Global Assets Stabilize, Hang Seng Index Rallies: Markets Wrap

Feb 26, 2025 by Bloomberg(Bloomberg) -- Stocks, Treasuries and other assets steadied as investors sought to move on from weak US economic data that had rattled financial markets Tuesday.

US stock-index futures pointed to gains, Treasury 10-year yields rebounded in Asian trading while gold, Bitcoin and oil all traded within a tight range after declines overnight. Hong Kong equities surged, extending a rally that started last month driven by optimism that China’s technological breakthroughs may help revive the sluggish economy.

Investors sought safer corners of the market Tuesday after a weak US consumer confidence reading raised worries about the outlook for the broader economy from President Donald Trump’s policies and their impact on global growth. Chances for early action on President Donald Trump’s tax cut plans improved as House Republicans passed a budget blueprint Tuesday.

The steadiness Wednesday will get a test later when Nvidia Corp. reports earnings.

“Nvidia’s numbers could well be a make-or-break event for the market, at least in the short term,” said Tim Waterer, chief market analyst at KCM Trade in Sydney. “What could really drive sentiment one way or the other could boil down to whether the outlook from the company remains as rosy as before.”

Hong Kong shares were the standout asset in Asian trading, after DeepSeek reopened access to its core programming interface after nearly a three-week suspension, resuming a service key to wider adoption of an AI model that’s proven remarkably popular since its emergence last month.

“The Chinese stock market is still attractive from the relative valuation point of view,” said Linda Lam, head of equity advisory for North Asia at Union Bancaire Privee in Hong Kong.

President Trump’s move to further decouple economic ties between the two nations had rattled global investors who had bet on a sustained rebound in Chinese stocks. The shares have risen this year on optimism around DeepSeek artificial intelligence and President Xi Jinping’s meeting with corporate leaders, a move seen as a possible end to the year-long crackdown on the private sector.

Investors will also be watching the upcoming policy meetings in China next month, said Frank Benzimra, a strategist at Societe Generale SA.

Get the Markets Daily newsletter

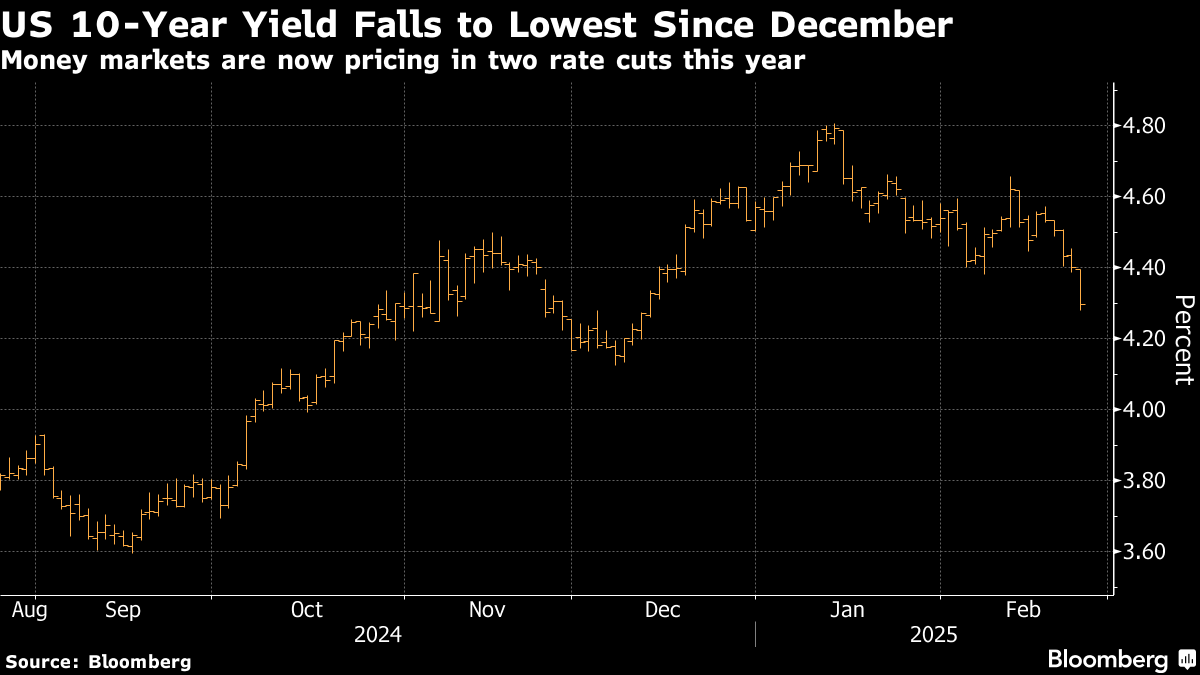

The yield on 10-year Treasuries rose after an 11-basis point decline overnight, sitting around its lowest levels since mid-December. Yields on Australian and Japanese bonds declined. Money markets are now pricing in more than two quarter-point reductions by the Fed in 2025.

Copper climbed after Trump signed an executive action directing the Commerce Department to examine possible tariffs on the metal.

Investors are awaiting this week’s reading on prices. The Fed’s preferred inflation metric — the core personal consumption expenditures price index — is expected to cool to the slowest pace since June.

In other markets, oil in New York steadied after sinking back into the $60s-a-barrel range as a souring economic outlook threatened prospects for energy demand. Gold edged up along with Bitcoin, which fell 6% overnight.

Key events this week:

- US new home sales, Wednesday

- Nvidia earnings, Wednesday

- Fed’s Raphael Bostic speaks, Wednesday

- Eurozone consumer confidence, Thursday

- US GDP, durable goods, initial jobless claims, Thursday

- Fed’s Jeff Schmid, Beth Hammack, Patrick Harker, Michael Barr, Michelle Bowman speak, Thursday

- Japan Tokyo CPI, industrial production, retail sales, Friday

- US PCE inflation, income and spending, Friday

- Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 1 p.m. Tokyo time

- Japan’s Topix fell 1%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng rose 2.5%

- The Shanghai Composite rose 0.5%

- Euro Stoxx 50 futures rose 0.4%

- Nasdaq 100 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0504

- The Japanese yen fell 0.3% to 149.42 per dollar

- The offshore yuan was little changed at 7.2594 per dollar

- The Australian dollar fell 0.3% to $0.6327

Cryptocurrencies

- Bitcoin rose 0.2% to $88,857.14

- Ether fell 0.9% to $2,488.74

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.32%

- Japan’s 10-year yield declined 2.5 basis points to 1.355%

- Australia’s 10-year yield declined four basis points to 4.35%

Commodities

- West Texas Intermediate crude rose 0.2% to $69.05 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By