Asian Stocks Rise Amid Cash Rotation Out of US: Markets Wrap

Mar 19, 2025 by Bloomberg(Bloomberg) -- Stocks in Asia rose for a fourth day, serving as a contrast to the US where a selloff continued. Gold rose to a new record.

Shares in Japan and South Korea rose, while Chinese stocks were mixed. S&P 500 futures advanced after benchmarks slid on Tuesday. Investors have slashed holdings of US equities by the most on record while cash levels jumped, according to Bank of America Corp.’s latest survey.

Uncertainty over President Donald Trump’s economic policies, particularly around trade and tariffs, has spurred fears of a recession, with traders seeking clarity from the Federal Reserve policy decision later Wednesday. Investors have also been hunting for opportunities elsewhere, with benchmarks in China and Japan rallying in recent weeks.

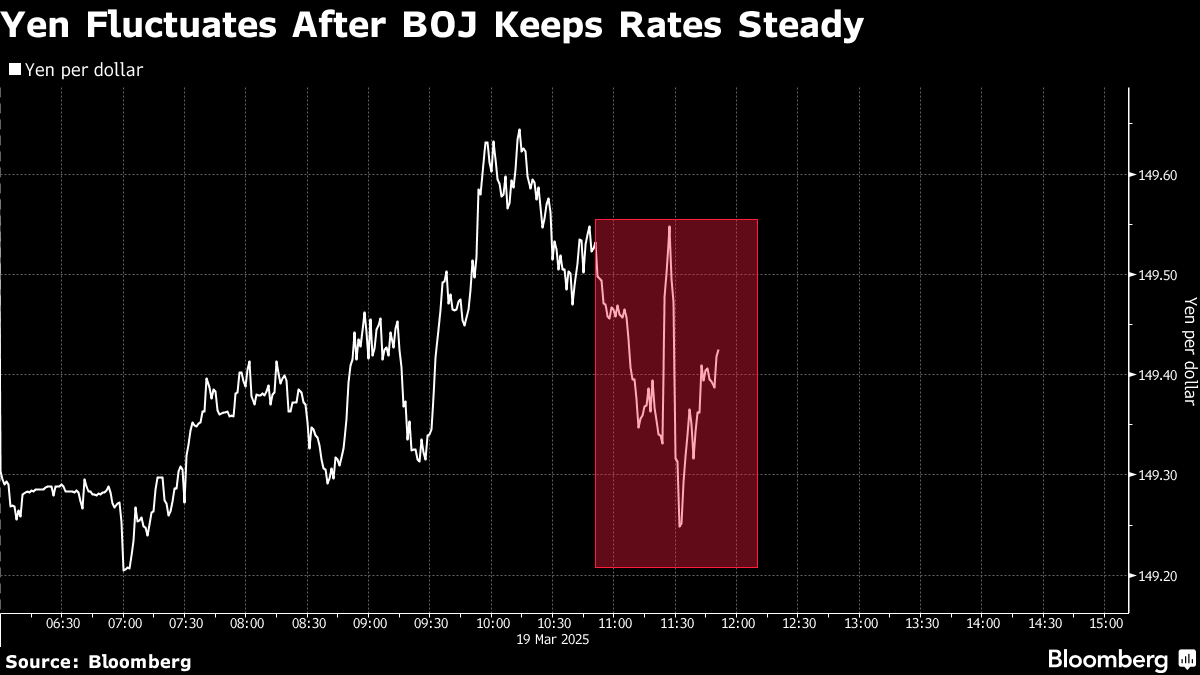

The yen retreated against the dollar, though fluctuated earlier as the BOJ stood pat and said a virtuous cycle of wages and prices is intensifying, while keeping an eye on the global trade situation. Traders are turning their focus to Governor Kazuo Ueda’s press conference Wednesday afternoon.

“The BOJ seems to be now factoring in external uncertainties, including tariff risks, into its decision-making. This could reduce the hawkish tilt,” said Charu Chanana, chief investment strategist at Saxo Markets. “In the Trump era, central banks play a less dominant role, so the yen’s impact may not be as pronounced as it was last year.”

Separately, Japan’s exports rose at a faster pace as businesses increased orders ahead of the rollout of higher tariffs in the US.

