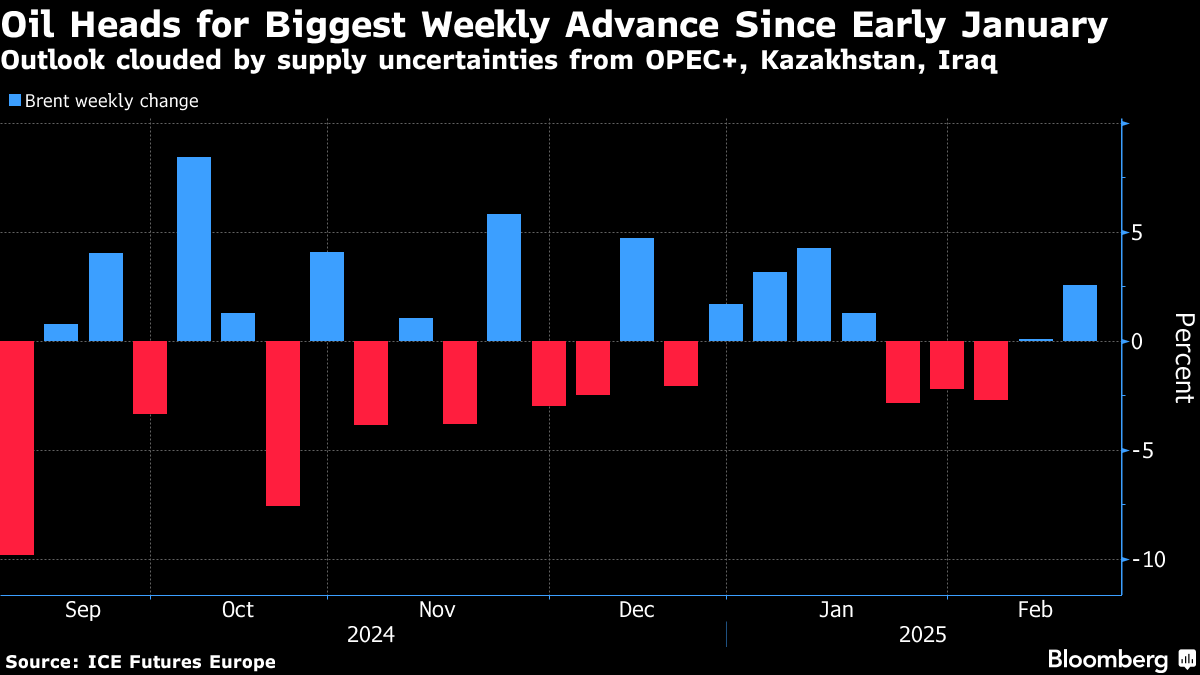

Oil Set for Weekly Advance as Supply Uncertainty Clouds Outlook

Feb 21, 2025 by Bloomberg(Bloomberg) -- Oil headed for its biggest weekly gain since early January on increasing supply uncertainty, and support from a weaker US dollar.

Brent crude held above $76 a barrel, and is up more than 2% this week for the biggest advance since Jan. 10, while West Texas Intermediate was near $72. OPEC+ could delay a production increase, Kazakh output remains disrupted after a Ukrainian drone attack in Russia, while the status of a resumption of exports from Iraq’s Kurdistan region is unclear.

OPEC+ postponing its 120,000 barrel-a-day hike — a move flagged as possible by delegates — would mark the fourth time that the group delayed plans to revive production halted since 2022. At present, the alliance aims to restore a total of 2.2 million barrels a day in monthly increments, starting from April.

“OPEC’s ability to phase out production cuts without disrupting the oil market is getting increasingly difficult,” ANZ Group Holdings analysts Daniel Hynes and Soni Kumari said in a note. “Given the economic and geopolitical uncertainties and its need to support oil prices, we expect OPEC will delay.”

A weaker dollar also made commodities more attractive for many buyers. A Bloomberg gauge of the US currency declined to its lowest level since December on Thursday.

Oil’s had a bumpy ride this year, buffeted by US President Donald Trump’s quick-fire tariff actions and wider policy decisions, as well as the question marks over global supplies. The threat of US duties on imports, or other disruptive measures on trade that could harm global growth, has seen futures erase most of this year’s early gains.

Elsewhere, the US signaled that sanctions relief for Russia could be on the table in talks over the war in Ukraine. Treasury Secretary Scott Bessent said Washington was prepared to either ramp up or take down the penalties based on the Kremlin’s willingness to negotiate.

©2025 Bloomberg L.P.

By