S&P 500 Rises on US-China Trade Talks; Apple Falls: Markets Wrap

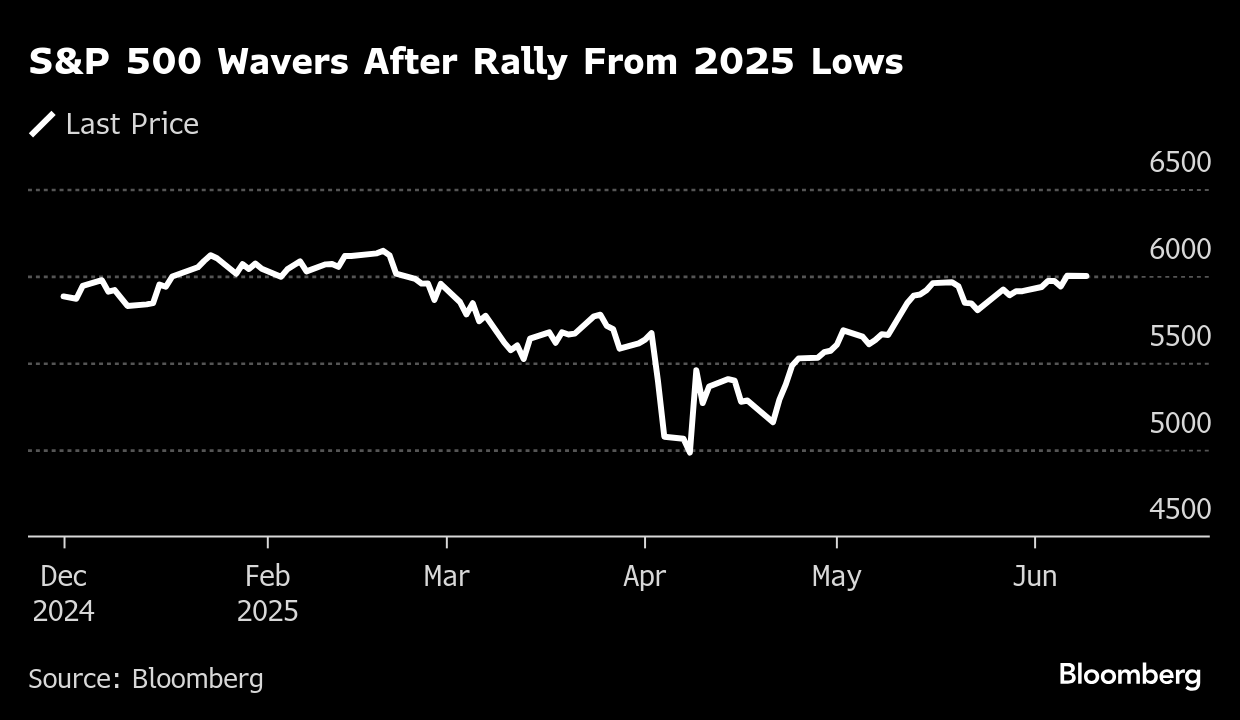

Jun 09, 2025 by Bloomberg(Bloomberg) -- Wall Street traders glued to their screens amid commercial talks between the US and China drove stocks higher, adding to an advance that put the S&P 500 within a striking distance of its record. Treasuries bounced after Friday’s selloff amid a drop in consumer expectations for inflation.

The US equity benchmark is now just about 2% away from its February peak. Big tech led gains Monday, but Apple Inc. slipped 1% as it hasn’t featured much in the way of major artificial-intelligence releases during its Worldwide Developers Conference. Tesla Inc. erased losses that were earlier driven by a pair of analyst downgrades. The Russell 2000 index of small firms climbed 1%.

Long-term bonds underperformed as investors geared up for Thursday’s $22 billion sale of 30-year debt in a fresh test of demand for the securities. Yields had soared in recent weeks amid growing concern over major governments’ spiraling debt and deficits. The dollar fell.

Trade talks between Washington and Beijing stretched on in London, with the US signaling a willingness to remove restrictions on some tech exports in exchange for assurances that China is easing limits on rare earth shipments. The meeting, which began Monday just after 1 p.m. local time, extended into the UK evening and may restart Tuesday if necessary.

“Markets have moved higher on tariff postponement and the perception that they will be more moderate than initially announced,” said Richard Saperstein at Treasury Partners. “We expect markets to remain headline-sensitive, as trade deals take time to negotiate and unsettling tariff news is likely to cause noticeable volatility.”

“While conditions aren’t as bad as feared, this isn’t a moment for complacency,” said Mark Hackett at Nationwide. “We’re within 2% of an all-time high, but absent a clear catalyst, a breakout doesn’t feel imminent this week.”

Wall Street strategists are growing optimistic about US stocks, with forecasters at Morgan Stanley and Goldman Sachs Group Inc. suggesting resilient economic growth would limit any pullback over the summer.

Morgan Stanley’s Michael Wilson said a sharp improvement in Corporate America’s earnings outlook bodes well for the S&P 500 into the year end. He reiterated his 12-month price target of 6,500 points. The gauge is currently hovering near 6,000.

A slate of strategists including at JPMorgan Chase & Co. and Citigroup Inc. have raised their year-end targets for the S&P 500 in recent days, on bets that the worst shock from the trade war was over. At Goldman Sachs, David Kostin said recent market action suggests investors are pricing an optimistic growth outlook.

“The potential for market swings continues,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “But in our view, this should not impede investors putting cash to work, especially given our continued expectation for US equity gains over 12 months and that both interest rates and cash returns are set to fall as the year progresses.”

