Asian Stocks Decline as Trump Tariffs Sap Risk: Markets Wrap

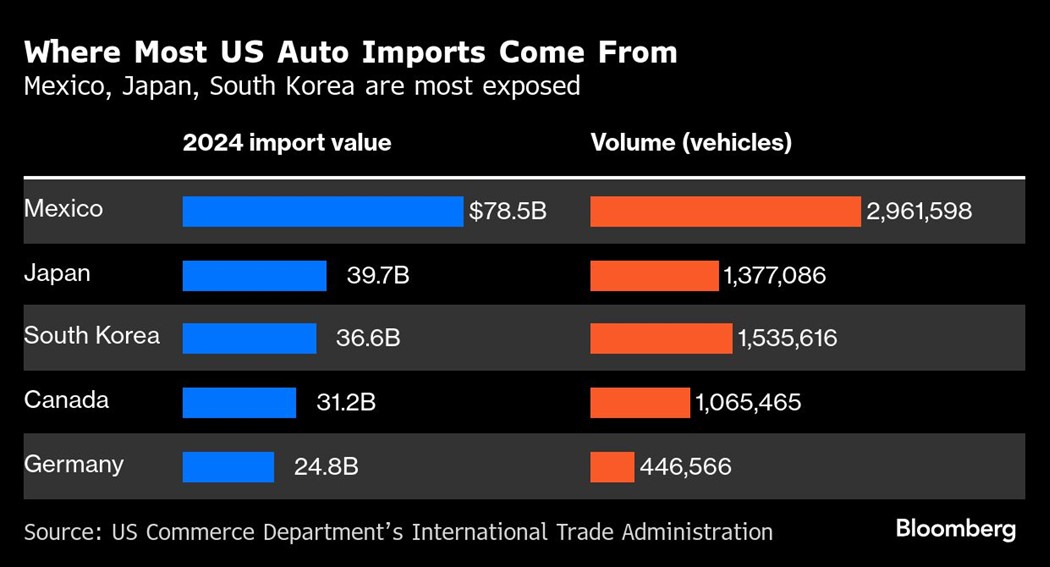

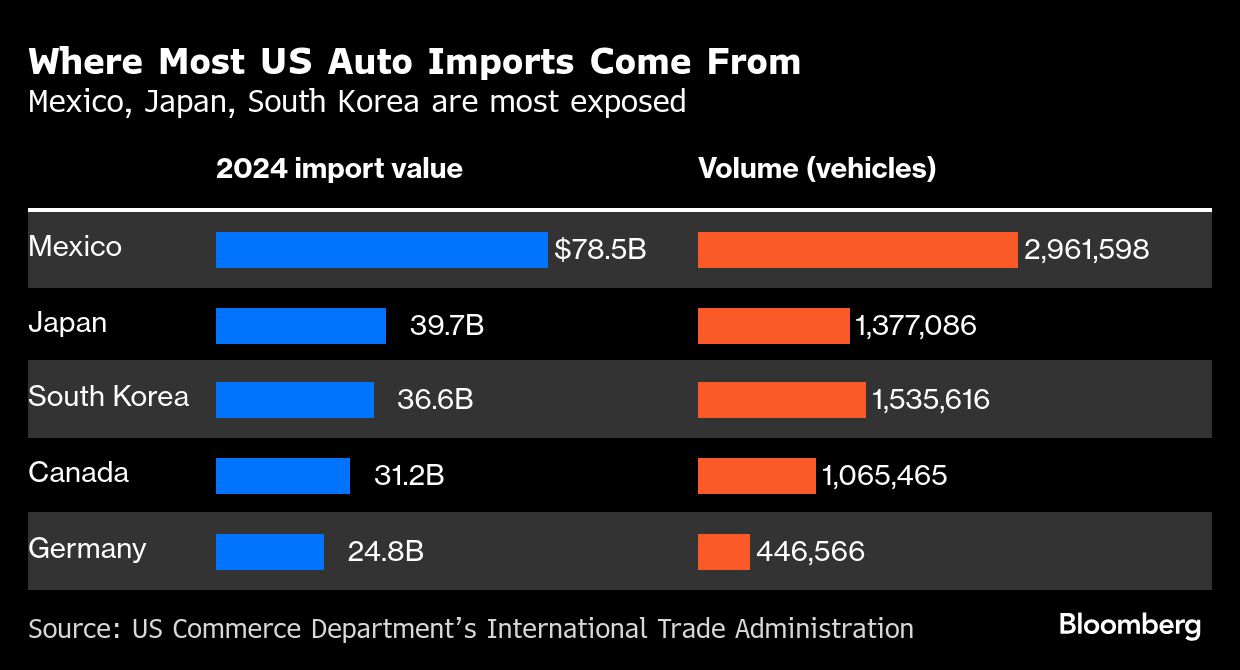

Mar 27, 2025 by Bloomberg(Bloomberg) -- Asian equities dropped after President Donald Trump imposed a 25% tariff on US auto imports, prompting investors to pare bets on riskier investments due to concerns about growth in the world’s largest economy. Shares of automakers slid.