Indonesian stocks rebounded slightly after mass selloffs triggered circuit breakers and trading halts on Tuesday. The benchmark Jakarta Composite Index is up as much as 1.3%.

Elsewhere in Asia, Chinese banks are slashing rates on consumer loans to record lows as policymakers ramp up stimulus to stabilize growth and counter US President Donald Trump’s tariffs.

Still, China’s stock rally may face a “meaningful correction soon” given its similarities with the 2015 boom and bust cycle, according to strategists at BofA securities.

Shares of Xpeng Inc. declined as its volume guidance came in short of some analyst expectations, while tech firm Xiaomi Corp. fluctuated in Hong Kong after reporting its fastest revenue growth since 2021 on electric vehicles.

Earnings are expected later from the likes of Tencent Holdings Ltd., Anta Sports Products Ltd. and Muyuan Foods Co.

In commodities, oil slipped as broader market weakness and concerns about a global glut of crude overshadowed escalating tensions in the Middle East. Meanwhile, gold extended a record high above $3,030 an ounce.

Dot Plot

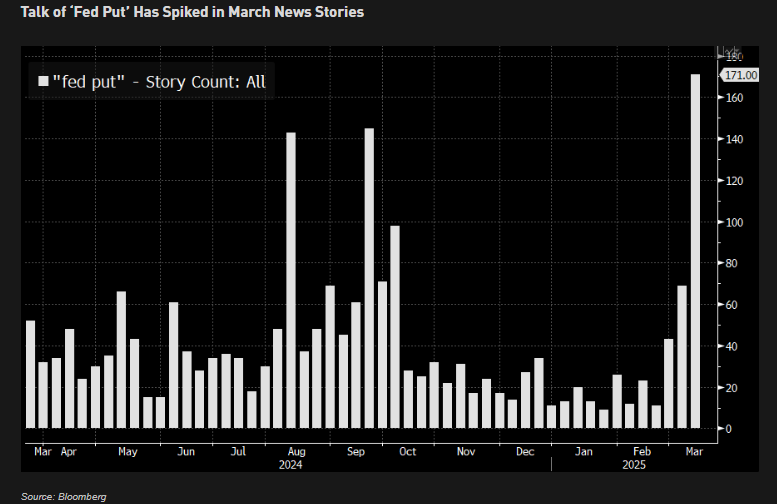

The Fed is expected to hold interest rates steady and its quarterly dot plot should give investors more insight into the outlook for the economy. Traders will also be focused on Fed Chair Jerome Powell’s press conference and his juggling act between communicating the central bank’s current view of the economy and weighing the potential impact of Trump’s trade policy.

“Amidst a deteriorating economic backdrop caused by tariffs and general trade uncertainty, the markets are looking for the proverbial ‘Powell put,’ hopefully expressed in dovish guidance and a lowered dot plot in the updated Summary of Economic Projections, said Kyle Rodda, a senior market analyst at Capital.com.

Options traders are pricing in a 1.2% move in the S&P 500 in either direction on Wednesday — up from an average of 0.8% for Fed days over the past year, according to data from Stuart Kaiser, Citigroup’s head of US equity trading strategy.

“Historically, Fed days when rates have been left unchanged have tended to see solid gains,” Bespoke Investment Group strategists said.

Key events this week:

- Federal Reserve rate decision, Wednesday

- China loan prime rates, Thursday

- Bank of England rate decision, Thursday

- US Philadelphia Fed factory index, jobless claims, existing home sales, Thursday

- Eurozone consumer confidence, Friday

- Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:32 p.m. Tokyo time

- Japan’s Topix rose 0.6%

- Australia’s S&P/ASX 200 fell 0.4%

- Hong Kong’s Hang Seng rose 0.1%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures were unchanged

- Nasdaq 100 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1% to $1.0933

- The Japanese yen fell 0.1% to 149.49 per dollar

- The offshore yuan fell 0.2% to 7.2392 per dollar

- The Australian dollar was little changed at $0.6357

Cryptocurrencies

- Bitcoin rose 0.9% to $82,807.13

- Ether rose 1.3% to $1,931.31

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.29%

- Japan’s 10-year yield advanced one basis point to 1.515%

- Australia’s 10-year yield advanced two basis points to 4.42%

Commodities

- West Texas Intermediate crude fell 0.4% to $66.64 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By