Asian Stocks Rise as Xi Meeting Spurs China Tech: Markets Wrap

Feb 18, 2025 by Bloomberg(Bloomberg) -- Asian stocks advanced, with gauges in Hong Kong outperforming after a meeting between China’s President Xi Jinping and business leaders raised expectations of more support for the private sector.

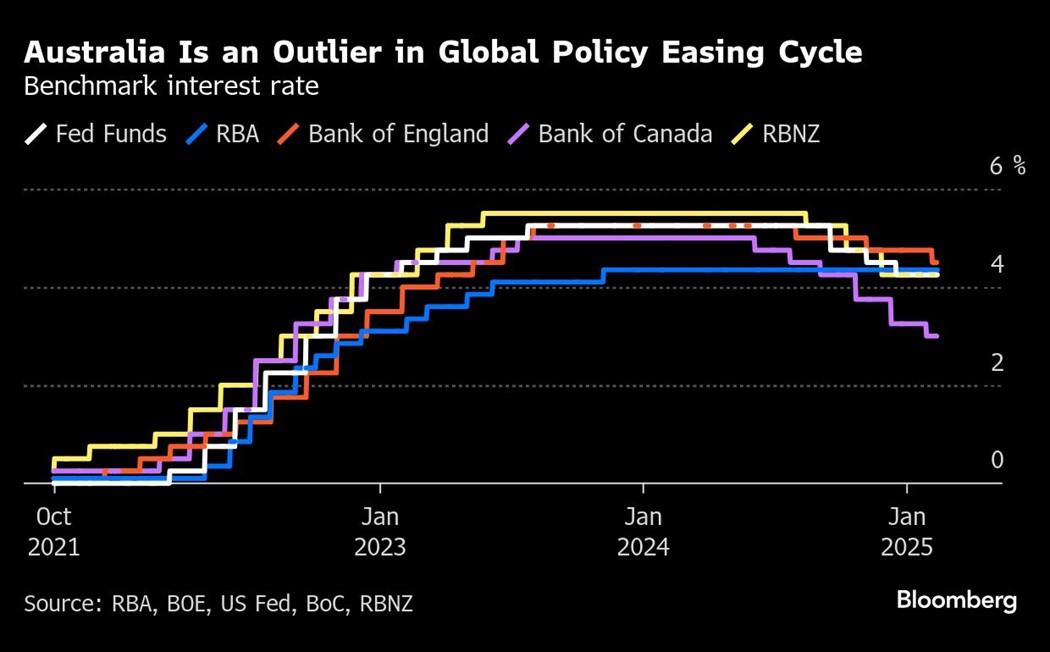

A regional benchmark of shares rose to its highest level since early November while Australian stocks extended losses after the central bank cut its policy rate. The dollar strengthened against all of its Group-of-10 peers and US Treasury 10-year yields were up three basis points to 4.5% as the bond market reopened Tuesday after the Presidents’ Day holiday. Earlier, Federal Reserve Governor Christopher Waller said recent economic data supported keeping interest rates on hold until more progress was seen in inflation.

The optimism around China got a further lift Monday after the encounter between Xi and corporate leaders, including Alibaba Group Holding Ltd. co-founder Jack Ma. Several analysts saw the conclave as a possible end to the years-long crackdown on the private sector. Separately, DeepSeek’s breakthrough in artificial intelligence has driven a rally of more than $1 trillion in Chinese shares.

“It’s a good rebound, but before it really evolves into a multi-year rising trend, a lot needs to be done,” Hao Hong, a partner and economist at Grow Investment Group, said in a Bloomberg TV interview. “If you really want a sustainable bull market, you really want a sustainable growth model going forward.”

Xi’s meeting drew many of the biggest names in Chinese business over the past decade, representing industries from chipmaking and electric vehicles to AI. The summit demonstrated Beijing’s softer stance toward the companies that fuel most of economy, just as Washington ramps up a potentially debilitating campaign of global tariffs.

A gauge of major Hong Kong-listed technology stocks is trading near a three-year high after its DeepSeek-driven rally. Technology stocks including Alibaba and Xiaomi Corp. contributed the most to the gains to the Hang Seng China Enterprises Index.

China’s government bond yields advanced with the 10-year rising 4 basis points to 1.73%, the highest since December, as tight cash conditions in the local market and a rally in stocks sapped the demand for debt.

Meanwhile, Fed Governor Waller said if US inflation behaves as it did in 2024, policymakers can get back to cutting “at some point this year.”

“If this wintertime lull in progress is temporary, as it was last year, then further policy easing will be appropriate,” Waller said in remarks he’s scheduled to deliver on Tuesday in Sydney. “But until that is clear, I favor holding the policy rate steady.”

Meanwhile, Australia’s dollar briefly climbed before paring gains after the country’s central bank said it remains cautious on future easing after lowering official cash rate.

In commodities, oil held its advance after OPEC+ delegates said the group was considering delaying restoring output, and Ukrainian drones attacked a crude-pumping station in Russia. Gold held a gain after rising 0.5% on Monday.

Some of the key events this week:

- Singapore budget, Tuesday

- UK jobless claims, unemployment, Tuesday

- Bank of England Governor Andrew Bailey speaks, Tuesday

- Canada CPI, Tuesday

- New Zealand rate decision, Wednesday

- Indonesia rate decision, Wednesday

- UK CPI, Wednesday

- South Africa CPI, retail sales, Wednesday

- US FOMC minutes, housing starts, Wednesday

- Australia unemployment, Thursday

- China loan prime rates, Thursday

- Eurozone consumer confidence, Thursday

- G-20 foreign ministers meet in South Africa, Thursday - Friday

- Reserve Bank of Australia Governor Michele Bullock and officials testify to parliamentary committee, Friday

- Japan CPI, Friday

- Eurozone HCOB manufacturing & services PMI, Friday

- UK S&P Global manufacturing & services PMI, Friday

- US S&P Global manufacturing & services PMI, Friday

- Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 1:13 p.m. Tokyo time

- Japan’s Topix rose 0.6%

- Australia’s S&P/ASX 200 fell 0.6%

- Hong Kong’s Hang Seng rose 2.1%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $1.0462

- The Japanese yen fell 0.4% to 152.09 per dollar

- The offshore yuan fell 0.1% to 7.2764 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $96,268.25

- Ether fell 2.2% to $2,715.01

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.51%

- Japan’s 10-year yield advanced 1.5 basis points to 1.400%

- Australia’s 10-year yield was little changed at 4.46%

Commodities

- West Texas Intermediate crude rose 0.9% to $71.35 a barrel

- Spot gold rose 0.4% to $2,907.63 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By