Stocks Climb After Jobs Report Amid US-China Hopes: Markets Wrap

Jun 06, 2025 by Bloomberg(Bloomberg) -- Stocks headed toward their highest since February and bond yields rose as jobs data allayed concerns of an imminent economic slowdown. Equities extended gains amid hopes US-China trade tensions are easing, with President Donald Trump saying negotiators will talk Monday.

The S&P 500 added over 1%, topping the 6,000 mark. Economically sensitive sectors outperformed. Tesla Inc. jumped 5.6% to lead megacaps higher. Shorter-term Treasuries bore the brunt of the selling as two-year yields topped 4%. Money markets trimmed bets the Federal Reserve will cut rates twice this year. The dollar climbed. Bitcoin rallied 4.3%.

While US job growth moderated in May and the prior months were revised lower, Friday’s report narrowly exceeded forecasts, bolstering bulls who were primed for disappointment after data this week raised doubts about the buoyancy of American hiring.

“While it may not be firing on all cylinders, it’s far from showing signs of a major breakdown,” said Bret Kenwell at eToro. “Today’s solid labor report buys the Fed more time, but Chair Jerome Powell may have a hard time justifying a restrictive rate policy should inflation continue lower.”

Following Friday’s data, Trump urged the Fed to cut rates by a full percentage point, intensifying his pressure campaign against Powell.

“‘Too Late’ at the Fed is a disaster!” Trump posted Friday on social media, using a derisive nickname for Powell. “Europe has had 10 rate cuts, we have had none. Despite him, our Country is doing great. Go for a full point, Rocket Fuel!”

Nonfarm payrolls increased 139,000 last month after a combined 95,000 in downward revisions to the prior two months. The unemployment rate held at 4.2%, while wage growth accelerated.

The payrolls figure helped alleviate concerns of a rapid deterioration in labor demand as companies contend with higher costs related to tariffs and prospects of slower economic activity.

“A solid jobs report reinforces the ‘slowly slowing’ economic narrative,” said Adam Hetts at Janus Henderson Investors. “Today’s news is positive, but ongoing tariff uncertainty means the subsequent hard data releases over the summer will be extremely important for clarity.”

In fact, Fed officials have signaled a wait-and-see approach on rates as they await further insights on the impact Trump’s policies will have on the economy.

“For the Fed, there is little urgency to cut rates,” said Seema Shah at Principal Asset Management. “Holding on until the trade mist clears will reduce the risk of a policy misstep. We expect the first rate cut to come in late-2025.”

