Dollar, Stock Futures Drop on Trump Tariff Threat: Markets Wrap

Jun 12, 2025 by Bloomberg(Bloomberg) -- US equity-index futures fell along with the dollar after President Donald Trump said he will set unilateral tariff rates within two weeks, dialing up trade tensions once again. Haven assets such as Treasuries and gold rose.

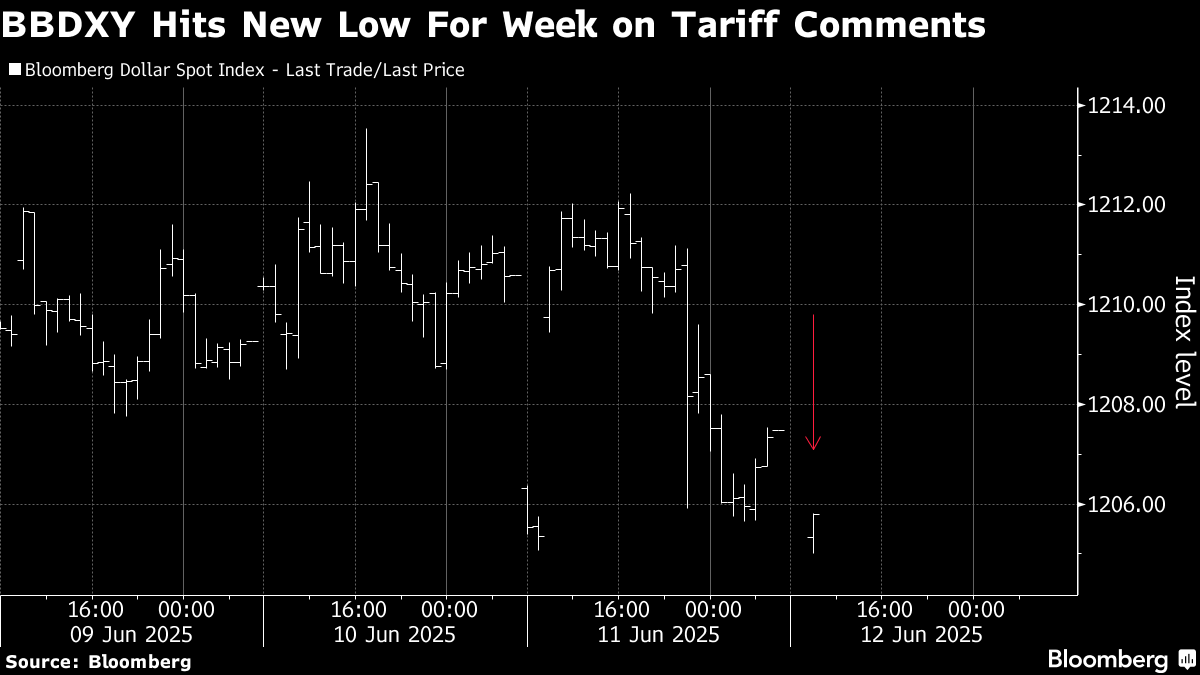

Contracts for the S&P 500 and the Nasdaq 100 dropped 0.3% after Trump said he will send letters to trading partners setting tariffs. A gauge of the dollar slid 0.3% to touch its lowest since July 2023, with the safe-haven yen and Swiss franc leading the advance against the greenback. Gold rose 0.5%. Asian shares edged up 0.1%. Oil dropped 0.4%, after jumping earlier Thursday on tensions in the Middle East.

Treasuries extended Wednesday’s gains after a combination of benign inflation data and strong demand at a 10-year auction sent yields lower for a fourth day, the longest losing streak since end-April. The focus for bond investors now switches to the sale of 30-year debt on Thursday.

The latest tariff threat came a day after Chinese and US officials struck a positive tone following their talks to dial down tensions. Amid US talking with countries including India and Japan to lower the levies, some investors see Trump’s comments as an effort to ramp up urgency in talks. It’s also unclear if Trump will follow through with his pledge - the president has often set two-week deadlines for actions, only for them to come later or not at all.

“Common sense would suggest this is another Trump strategy to increase urgency in trade negotiations,” said Rodrigo Catril, senior foreign exchange strategist at National Australia Bank Ltd. “Trump wants trade deals and he wants them sooner rather than later.”

Stocks have steadied in recent weeks and the MSCI All Country World Index hit another record Thursday after recovering from their lows in April. That’s when Trump announced the highest US levies in a century in an effort to rewrite global trade.

“We’re going to be sending letters out in about a week and a half, two weeks, to countries, telling them what the deal is,” Trump said. “At a certain point, we’re just going to send letters out. And I think you understand that, saying this is the deal, you can take it or leave it,” he added.

The dollar was already under pressure from a weaker-than-expected US inflation print, which helped spur traders to fully price in two quarter-point Federal Reserve interest rate cuts this year.

“Risk sentiment remains fragile, with geopolitical tensions and lingering trade concerns weighing on the dollar,” said Shier Lee Lim, lead FX & macro strategist at Convera Singapore.

Trump had earlier said a trade framework with China has been completed, with Beijing supplying rare earths and magnets up front and the US allowing Chinese students into its colleges and universities. The US and China will maintain tariffs at their current, lower levels following the two nations’ agreement this week in London, Trump said Wednesday.

“The uncertainty doesn’t help,” said Nick Twidale, chief analyst at AT Global Markets Australia. “And his overall comments overnight have led to more uncertainty for the market rather than the clarity we were hoping for.”

Earlier Thursday, West Texas Intermediate rallied as much as 1.7% to top $69 a barrel after climbing the most since October in the previous session. Tensions flared up in the Middle East with Iran threatening to strike US bases in the region if talks over its nuclear program fall through and it’s attacked.

The US ordered some staff to depart the embassy in Iraq, and allowed military service members’ families to leave the Middle East. The UK Navy warned that higher tensions could affect shipping in the region.

Separately, Seazen Group Ltd., one of the few major private-sector Chinese developers yet to default, started marketing a dollar bond that would be the first of its kind in more than two years.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.3% as of 12:53 p.m. Tokyo time

- Japan’s Topix fell 0.2%

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng fell 0.5%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.3% to $1.1519

- The Japanese yen rose 0.5% to 143.88 per dollar

- The offshore yuan rose 0.2% to 7.1828 per dollar

Cryptocurrencies

- Bitcoin fell 1% to $107,873.4

- Ether fell 1.6% to $2,769.66

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.40%

- Japan’s 10-year yield declined one basis point to 1.445%

- Australia’s 10-year yield declined five basis points to 4.23%

Commodities

- West Texas Intermediate crude fell 0.4% to $67.87 a barrel

- Spot gold rose 0.5% to $3,373.02 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By