Asian Stocks Fluctuate After Churn in Wall Street: Markets Wrap

Mar 13, 2025 by Bloomberg(Bloomberg) -- Asian equities traded in a tight range Thursday after two weeks of heightened volatility inflicted losses on hedge funds and caused strategists across Wall Street to cut their forecasts for US stocks.

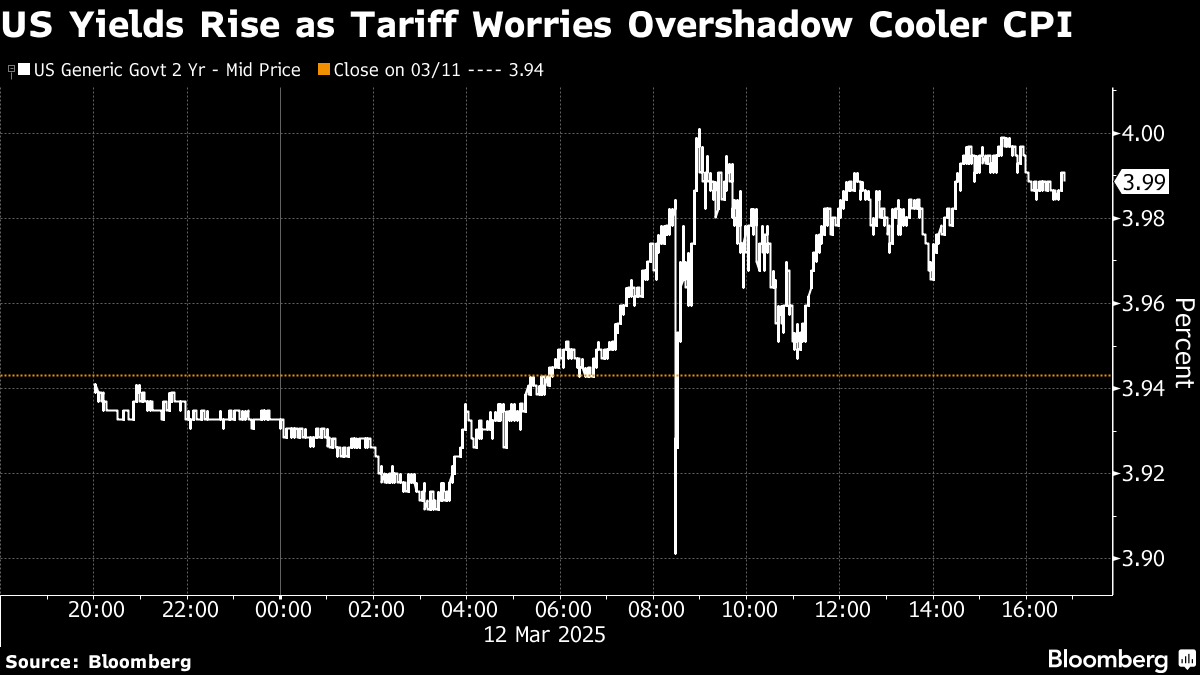

A gauge of regional shares swung between small gains and losses as shares in mainland China and Hong Kong fluctuated. Futures contracts for the tech-heavy Nasdaq 100 and the S&P 500 declined in Asian trading after cooler-than-forecast US inflation helped lift stocks Wednesday. Treasuries and a gauge of the dollar strength were little changed.

