Oil Advances After Weekly Drop as Market Weighs Trump’s Tariffs

Feb 10, 2025 by Bloomberg(Bloomberg) -- Oil rose after a string of weekly declines as the market weighed the fallout from President Donald Trump’s ongoing tariffs, as well as sanctions on Russia and soaring natural gas prices.

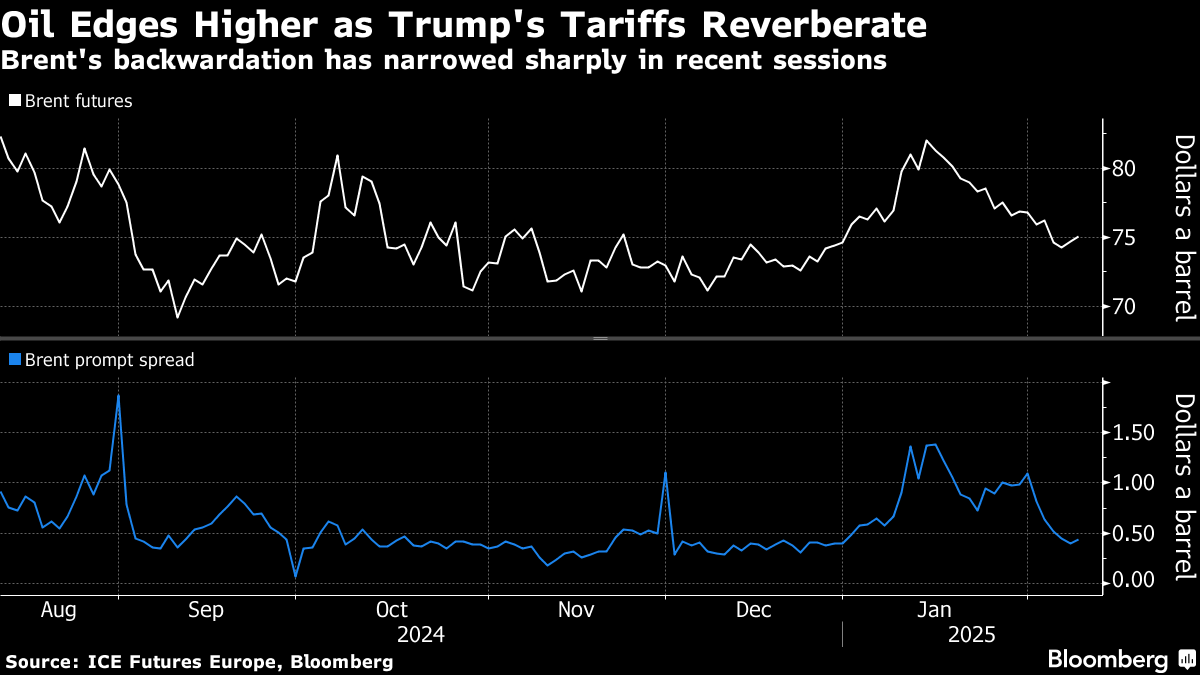

Brent rose above $75 a barrel after a third weekly drop, the longest losing streak since September. Chinese tariffs on US goods are set to start Monday, in retaliation against Trump’s levies that took effect last week.

Trump’s tariff plans pushed investors into the biggest two-week pullback in net-bullish bets on US crude since 2017. But there are still bullish factors at play, with major US sanctions on Russia’s oil exports and European natural gas prices at a two-year high, boosting the risk of higher oil demand.

Oil has been on a downward trend since mid-January as a lackluster demand outlook and Trump’s tariffs hurt sentiment, outweighing US sanctions on Russian and Iranian oil.

The US president flagged more tariffs on Sunday, this time on aluminum and steel, which would apply to all countries. The duties could ripple through the US energy industry, including oil drillers, which are reliant on specialty steel that’s not made in the country. He didn’t specify when the levies would start.

“It seems that rather than speculate on the outcome of tariffs and economic fallouts, the market is going to take a wait-and-see approach, as which way Mr. Trump prefers to lean is anyone’s guess,” said Harry Tchilinguirian, group head of research at Onyx Capital Group. “This week will be all about tariffs.”

©2025 Bloomberg L.P.

By