Asian Stocks Drop on AI Concerns, Dollar Advances: Markets Wrap

Jan 28, 2025 by Bloomberg(Bloomberg) -- Most Asian shares fell as concern about the potential overvaluation of artificial-intelligence companies stretched into a second day. The dollar gained as US President Donald Trump said he wanted higher universal tariffs.

The MSCI Asia Pacific Index slipped as much as 0.6% with Japan’s largest technology firms among the biggest losers. US equities had slumped 3% Monday as a cheap AI model from Chinese startup DeepSeek sparked fears about lofty valuations of the global tech sector. Many Asian markets, including China, South Korea and Taiwan are shut for the Lunar New Year holidays.

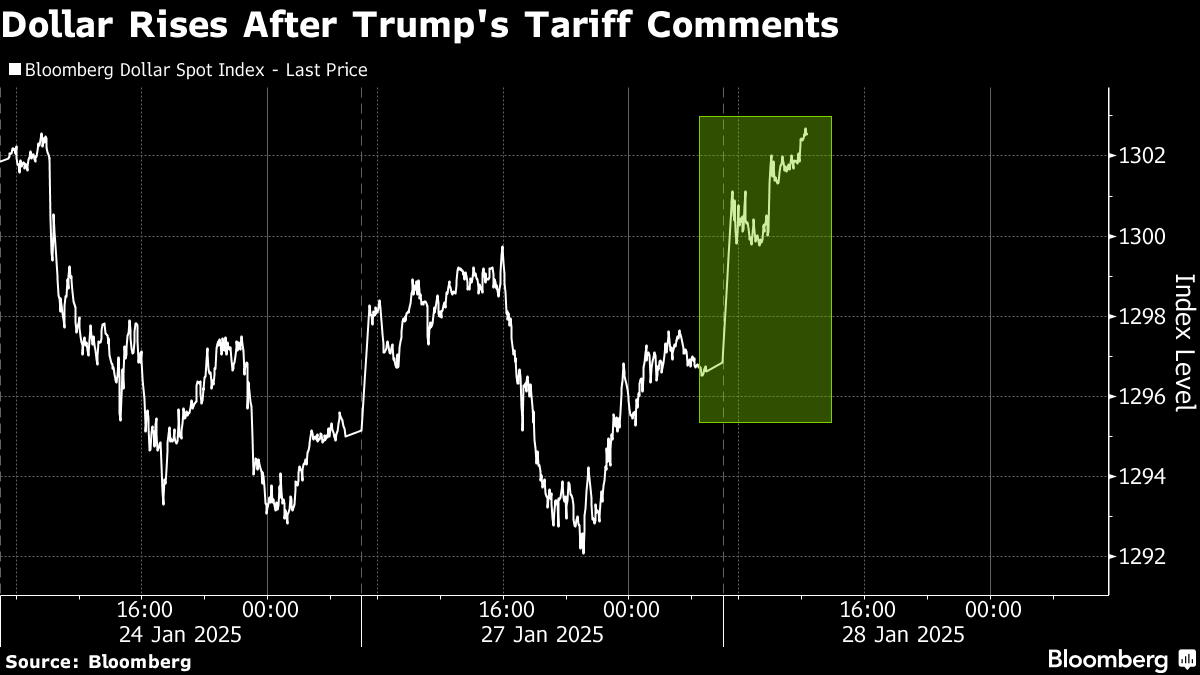

The dollar strengthened against all of its Group-of-10 peers as Trump said he wanted across-the-board tariffs “much bigger” than 2.5%. He also said he would soon put levies on foreign-produced semiconductors, pharmaceuticals and some metals to compel producers to manufacture in the country. Scott Bessent, whom the Financial Times said backed gradual universal levies, was confirmed as the next Treasury Secretary.