The S&P 500 has round-tripped from selloff to full recovery in under two months, marking the shortest “vol shock” on record, according to Deutsche Bank AG strategists including Parag Thatte. They noted that during prior volatility shocks, equities would typically take six to seven months for a round-trip and usually at this stage the US gauge would still be down almost 10%.

“Fear, capitulation and offsides positioning have driven the 20% plus rebound in the S&P 500,” said Lisa Shalett at Morgan Stanley Wealth Management. “While markets are anticipatory, the current rally still seems to be struggling with a credible narrative.”

With a key inflation read on tap Wednesday as the Federal Reserve enters a blackout period before its June 18 interest-rate decision, money managers are wrestling with what could propel the S&P 500 back to a record after the index soared 20% from its April lows.

Closing above the February record would mark the 25th correction — decline of 10% to 19.9% — since World War II, according to Sam Stovall at CFRA. Using history as a guide, the S&P 500 rose an average of 10% over a 127 calendar-day period following the conclusion of all 24 prior corrections since WWII, he said.

“A continued easing of inflation readings and still-favorable employment data should help extend the duration and magnitude of this advance,” Stovall said.

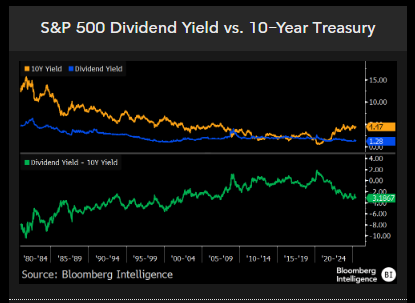

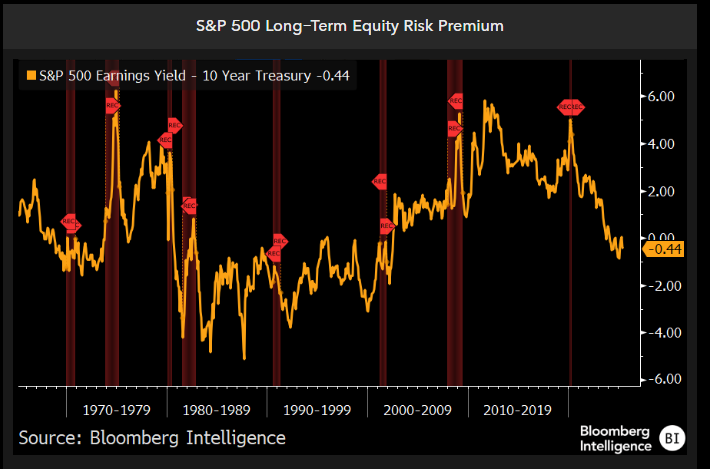

The S&P 500 equity risk premium — the spread between the earnings yield on stocks and the yield on the 10-year Treasury — is negative, below its long-term average, and likely still too low to support an expectation for strong forward returns, according to Bloomberg Intelligence strategists Gina Martin Adams and Michael Casper.

Despite popular notions, a negative or low risk premium isn’t necessarily a predictor of poor forward returns, they said. It was negative for two long stretches in the post-WWII era — from October 1968 to October 1973 and from September 1980 to June 2002. During the first stretch, stocks gained 1.1% annually, but they surged an annualized 10% in the latter.

The 1980-2002 run coincided with a negative 52-week correlation between stock prices and bond yields, suggesting inflation trends may be key to the efficacy of the indicator, according to BI. However, that relationship flipped back to positive in April.

Corporate Highlights:

- Apple Inc. unveiled a new operating system interface called Liquid Glass at its annual Worldwide Developers Conference, calling it the company’s broadest design update ever.

- Warner Bros. Discovery Inc. is splitting itself in half, unshackling its fast-growing streaming business from the struggling legacy media channels and setting up two independent companies that could pursue deals on their own.

- Tesla Inc. was hit with a pair of downgrades, underscoring mounting concerns on Wall Street about the electric-vehicle maker’s outlook following last week’s clash between Chief Executive Elon Musk and President Donald Trump.

- Both Argus Research and Baird cut the stock to the equivalent of hold ratings.

- Qualcomm Inc. has agreed to buy London-listed semiconductor company Alphawave IP Group Plc for about $2.4 billion in cash to expand its technology for artificial intelligence.

- Meta Platforms Inc. is in talks to make a multibillion-dollar investment into artificial intelligence startup Scale AI, according to people familiar with the matter.

- Sunnova Energy International Inc., one of the largest US rooftop solar companies, filed for bankruptcy following struggles with mounting debt and diminishing sales prospects.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.3% as of 2:18 p.m. New York time

- The Nasdaq 100 rose 0.3%

- The Dow Jones Industrial Average rose 0.3%

- The MSCI World Index rose 0.3%

- Bloomberg Magnificent 7 Total Return Index rose 0.7%

- The Russell 2000 Index rose 1%

- Apple fell 1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.2% to $1.1424

- The British pound rose 0.2% to $1.3560

- The Japanese yen rose 0.3% to 144.46 per dollar

Cryptocurrencies

- Bitcoin rose 2.2% to $108,551.01

- Ether rose 1.9% to $2,579.26

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.47%

- Germany’s 10-year yield was little changed at 2.57%

- Britain’s 10-year yield declined one basis point to 4.63%

Commodities

- West Texas Intermediate crude rose 0.8% to $65.09 a barrel

- Spot gold rose 0.7% to $3,335.01 an ounce

©2025 Bloomberg L.P.

By