Dollar’s Tepid Rebound Reinforces Questions Around Haven Role

Jun 13, 2025 by Bloomberg(Bloomberg) -- The dollar’s muted rally against major peers after Israel’s strikes on Iran reinforced the impression that the greenback’s role as a global haven currency is fading.

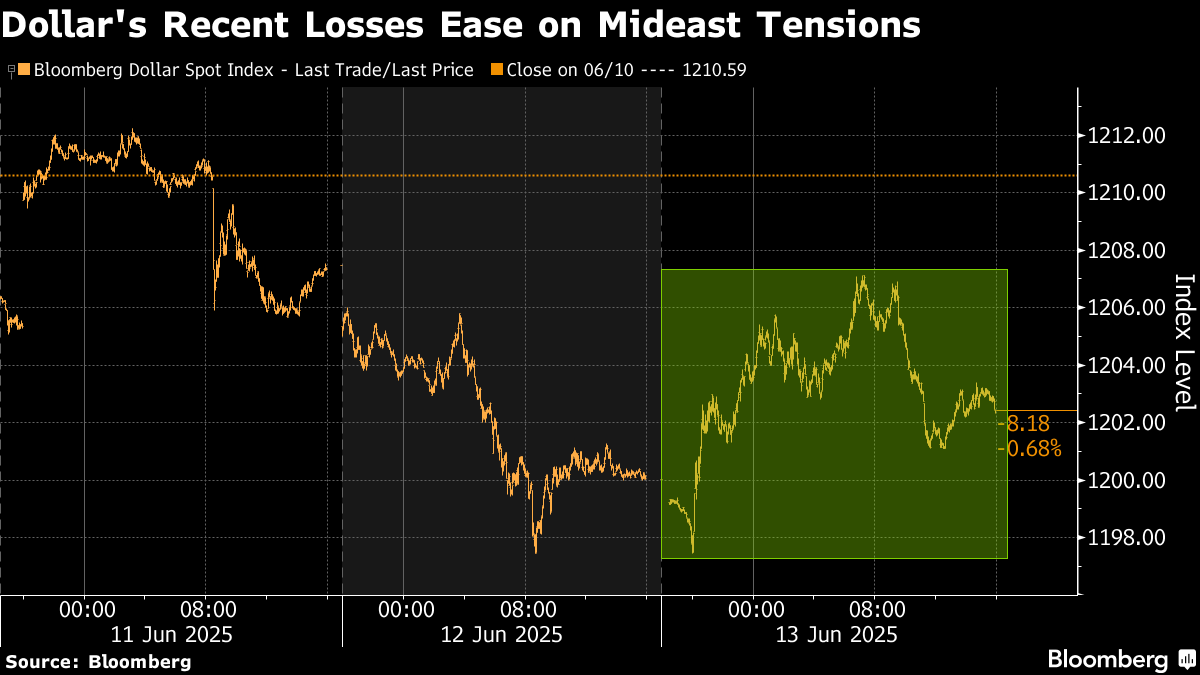

A Bloomberg gauge of the US dollar gained as much as 0.6% at one point on Friday after Israel’s attacks on Iranian nuclear facilities stoked fears of a wider conflict in the Middle East. However, the currency pared much of its advance and closed some 0.2% higher in New York.

The modest recovery leaves the greenback just above the three-year low it hit this week after President Donald Trump threatened fresh levies against global trading partners. The dollar has slid during the past five months as Trump pushed ahead with tariffs, which have raised concerns over the US economic outlook and fueled speculation that foreigners will shun American assets — the so-called Sell America trade.

“Middle East tensions are a risk to navigate rather than a game changer for the bearish dollar view,” JPMorgan strategists including Meera Chandan and Arindam Sandilya said to clients in a note Friday. “We do not expect the dollar impact to be more pronounced or durable than this at this stage.”

The day’s trading pattern was a far cry from decades past, when international crises would typically fuel gains in the greenback and Treasuries, long considered havens in part because of their liquidity and confidence in the US as a leader in the global economy.

The 10-year US Treasury yield rose about five basis points on Friday as surging oil prices stoked inflation worries.

