Laura Wang wrote in a note.

“This development further validates our firm belief that China’s ability to participate and even lead in the AI empowered global technology competition should be reassessed and more appreciated by global investors,” she wrote.

Meanwhile, the yen weakened back past 150 per dollar in Friday trading after strengthening past that key level Thursday on speculation the Bank of Japan will hike interest rates sooner rather than later. Traders are pricing in a roughly 84% chance of a 25 basis point hike at the July meeting, up from a 70% chance at the start of the month, according to data compiled by Bloomberg.

On Friday, data showed Japanese inflation accelerated more than expected. Consumer prices excluding fresh food rose 3.2% from a year earlier in January, the biggest gain since June 2023.

“The CPI prints, alongside the recent Q4 GDP and December wage data, justified the recent lift in BOJ rate-hike pricing,” said Carol Kong, a strategist at Commonwealth Bank of Australia. “USD/JPY can reach our end-March forecast of 149 sooner than expected.”

Bank of Japan Governor Kazuo Ueda signaled a readiness to intervene in the bond market to quell a surge in yields, reiterating the central bank’s long-standing commitment to supporting stable markets. Those comments pushed benchmark bond yields lower after touching a fresh 15-year high on Friday.

The S&P 500 slipped 0.4% Thursday as Walmart Inc. shares fell — the first big-box retailer to report results after the holiday season. That’s just days after retail sales signaled an abrupt pullback by consumers. A slide in banks also weighed on trading, with JPMorgan Chase & Co. and Goldman Sachs Group Inc. each falling over 3.8%.

Elsewhere, Treasuries were little changed in Asia. Treasury Secretary Scott Bessent said that any move to boost the share of longer-term Treasuries in government debt issuance is some ways off given current hurdles that include elevated inflation and the Federal Reserve’s quantitative tightening program.

In Australia, the central bank is closely monitoring the state of the labor market as persistent tightness may signal a stronger economy, Governor Michele Bullock said, adding that policymakers aren’t “pre-committed” to any path for interest rates.

In commodities, oil headed for its biggest weekly gain since early January on increasing supply uncertainty. Gold held near a record, and is on pace for an eighth straight weekly advance, on increasing haven demand fueled by geopolitical and trade tensions, as well as concerns about the economic outlook.

Key events this week:

- Eurozone HCOB manufacturing & services PMI, Friday

- US S&P Global manufacturing & services PMI, existing home sales, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 12:29 p.m. Tokyo time

- Japan’s Topix was little changed

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng rose 2.9%

- The Shanghai Composite rose 0.8%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0504

- The Japanese yen fell 0.6% to 150.49 per dollar

- The offshore yuan was little changed at 7.2413 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $98,310.62

- Ether rose 0.8% to $2,748.69

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.49%

- Australia’s 10-year yield was little changed at 4.52%

Commodities

- West Texas Intermediate crude fell 0.1% to $72.40 a barrel

- Spot gold fell 0.3% to $2,928.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By