Trump’s Tariffs, Curbs on China Hurt Asian Stocks: Markets Wrap

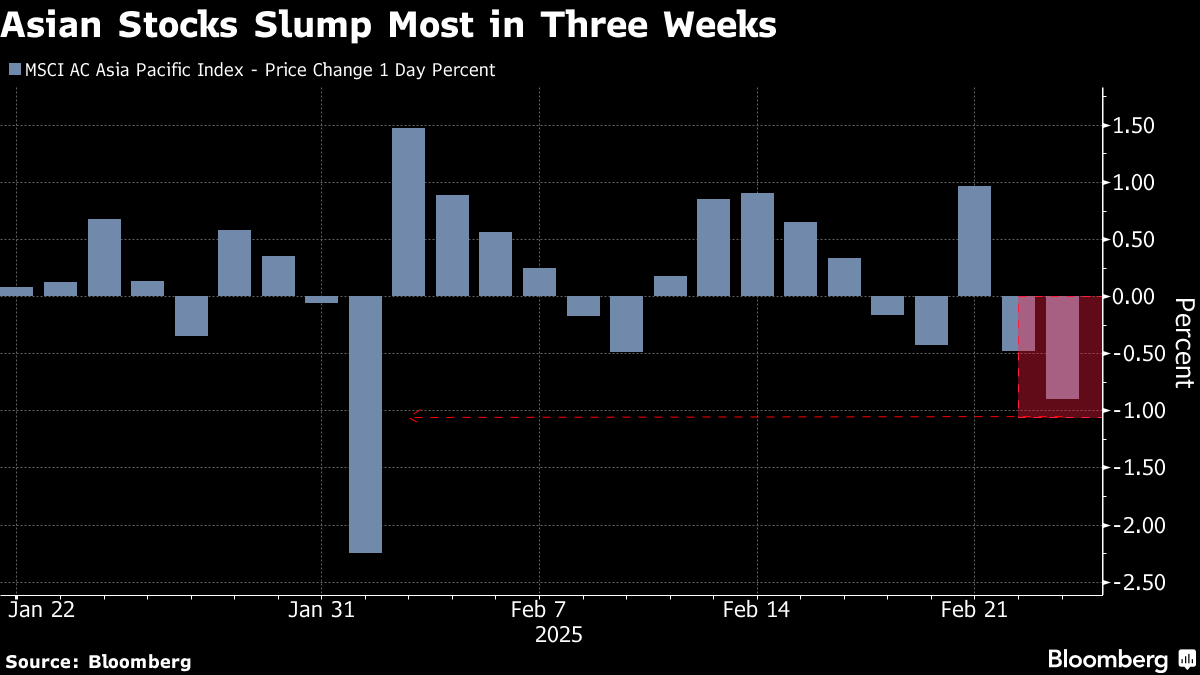

Feb 25, 2025 by Bloomberg(Bloomberg) -- Asian stocks fell the most in three weeks as US President Donald Trump’s decision to go ahead with tariffs on Canada and Mexico and order curbs on Chinese investment damped risk appetite.

Shares fell across the region with some of the biggest declines in Japan, Taiwan and Hong Kong. Treasury 10-year yields dropped three basis points to 4.4% in Asia, after gold climbed to a record Monday on demand for havens. Bitcoin, seen as a so-called “Trump trade,” slipped with other crypto currencies.

Trump said tariffs scheduled to hit Canada and Mexico next month were “on time” and “moving along very rapidly” following an initial delay. Sentiment in the broader market also soured after the president told a government committee to curb Chinese spending on tech, energy and other strategic American sectors.

“There’s just so much uncertainty in the market and it’s so hard for Asian investors to know what the end game is,” Jessica Jones, head of Asia at PGIM Investments, said in a Bloomberg TV interview. “Whether it’s going to end up causing more inflation or whether it’s going to actually slow down growth — the jury is still out.”

Trump also deepened Washington’s split with its allies over Ukraine, withdrawing US condemnation of Russia’s 2022 invasion at the United Nations and among Group-of-Seven countries as he aims to end the war on terms agreeable to Moscow.

Trump officials are also sketching out tougher versions of US semiconductor curbs. The declines are a test for Chinese technology shares after they rallied to a three-year high on optimism over DeepSeek and President Xi Jinping’s meeting with corporate leaders.

Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd. and ASML Holding NV engineers from maintaining semiconductor gear in China, according to people familiar with the matter.

This comes after a directive set the stage for a more muscular use of the Committee on Foreign Investment in the United States, or CFIUS, a secretive panel that scrutinizes proposals by foreign entities to buy US companies or property, to thwart Chinese investment.

“If these orders were to go into effect, there is a risk that AI supply chains could be impacted,” said Charu Chanana, chief investment strategist at Saxo Markets Pte. “However, since the inauguration, there has been several such orders from the Trump administration, but these have been directed towards gaining leverage and bargaining power in negotiations.”

In Japan, trading houses, including Mitsubishi Corp. and Marubeni Corp., rallied on Tuesday after Berkshire Hathaway Inc. said it was looking to increase ownership in the companies in an annual letter to shareholders dated Saturday.

Elsewhere in Asia, Bank of Korea cut its seven-day repurchase rate by a quarter-percentage point to 2.75% in a widely expected move.

In other markets, oil edged higher as investors assessed a fresh wave of US sanctions on Iran. Gold held near its record. Bitcoin slipped for a third day, while Ether and many of the higher profile altcoins such as Solana and Dogecoin also remained under pressure as investors turn elsewhere with the sector still reeling after its biggest-ever hack last week.

Key events this week:

- US consumer confidence, Tuesday

- Fed’s Lorie Logan, Tom Barkin, Michael Barr speak, Tuesday

- Apple shareholder meeting, Tuesday

- US new home sales, Wednesday

- Nvidia earnings, Wednesday

- Fed’s Raphael Bostic speaks, Wednesday

- Eurozone consumer confidence, Thursday

- US GDP, durable goods, initial jobless claims, Thursday

- Fed’s Jeff Schmid, Beth Hammack, Patrick Harker, Michael Barr, Michelle Bowman speak, Thursday

- Japan Tokyo CPI, industrial production, retail sales, Friday

- US PCE inflation, income and spending, Friday

- Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 2:11 p.m. Tokyo time

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 fell 0.7%

- Hong Kong’s Hang Seng fell 0.8%

- The Shanghai Composite fell 0.3%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0473

- The Japanese yen was little changed at 149.58 per dollar

- The offshore yuan was little changed at 7.2567 per dollar

Cryptocurrencies

- Bitcoin fell 2.1% to $91,959.34

- Ether fell 5.1% to $2,502.14

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.38%

- Australia’s 10-year yield declined four basis points to 4.39%

Commodities

- West Texas Intermediate crude rose 0.7% to $71.17 a barrel

- Spot gold fell 0.4% to $2,938.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By