Shares Advance in Asia Boosted by Tech Optimism: Markets Wrap

Feb 17, 2025 by Bloomberg(Bloomberg) -- Asian stocks gained as AI optimism boosted technology shares across the region, while other investors remained cautious due to tensions between the US and European Union over tariffs and the war in Ukraine.

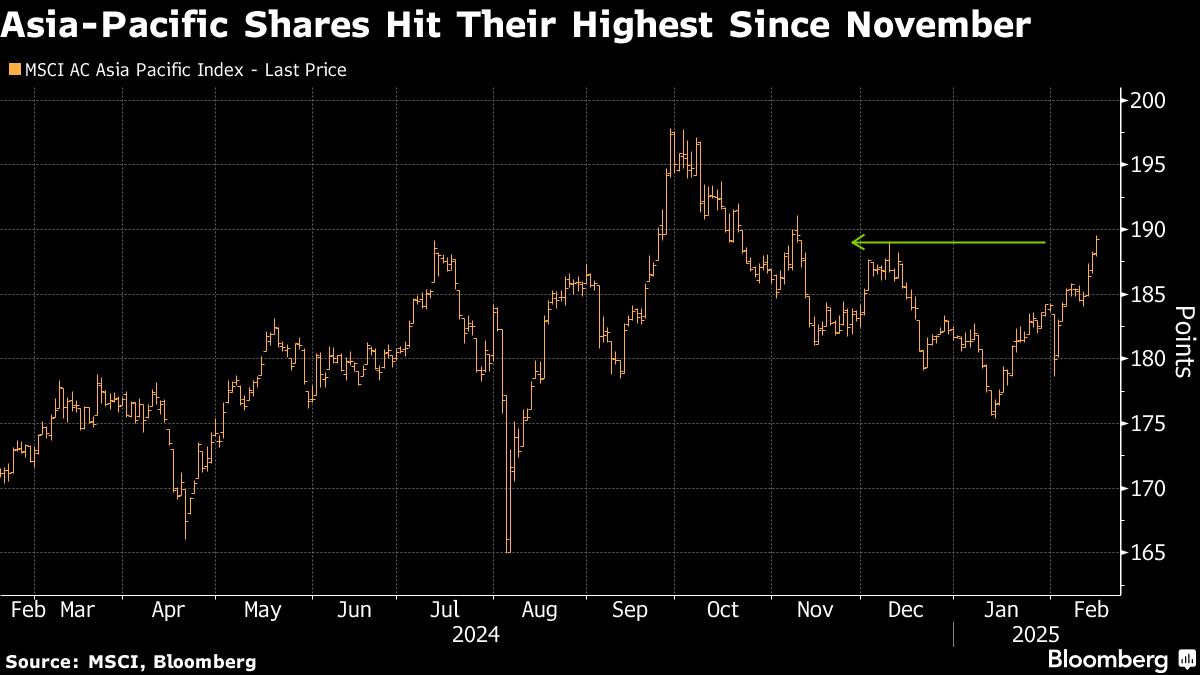

Tencent Holdings Ltd. jumped as much as 7.8% in Hong Kong, extending a winning run that’s gotten a boost from DeepSeek’s debut. A gauge of Asian shares rose to its highest level since November, helped by technology companies from Japan to Taiwan. Treasury futures edged lower with cash trading closed globally due to Presidents’ Day in the US. The dollar was little changed.

China’s tech-powered rally is gaining momentum as DeepSeek’s breakthrough in artificial intelligence drove a $1.3 trillion rally in the country’s shares. A meeting between President Xi Jinping and business figures including e-commerce icon Jack Ma may fuel optimism further. That contrasts with increasing discord between the US and Europe, which prompted a drop in German and French bond futures.

“The growth momentum in China could see some new lease on life” given what’s happening in AI,” said Tai Hui, Asia-Pacific chief Market strategist at JPMorgan Asset Management. “The China-AI story is continuing to develop.”

Goldman Sachs Group Inc. strategists raised their MSCI China index target on optimism over the country’s technological advancements. Meanwhile, investor Michael Burry had rolled back on some of his investments in Chinese tech stocks just before DeepSeek’s breakthrough.

Markets remained volatile during Asian trade, with the MSCI Asia Pacific gauge trimming some gains from its earlier highs.

US President Donald Trump’s tariff plans sparked threats of retaliation while Vice President JD Vance attacked longstanding European allies at a security conference at the weekend. Plans to negotiate an end to the war in Ukraine have left the bloc on the sidelines.

Investors may demand higher yields on government debt across the European region on concern officials will seek to beef up military investment. Upgrading defense and protecting Ukraine may cost Europe’s major powers an additional $3.1 trillion over 10 years, according to Bloomberg Economics estimates. The euro was rangebound on Monday.

“The scope for a further rally in European FX on a potential Russia-Ukraine ceasefire deal is limited,” Barclays Plc analysts led by Sheryl Dong wrote. “Provisional details are negative for Europe’s security and the war premium is low.”

Elsewhere in Asia, Westpac Banking Corp.’s shares slid as much as 6.2% after profit and margins slipped. Japan’s economy expanded for a third straight quarter as companies boosted investment and net exports improved.

In commodities, oil steadied after a string of declines as the prospect of increased flows from Iraq and Russia weighed on the outlook.

Some of the key events this week:

- Presidents Day holiday in the US; bond and stock markets are closed, Monday

- Australia rate decision, Tuesday

- UK jobless claims, unemployment, Tuesday

- Bank of England Governor Andrew Bailey speaks, Tuesday

- Canada CPI, Tuesday

- New Zealand rate decision, Wednesday

- Indonesia rate decision, Wednesday

- UK CPI, Wednesday

- South Africa CPI, retail sales, Wednesday

- US FOMC minutes, housing starts, Wednesday

- Australia unemployment, Thursday

- China loan prime rates, Thursday

- Eurozone consumer confidence, Thursday

- G-20 foreign ministers meet in South Africa, Thursday - Friday

- Reserve Bank of Australia Governor Michele Bullock and officials testify to parliamentary committee, Friday

- Japan CPI, Friday

- Eurozone HCOB manufacturing & services PMI, Friday

- UK S&P Global manufacturing & services PMI, Friday

- US S&P Global manufacturing & services PMI, Friday

- Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 1:55 p.m. Tokyo time

- Japan’s Topix rose 0.4%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng rose 0.2%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0496

- The Japanese yen rose 0.4% to 151.70 per dollar

- The offshore yuan rose 0.2% to 7.2451 per dollar

Cryptocurrencies

- Bitcoin fell 1.1% to $96,098.14

- Ether fell 0.9% to $2,663.94

Bonds

- Australia’s 10-year yield advanced three basis points to 4.44%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold rose 0.6% to $2,900.27 an ounce

This story was produced with the assistance of Bloomberg Automation.

(An earlier version was corrected to remove the reference to Treasuries trading)

©2025 Bloomberg L.P.

By