Indexes in Japan, South Korea and Australia fell while stocks in Hong Kong and India gained. Equity-index futures pointed to a steady open for US stocks while contracts for Europe indicated a lower open. The Mexican peso slipped on the tariff announcement along with shares of automakers such as Toyota Motor Corp., General Motors Co. and Ford Motor Co. The dollar fell after Trump downplayed reciprocal tariffs.

The quickly shifting stance on US trade sanctions on the nation’s allies and foes alike adds to already heightened market concerns as investors race to assess the impact on global trade and economic growth. Two months into Trump’s presidency, the mood in the market has turned wary as investors temper their bullish views and the Federal Reserve signals it’s in no rush to adjust its interest-rate policy.

“Tariff-related headlines have once again rattled market confidence across the region,” said Jun Rong Yeap, market strategist at IG Asia. “With investors linking tariffs to higher recession risks, any form of trade restriction may trigger an initial rush to the exit – what we’re seeing in today’s session.

Trump signed an order to slap a 25% tariff on all cars not made in the US. His proclamation, released later Wednesday, specified automobile tariffs would be collected starting just after midnight, at 12:01 a.m. Washington time April 3.

(Get the Markets Daily newsletter)

Reciprocal duties that are set to be announced next week will be “very lenient,” he said. China may also get a tariff reduction to secure a deal on the sale of ByteDance Ltd.’s social video platform TikTok to an American company, Trump added.

The dollar fell against all Group-of-10 currencies as Trump downplayed reciprocal tariffs, while the yield on 10-year Treasuries edged lower in Asian trading, reversing moves in the prior session.

Trump “could be recognizing that his trade policies might be having a ricocheting effect on the US consumers and business owners,” said Fiona Lim, a senior strategist at Malayan Banking Bhd in Singapore. “That makes US dollar gains susceptible to reversal”

Meanwhile, profits at China’s industrial firms contracted at the start of 2025, flashing a worrying sign for the economy as higher US tariffs loom.

India’s BSE Sensex advanced Thursday, its eighth gain in nine sessions. Eastspring Investments expects a stronger second half for the equity market in the country on fiscal support from the government and bets the central bank will cut interest rates.

“Government seems to be putting more capital at work,” Alexander Davey, a head of client portfolio managers at Eastspring said in a Bloomberg TV interview. “We had that February cut, we can see further cuts coming down the line. The second half of the year look supportive for Indian markets.”

Worries over the economic effects of the global trade war are sapping liquidity in US stocks, creating a headache for institutional investors that may also boost volatility in broader markets. Liquidity in S&P 500 stock-index futures, as measured in the most-active contract, stands at a two-year low, data compiled by Deutsche Bank AG show.

Federal Reserve Bank of St. Louis President Alberto Musalem said it’s not clear the impact of tariffs will prove temporary, and cautioned that secondary effects could prompt officials to hold interest rates steady for longer.

“While we consider material increases in US tariffs will weigh on the US economy, we do not predict a US recession,” said Carol Kong, a strategist at Commonwealth Bank of Australia. “That said, market participants may still price a higher risk of a US recession as more tariffs are announced” which will push up the dollar against major currencies, she said.

In commodities, oil held a gain after US crude inventories fell the most since December. Gold steadied near a record high.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:46 p.m. Tokyo time

- Nikkei 225 futures (OSE) fell 1%

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng rose 1%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures fell 0.4%

- Nasdaq 100 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.0781

- The Japanese yen rose 0.3% to 150.16 per dollar

- The offshore yuan was little changed at 7.2669 per dollar

- The Australian dollar rose 0.2% to $0.6314

Cryptocurrencies

- Bitcoin rose 0.3% to $87,517.78

- Ether rose 1% to $2,031.4

Bonds

- The yield on 10-year Treasuries was little changed at 4.35%

- Australia’s 10-year yield advanced three basis points to 4.51%

Commodities

- West Texas Intermediate crude rose 0.2% to $69.77 a barrel

- Spot gold rose 0.5% to $3,033.49 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By