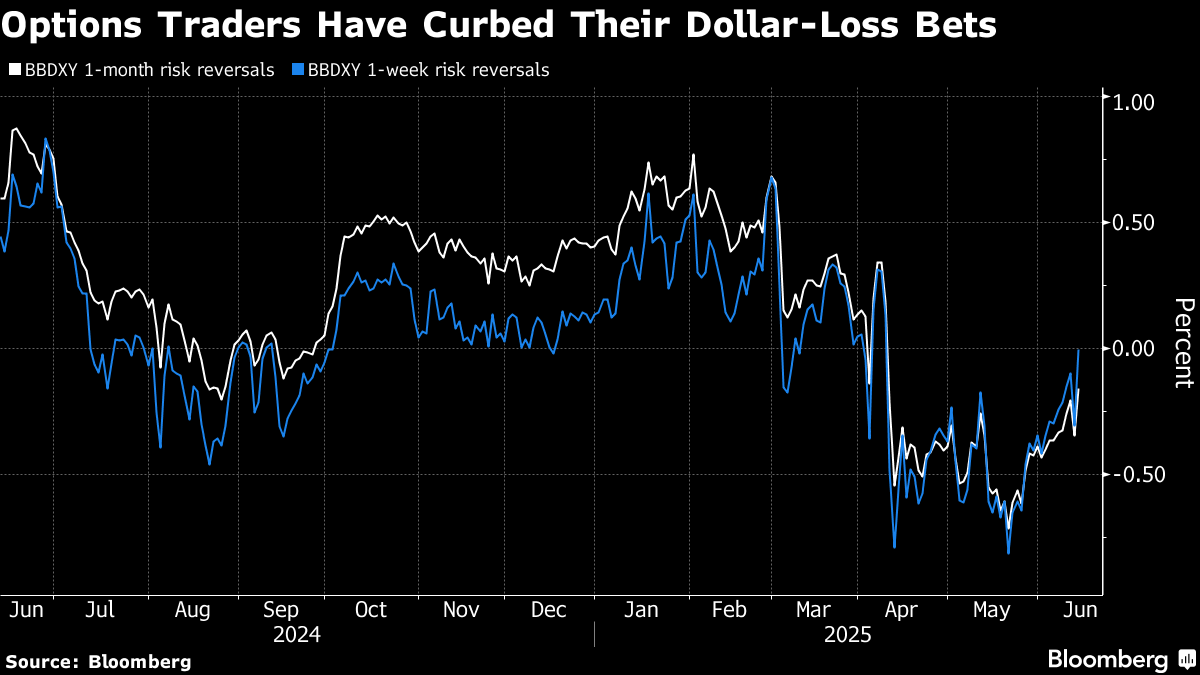

There are some signs that the gloomy stance toward the dollar is easing a bit. For example, options traders — while still broadly bearish on the US currency’s prospects — have moderated their negative views in recent weeks and are banking on a pause in the greenback’s sharp decline.

“The source of shocks to global risk and growth have been more concentrated in the US so far this year,” Goldman Sachs Group Inc. strategists Stuart Jenkins, Kamakshya Trivedi and Teresa Alves said in a report to clients on Friday. “If that source were to shift more to the rest of the world, the dollar may resume trading with more safe-haven type characteristics.”

The US’s position as the world’s largest oil producer likely helped buoy the dollar on Friday as crude futures soared, analysts said. So did the possibility of a squeeze in short positions against the greenback.

The Bloomberg Dollar Spot Index has dropped about 8% this year as Trump’s efforts to overhaul global trade chipped away at investor confidence in the US economy. There are also projections that proposed tax legislation will add trillions of dollars to the federal deficit, while America’s role in security and political alliances is being called into question as well.

“Dollar sentiment has taken a real hit,” Sonja Marten, DZ Bank’s head of FX and monetary policy, told Bloomberg Television on Friday. It would take “a complete escalation in the Middle East” to extend the dollar’s gains, she said.

What Bloomberg Strategists Say...

“It won’t so much be about haven flows, but just about the fact that the US is the world’s largest oil producer. Given that the greenback had only just hit a fresh multi-year low, downside stops got cleaned out and the short-term market will get caught offside by a bounce, which means it may become a self-sustaining climb higher.”