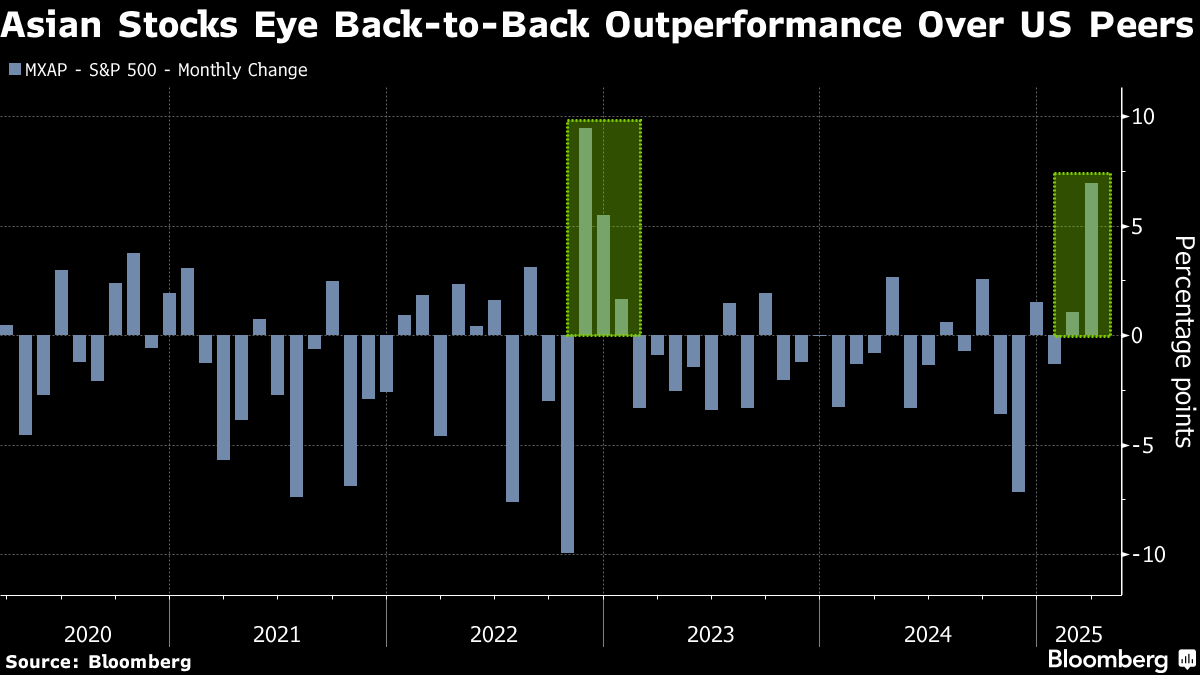

The range-bound moves come after frenzied selling in the last two weeks driven by higher unemployment rate and federal workforce job cuts raised the prospect of a slowdown in growth in the US and pushed the S&P 500 to the brink of a correction. President Donald Trump’s escalating tariff war and global geopolitical realignment over Ukraine added to concerns with some investors considering moving investments from the US toward Asia.

“The case for tactical diversification away from the US remains intact,” said Charu Chanana, chief investment strategist at Saxo Markets. “Whether Asia benefits depends on two key factors - the depth of a potential US growth scare and China’s ability to sustain momentum.”

Equity strategists have recently tempered their expectations about the US market. Goldman Sachs Group Inc. became the latest to sound the alarm, following those at Citigroup Inc. and HSBC Holdings Plc. Earlier this week, Citi downgraded US equities to neutral from overweight while upgrading China to overweight.

Risk appetite is still intact among investors, but there is a “deeper desire to allocate outside of the US,” Kamal Bhatia, chief executive officer at Principal Asset Management told Bloomberg Television. “We have observed that a lot of capital wants to find pockets in the Asia Pacific region,” Bhatia said.

Hong Kong’s stock market has turned into one of the biggest winners of Trump’s chaotic first 50 days in the office. The city’s Hang Seng benchmark has surged 21% since Trump assumed the presidency, making it the world’s top performer. The city’s stock exchange is discussing options to lower the threshold for investors to buy some of the city’s most expensive stocks to stoke trading, according to people familiar with the matter.

In US political news, Senate Democratic leader Chuck Schumer said his party would block a Republican spending bill to avert a government shutdown on Saturday and urged the GOP to accept a Democratic plan to provide funding through April 11 instead.

Still, some strategists think a bottom for US stocks is “probably” here. The worst of the US equity correction may be over, with credit markets indicating a lower risk of a recession happening, according to JPMorgan Chase & Co.

If US equity exchange-traded funds continue to see mostly inflows, “there is a good chance that most of the current US equity market correction is behind us,” JPMorgan strategists including Nikolaos Panigirtzoglou and Mika Inkinen wrote in a note.

Get the Markets Daily newsletter

On tariffs, Trump said the US would respond to the European Union’s countermeasures against his new 25% tariffs on steel and aluminum, raising the risk of further escalation in his global trade war. Earlier, Canada announced new 25% tariffs on about $20.8 billion of US-made products, including steel and aluminum, after the Trump administration went ahead with global levies on imports of the two materials.

“In terms of near-term outlook, it will be very much dependent on the US outlook,” said Frank Benzimra, head of Asia equity strategy at Societe Generale SA. “I don’t know whether tariff fears are easing. There still seems to be a lot of uncertainties,” he said.

In Asia, the yen swung between gains and losses. Bank of Japan officials see several reasons against intervening in the bond market even after benchmark yields hit the highest level since 2008, according to people familiar with the matter.

In commodities, gold rose and was trading above $2,940 per ounce. Oil steadied after the biggest gain in two weeks.

Key events this week:

- Eurozone industrial production, Thursday

- US PPI, initial jobless claims, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.5% as of 1:41 p.m. Tokyo time

- Japan’s Topix rose 0.3%

- Australia’s S&P/ASX 200 fell 0.5%

- Hong Kong’s Hang Seng fell 0.7%

- The Shanghai Composite fell 0.4%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was unchanged at $1.0888

- The Japanese yen rose 0.3% to 147.85 per dollar

- The offshore yuan was little changed at 7.2375 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $83,301.82

- Ether fell 1% to $1,871.84

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.29%

- Australia’s 10-year yield declined three basis points to 4.40%

Commodities

- West Texas Intermediate crude fell 0.2% to $67.56 a barrel

- Spot gold rose 0.3% to $2,943.97 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By