There were at least some signs Asian share markets are stabilizing. While the Nikkei 225 Stock Average slipped 1%, the broader Topix reversed its earlier decline. Among major tech firms, Advantest Corp. tumbled as much as 11% and SoftBank Group Corp. slumped 6%. The Hang Seng Index closed marginally higher in a shortened trading day.

“I don’t see DeepSeek as revolutionary but rather a wake up call to recalibrate the AI trade,” said Billy Leung, an investment strategist at Global X ETFs in Sydney. “I’d expect this to create sectoral rotation rather than a broad market collapse. The early cycle AI hype focused heavily on hardware, but this may tilt toward software and cloud providers as the narrative and headlines mature.”

US equity futures were little changed in Asia after Monday’s selloff. Treasuries edged lower with the 10-year yield rising one basis point to 4.55% after sinking nine basis points on Monday.

The Bloomberg Dollar Spot Index climbed 0.4%, extending gains after Trump’s latest tariff comments. The risk-sensitive Australian and New Zealand dollars both fell at least 0.5%, while the Thai baht tumbled 0.7%, leading losses in emerging Asia. China’s offshore yuan also weakened.

“Bessent talking about universal tariffs across the board and while gradual they could go up all the way to 20% — that is a big deal,” said Rodrigo Catril, strategist at National Australia Bank Ltd. in Sydney. “The president has a protectionist agenda, not good for global growth and supportive for the dollar as the preeminent safe haven.”

In commodities, copper declined after Trump said he planned to impose import tariffs on the metal, as well as aluminum and steel, raising fears of trade wars.

In the corporate world, shares of China Vanke Co. jumped as much as 14% in Hong Kong after the authorities vowed to support the developer, which reported a record loss on Monday. They closed 2.1% higher.

The slide in the US equities Monday was triggered by a rise of DeepSeek’s latest AI model to the top of the Apple’s appstore. A closely watched gauge of chipmakers slid the most since March 2020, while Nvidia Corp., the poster child of the AI boom, slumped 17% in New York, wiping out $589 billion in market value, the most ever for a single stock.

China Weakness

Chinese investors have much to ponder as they start their Lunar New Year holidays that last until next Tuesday. The nation’s economic activity unexpectedly faltered to start the year, breaking the momentum of a recovery sparked by stimulus measures and underlining the need for Beijing to do more to prevent another slowdown.

Global traders’ focus will be on earnings announcements from the likes of Microsoft and Apple this week to restore confidence in the so-called Magnificent Seven group of companies.

Investors are heading into yet another pivotal Big Tech earnings cycle with the companies’ shares near record highs and valuations stretched. A key distinction this time: The group’s profit growth is projected to come in at the slowest pace in in almost two years.

Key events this week:

- US consumer confidence, durable goods, Tuesday

- Fed rate decision followed by news conference by Chair Jerome Powell, Wednesday

- Canada rate decision, Wednesday

- Tesla, Microsoft, Meta, ASML earnings, Wednesday

- Eurozone ECB rate decision, consumer confidence, unemployment, GDP, Thursday

- US GDP, jobless claims, Thursday

- Apple, Deutsche Bank, Thursday

- ECB rate decision followed by news conference by President Christine Lagarde, Thursday

- US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets

Stocks

- S&P 500 futures were little changed as of 1:30 p.m. Tokyo time

- Hang Seng futures rose 0.3%

- Nikkei 225 futures (OSE) fell 1%

- Japan’s Topix was little changed

- Australia’s S&P/ASX 200 was little changed

- Euro Stoxx 50 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.5%

- The euro fell 0.6% to $1.0428

- The Japanese yen fell 0.9% to 155.87 per dollar

- The offshore yuan fell 0.4% to 7.2833 per dollar

Cryptocurrencies

- Bitcoin rose 1.7% to $103,025.47

- Ether rose 1.4% to $3,203.55

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.55%

- Japan’s 10-year yield declined two basis points to 1.195%

- Australia’s 10-year yield declined five basis points to 4.42%

Commodities

- West Texas Intermediate crude rose 0.5% to $73.51 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By