Mark Cudmore, Markets Live strategist

At cross-border payments firm Corpay, Chief Market Strategist Karl Schamotta said the risk-off tone permeating markets reminded investors that the dollar’s losses this year are more a reflection of long-term growth concerns — and less so of any change in short-term demand for the liquidity of US assets.

Before the attack, Wall Street banks were reinforcing their calls on further dollar weakness. Paul Tudor Jones, the founder of macro hedge fund Tudor Investment Corp., said the US currency may be 10% lower a year from now as he expects to see short-term interest rates cut “dramatically” in the next year.

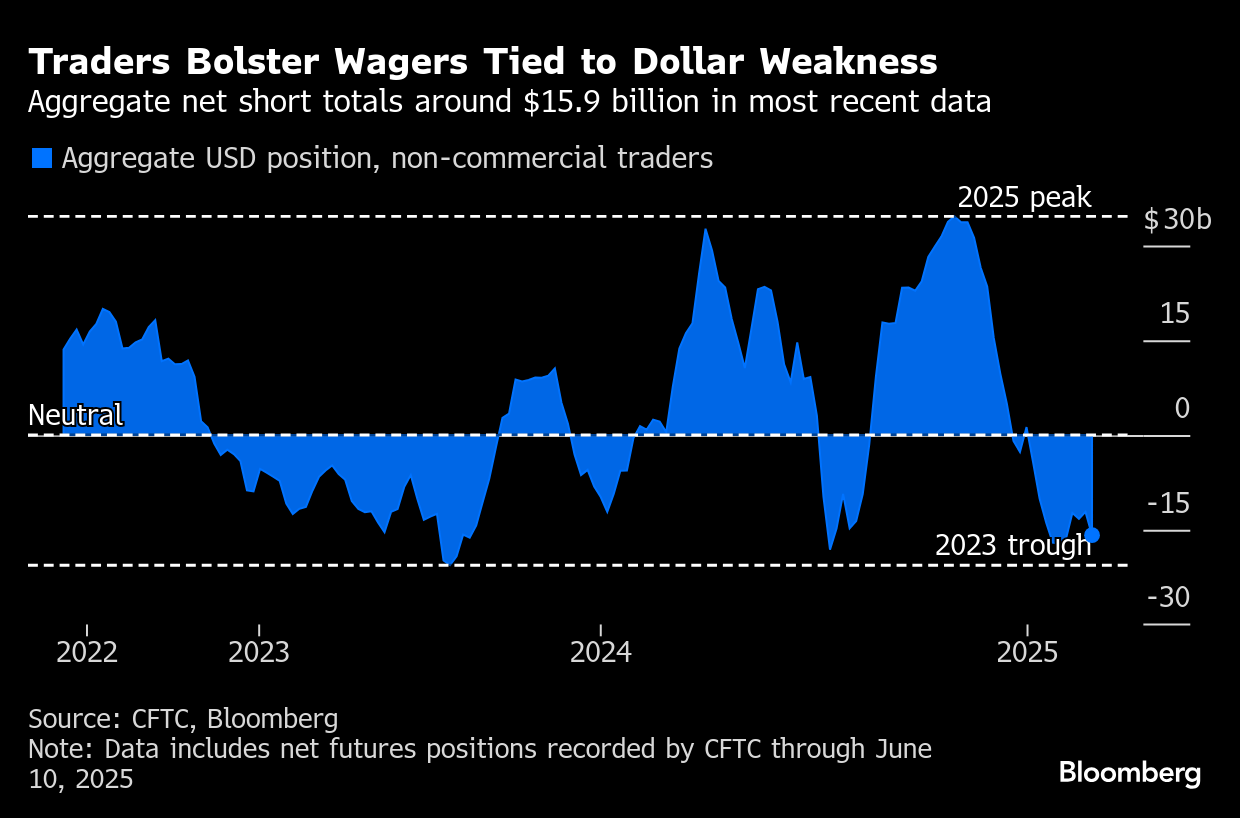

Hedge funds, asset managers and other speculative traders boosted their bets tied to the dollar’s decline to some $15.9 billion for the week through June 10, up from $12.2 billion the week prior, according to data by the Commodity Futures Trading Commission released on Friday.

(Updates closing prices, adds latest CFTC positioning data and JPMorgan comment.)

©2025 Bloomberg L.P.

By