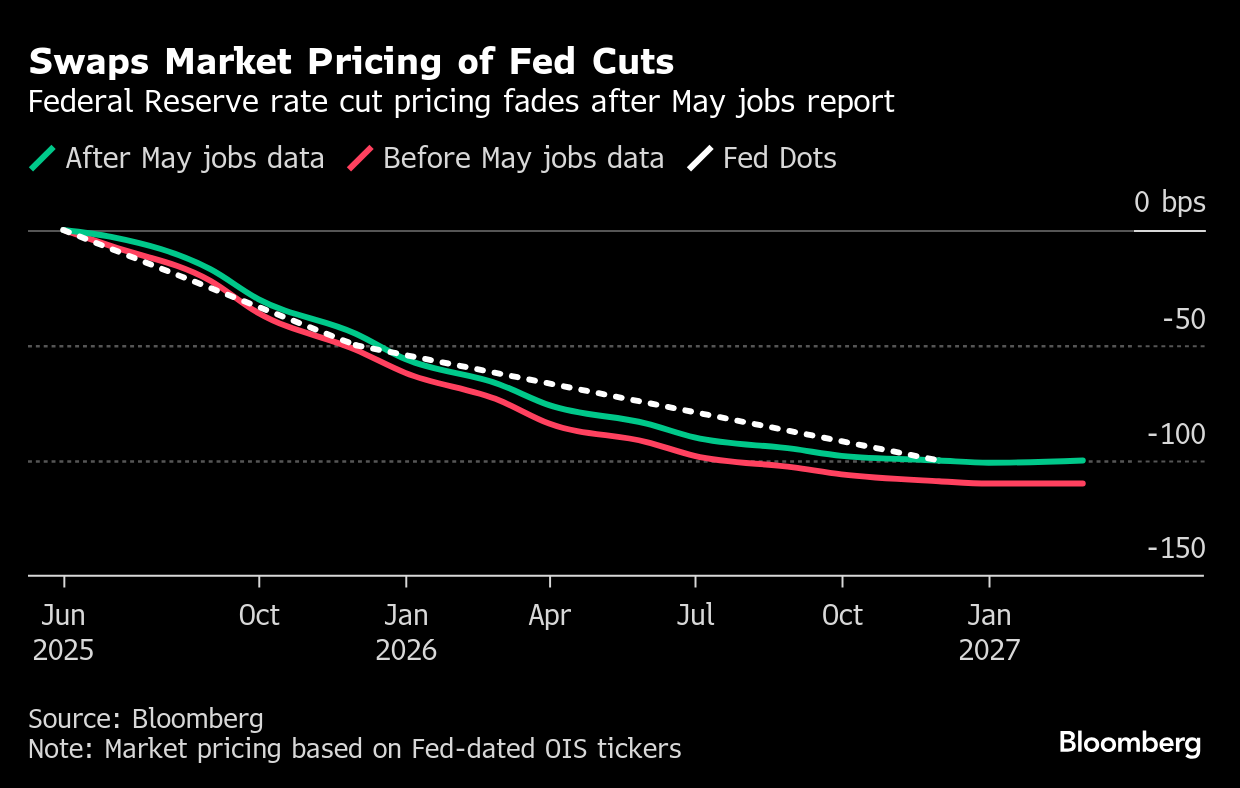

Interest-rate swaps showed traders now see a roughly 70% chance of a quarter-point rate cut by September, compared with a probability of about 90% on Thursday. Fewer than two rate cuts are fully priced in for the year.

“The Fed should be reluctant to cut rates because the full effects of tariffs haven’t impacted inflation numbers yet and the job market isn’t deteriorating enough to force their hand,” said Chris Zaccarelli at Northlight Asset Management.

Under this backdrop, Zaccarelli thinks caution is still warranted because valuations are high, much of the tariff risks haven’t been removed and the economy appears to be slowing.

“While there is still uncertainty over tariffs, the stock market is forward looking and has been pricing in an eventual thawing of trade fears,” said Glen Smith at GDS Wealth Management. “We would not be surprised to see stocks breach and even move above their February peak at some point this summer, albeit with some continued volatility.”

