Asian Stocks Advance on Tech Rebound Ahead of Fed: Markets Wrap

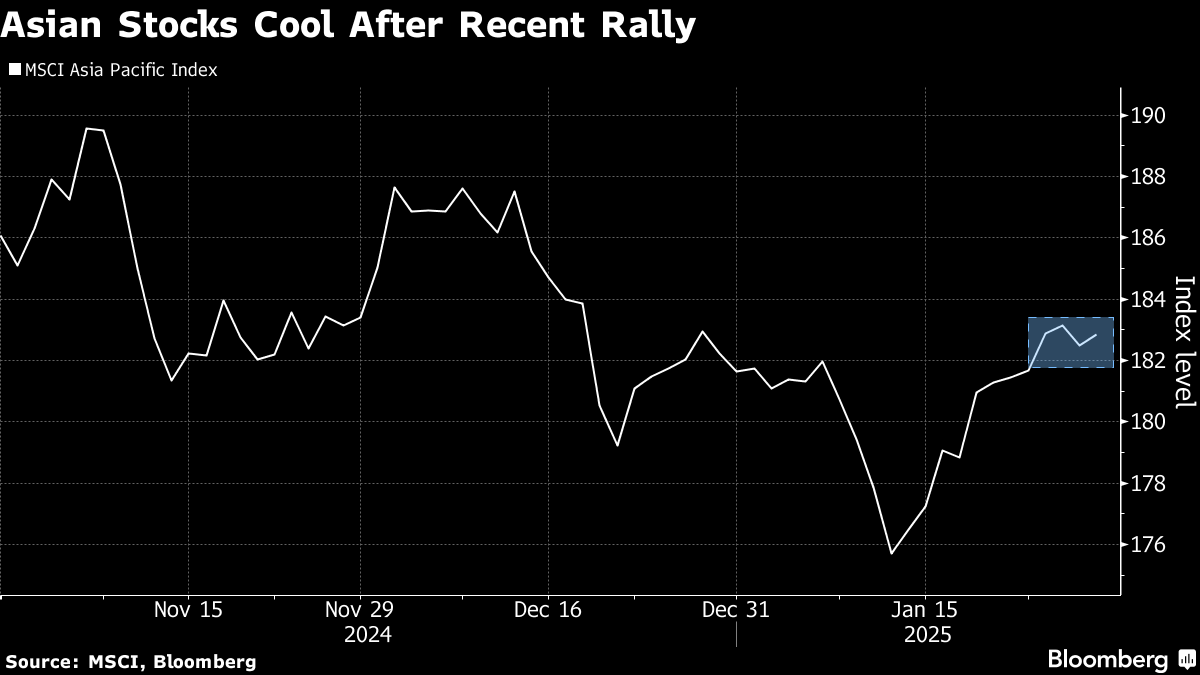

Jan 29, 2025 by Bloomberg(Bloomberg) -- Stocks in Asia advanced to follow Wall Street’s tech-led rebound from a selloff that shook global markets, as focus turns to the Federal Reserve’s rate decision and US mega-cap earnings.

