Oil Set for Monthly Loss as Tariff Risks Batter Sentiment

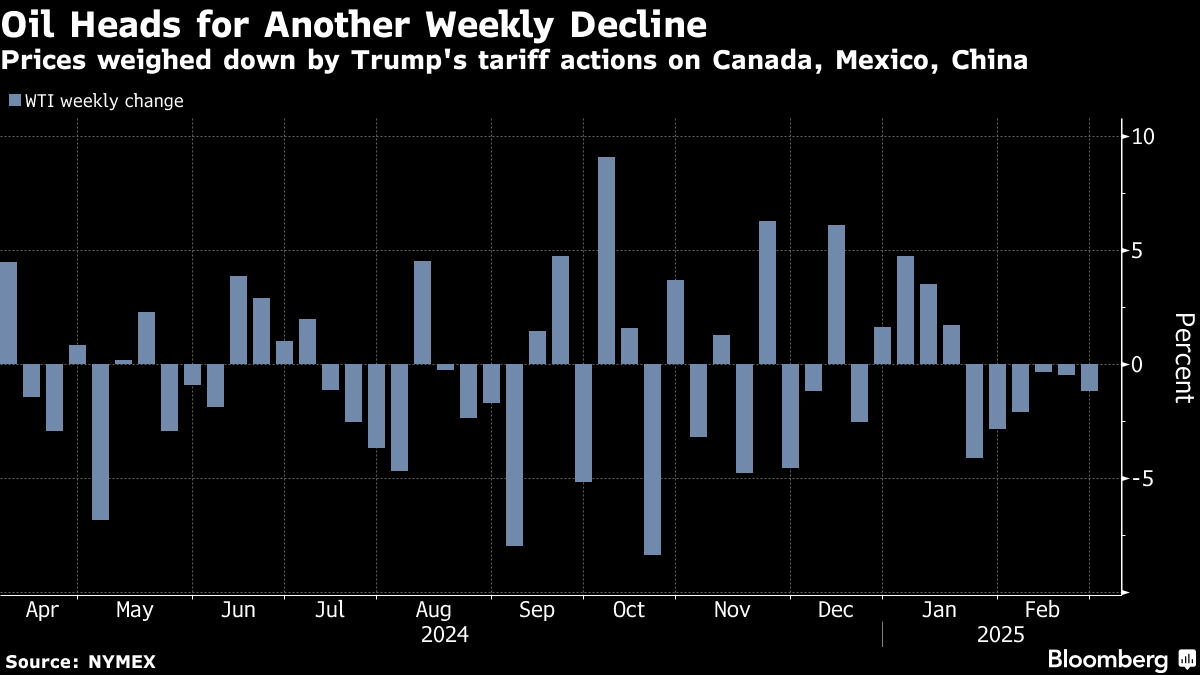

Feb 28, 2025 by Bloomberg(Bloomberg) -- Oil headed for the biggest monthly loss since September as US President Donald Trump’s escalating tariff threats cut investors’ risk appetite, strengthened the dollar and clouded the outlook for energy demand.

West Texas Intermediate futures edge lower to trade below $70 a barrel and are down by more than 4% this month. Trump affirmed the March 4 start of levies on imports from Canada and Mexico, which are biggest suppliers of foreign oil to the US. He also threatened to double an existing tariff on imports from China. Beijing vowed countermeasures.

Crude is on track for its sixth consecutive weekly loss, dragged down by hawkish US trade policy, as well as weak economic data. Algorithmic-driven investors known as commodity trading advisers are seizing on the gloom to build a net-short position in oil for the first time since late December, said Daniel Ghali, a commodity strategist at TD Securities.

The potential tariffs may have a complex effect on crude prices. The US relies heavily on oil imports from Canada and Mexico to feed its refineries, and a levy could raise oil costs. At the same time, higher charges on all other goods pose risks to economic growth, consumer confidence and energy consumption.

Trump’s attempts to broker an end to the Russia-Ukraine war added come choppiness to the market Friday, after his much-awaited meeting with Ukrainian President Volodymyr Zelenskiy devolved. Trump earlier said the US would be a major partner in developing Ukraine’s commodities extraction, including oil and gas, as well as minerals and rare earths.

On the supply side, pipeline exports from Iraq’s Kurdistan region may be restarted, and OPEC+ is expected to defer a production increase once again.

©2025 Bloomberg L.P.

By