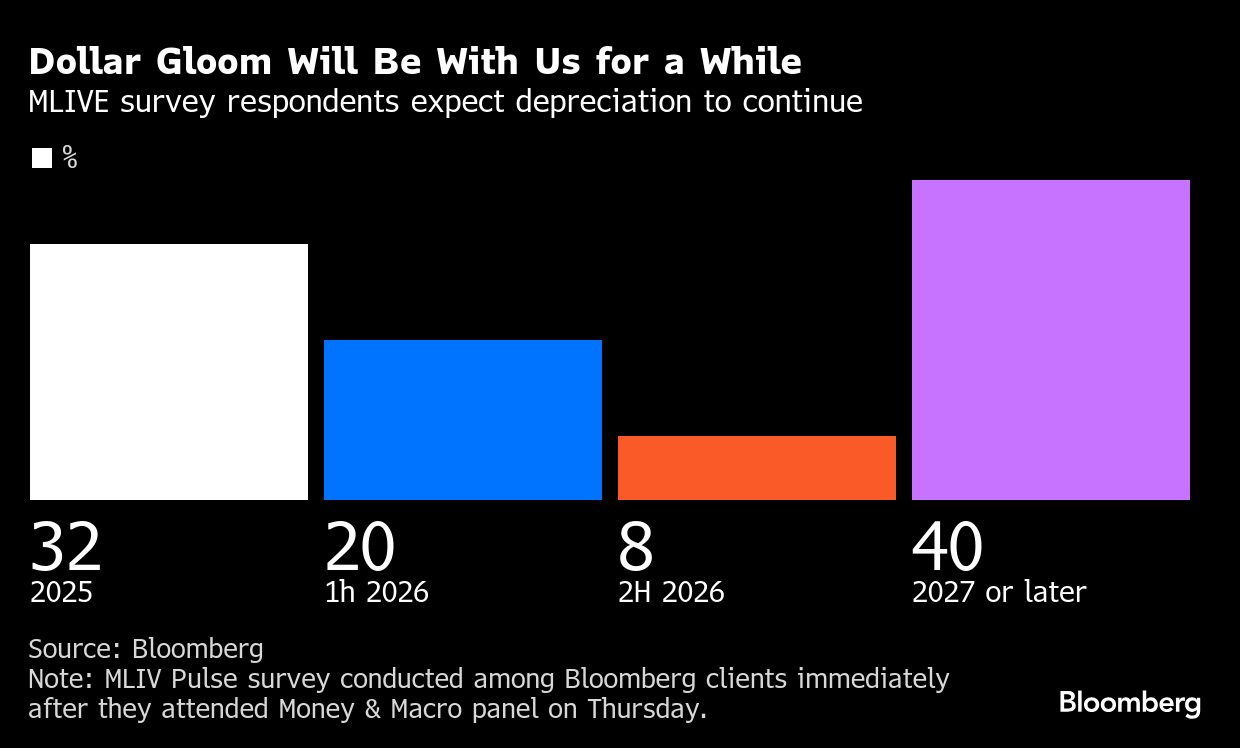

US equities will put the worst of this year’s trade-war turmoil behind them and rally to fresh highs in 2025, according to a survey of Bloomberg subscribers who attended a panel discussion on macro trends.

The S&P 500 will climb to 6,500 by year-end, according to 44% of the 27 responses in a Markets Live Pulse survey. The index was seen reaching that level by the first half of next year by 26% of participants.

Investors are enjoying a much-needed breather following a tumultuous two-month period, with the S&P 500 gaining for the fifth week in seven, noted Mark Hackett at Nationwide. Retail investor sentiment has inflected considerably, forcing institutional investors off the sidelines, he added.

“Earnings revisions have stabilized, forward earnings have marginally improved, and corporate resilience is evident in forward guidance, suggesting the path of least resistance is to new highs,” Hackett said.

Corporate Highlights:

- Boeing Co. has begun shipping commercial jets to China for the first time since early April, indicating a reopening of trade flows amid the long-simmering tariff war between the US and Asia’s biggest economy.

- Broadcom Inc., a chip supplier to companies like Alphabet Inc. and Apple Inc., gave a lackluster revenue forecast for the current quarter, suggesting that the AI spending frenzy isn’t as strong as some investors anticipated.

- Lululemon Athletica Inc. posted a second straight disappointing quarter, fueling concerns that rising competition, new tariffs and a shift away from yoga pants are derailing its ambitious growth plans.

- Circle Internet Group continued to climb a day after the stablecoin issuer’s more than doubled from the IPO price.

- Robinhood Markets Inc. rose for a sixth straight day as investors speculate that the online brokerage could become the latest firm to earn a coveted spot in the S&P 500 Index.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.2% as of 2:37 p.m. New York time

- The Nasdaq 100 rose 1.3%

- The Dow Jones Industrial Average rose 1.1%

- The MSCI World Index rose 0.8%

- Bloomberg Magnificent 7 Total Return Index rose 2.5%

- The Russell 2000 Index rose 1.4%

- Tesla rose 5.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.4% to $1.1397

- The British pound fell 0.3% to $1.3531

- The Japanese yen fell 0.9% to 144.84 per dollar

Cryptocurrencies

- Bitcoin rose 4.3% to $104,806.68

- Ether rose 4.1% to $2,497.3

Bonds

- The yield on 10-year Treasuries advanced 11 basis points to 4.50%

- Germany’s 10-year yield was little changed at 2.58%

- Britain’s 10-year yield advanced three basis points to 4.64%

- The yield on 2-year Treasuries advanced 12 basis points to 4.04%

Commodities

- West Texas Intermediate crude rose 2% to $64.62 a barrel

- Spot gold fell 1% to $3,318.81 an ounce

©2025 Bloomberg L.P.

By