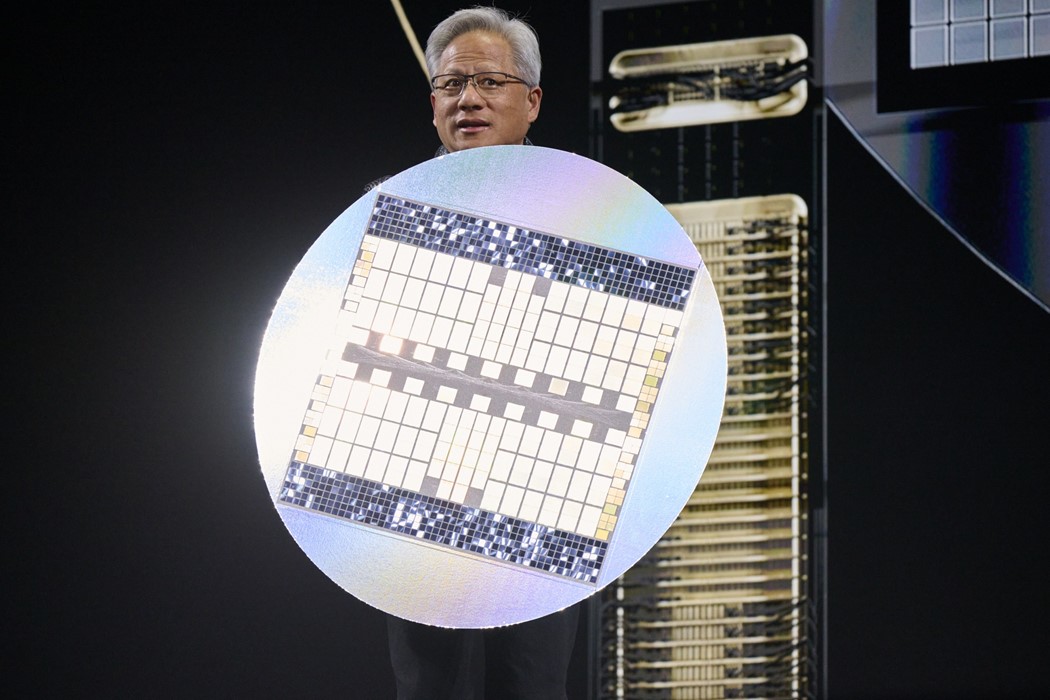

Japanese, Australian and Indian shares rose. Most other major markets in the region are closed for Lunar New Year holidays. Futures in Europe climbed, while US contracts were steady after the S&P 500 rose 0.9% and Nasdaq 100 advanced 1.6% on Tuesday, as Nvidia Corp. rallied 8.9% following the largest one-day value loss in history.

Shares rebounded after a rough start to the week, sparked by concerns over a cheap artificial intelligence-model from Chinese startup DeepSeek. However, investors like Steve Cohen see the development as a boon for the industry. Focus shifts to the Fed decision and Big Tech earnings, starting Wednesday.

“The dust has settled on DeepSeek and investors seem much more circumspect,” said Kyle Rodda, a senior market analyst at Capital.Com Inc. “We look to earnings and the Fed now — the former being more important because the latter will probably be a nothing-burger!”

Fed officials are widely expected to hold borrowing costs steady on Wednesday against a backdrop of healthy demand and stubborn inflation. Bond traders are ratcheting up bullish bets on US Treasuries in hopes that Fed Chair Jerome Powell signals a cut in March is firmly on the table. A survey conducted by 22V Research shows 67% of respondents expect the reaction to the Fed Wednesday to be “mixed/negligible,” 21% said “risk-off” and 12% “risk-on.”

The yield on 10-year Treasuries inched lower. West Texas Intermediate oil steadied on Wednesday after gaining 0.8% on Tuesday.

“Simply put, the strong US fundamental story of strong growth, elevated inflation, and a more hawkish Fed continues to favor higher US yields and a stronger dollar,” Win Thin, a strategist at Brown Brothers Harriman, wrote in a note.

In Japan, the benchmark repurchase-agreement rate surged the most in 16 months, indicating that bond crunch has eased. It fell more than 30 basis points in the past two days amid signs that investors rushed to borrow bonds to close out bearish positions on these securities.

As for earnings in the US, while profits from the so-called Magnificent Seven behemoths are still rising — and far outpacing the rest of the market — growth is projected to come in at the slowest pace in almost two years.

“While we still believe in the AI-driven productivity story, investing in this sector going forward may not be as easy as it was over the past two years,” said Emily Bowersock Hill at Bowersock Capital Partners. “We expect investors to be more discerning and selective when it comes to AI investing.”

In Australia, core inflation eased by more than expected in the final three months of 2024. The Australian dollar dropped and the policy-sensitive three-year yield fell 5 basis points on bets that the Reserve Bank may embark on a monetary easing cycle soon.

In corporate news, Sony Group named President Hiroki Totoki as CEO, effective April 1. The company was one of the top performers on the Nikkei 225 index Wednesday, while software and gaming stocks rose.

Apple Inc. has been secretly working with SpaceX and T-Mobile US Inc. to add support for the Starlink network in its latest iPhone software, according to people with knowledge of the matter.

Key events this week:

- US Fed rate decision, Wednesday

- Tesla, Microsoft, Meta, ASML earnings, Wednesday

- Canada rate decision, Wednesday

- Eurozone ECB rate decision, consumer confidence, unemployment, GDP, Thursday

- US GDP, jobless claims, Thursday

- Apple, Deutsche Bank earnings, Thursday

- US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:35 p.m. Tokyo time

- Japan’s Topix rose 0.7%

- Australia’s S&P/ASX 200 rose 0.7%

- Hong Kong’s Hang Seng rose 0.1%

- Euro Stoxx 50 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.1% to $1.0441

- The Japanese yen rose 0.1% to 155.33 per dollar

- The offshore yuan rose 0.2% to 7.2605 per dollar

Cryptocurrencies

- Bitcoin rose 1.8% to $102,137.14

- Ether rose 2.7% to $3,133.59

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.52%

- Japan’s 10-year yield was little changed at 1.185%

- Australia’s 10-year yield declined five basis points to 4.37%

Commodities

- West Texas Intermediate crude fell 0.1% to $73.68 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By