Oil Extends Gains on Weaker Dollar, Geopolitical Uncertainty

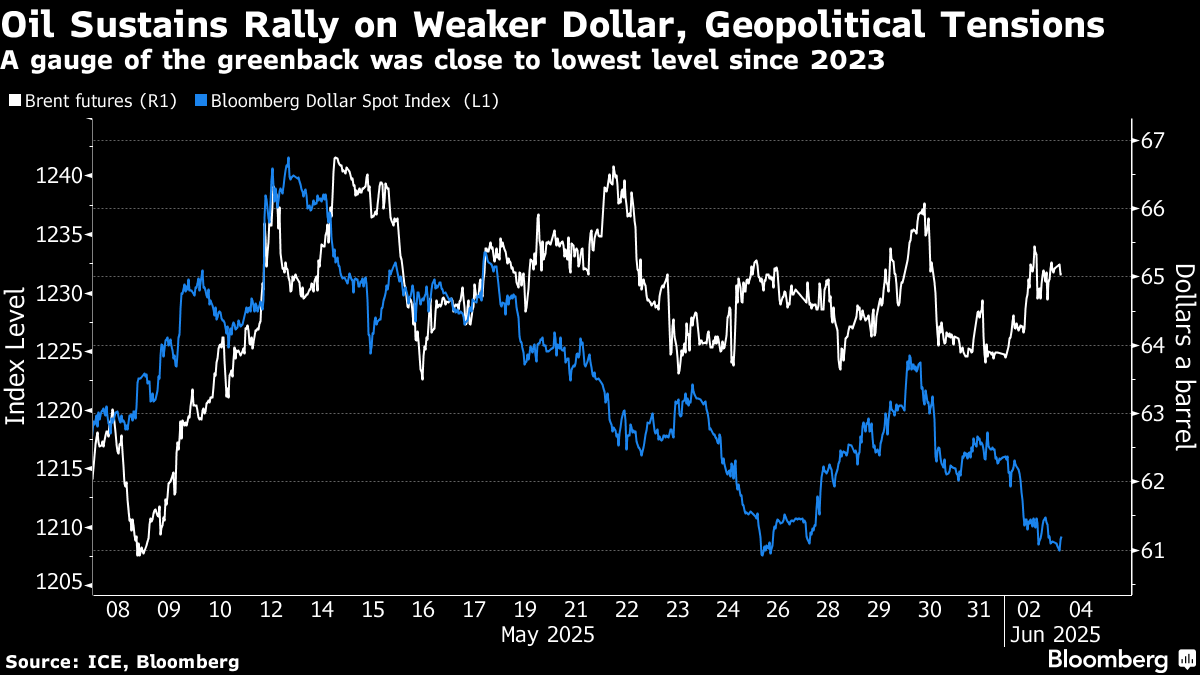

Jun 03, 2025 by Bloomberg(Bloomberg) -- Oil rose for a second day as a weakener dollar boosted the appeal of commodities priced in the currency and geopolitical ructions limited the chance of more supply from Russia and Iran.

Brent traded near $65 a barrel after jumping 2.9% on Monday, while West Texas Intermediate was around $63. A gauge of the dollar closed at its lowest since July 2023 before rebounding slightly, with Wall Street banks reinforcing their calls that the greenback will decline further.

On the geopolitical front, Russia and Ukraine wrapped up a second round of talks in Istanbul that failed to bring the two sides closer to ending the war. Meanwhile, President Donald Trump said the US will not allow uranium enrichment as part of any deal with Iran, as Tehran pushed for assurances that any agreement will include sanctions removal.

Brent rose as much as 4.7% on Monday after OPEC+ boosted supply in line with expectations, easing concerns of a bigger increase and leading to an unwinding of bearish bets made in advance of the decision over the weekend. Oil is still down about 13% this year after the producer group abandoned its former strategy of defending higher prices by curbing output and on concerns trade wars will hamper demand.

“Oil’s rally is a classic case of worst fears not materializing,” said Charu Chanana, chief investment strategist at Saxo Markets Pte. “OPEC’s mixed signals, coupled with rising geopolitical tensions and driving-season demand, sparked a sharp short-covering rally,” with the weaker dollar also contributing to the move higher, she said.

Meanwhile, wildfires in Alberta, Canada, have shut down almost 350,000 barrels of daily crude production, about 7% of the country’s output, as a major blaze near the province’s eastern border threatens oil sands operations.

©2025 Bloomberg L.P.

By