Asian Stocks Rise as Fed Calms Fears Over Tariffs: Markets Wrap

Mar 20, 2025 by Bloomberg(Bloomberg) -- Asian stocks advanced following a rally on Wall Street after the Federal Reserve signaled it still sees room to cut interest rates later this year because any increase in inflation due to tariffs will be brief.

MSCI’s regional stock benchmark climbed to its highest level since early November as equities in Taiwan, Australia and South Korea all rallied. US equity futures rose in Asia after the Financial Times reported Nvidia Corp. aims to spend several hundred billion dollars to procure US-made chips and electronics over the next four years. Japanese markets are shut for a holiday.

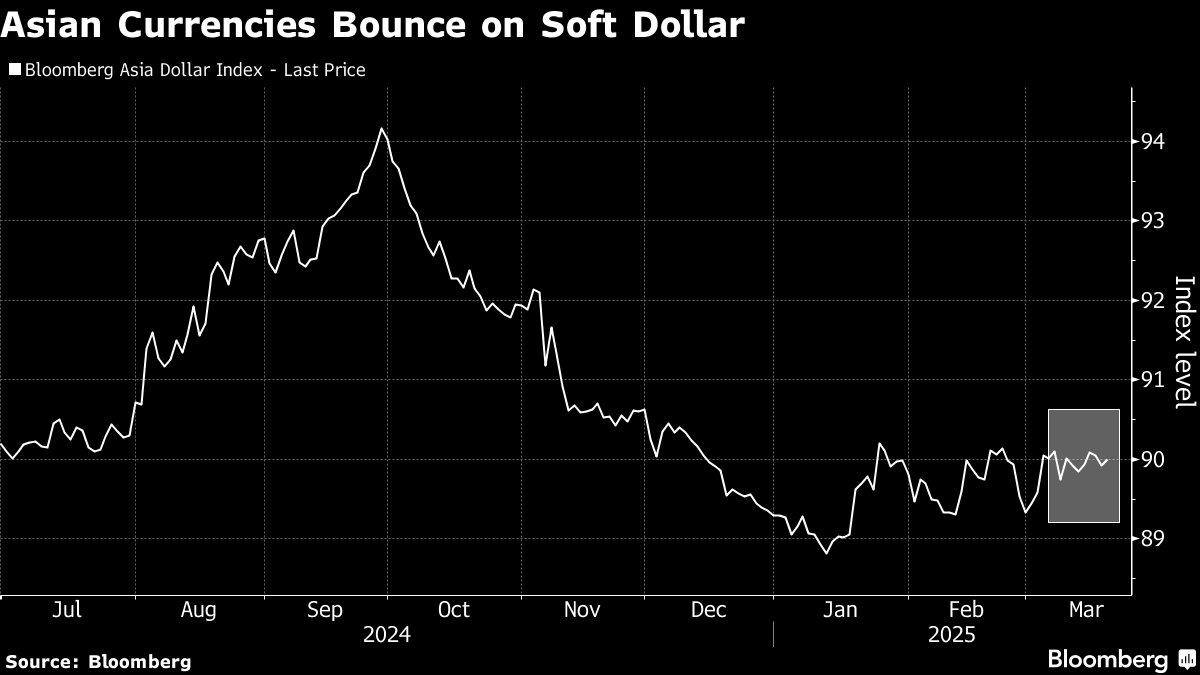

Australia’s dollar dropped after a report showed employment in the nation fell by 52,800 last month, compared with a forecast increase of 30,000. Copper climbed above $10,000 a ton amid the threat of higher tariffs, while gold rose to another record. Bloomberg’s gauge of the dollar edged lower, while cash Treasuries were shut in Asia due to the holiday in Japan.

“The Fed’s commentary will feed into dollar weakness going ahead and ease the pressure on capital outflows from Asian markets,” said Rajat Agarwal, an Asia strategist at Societe Generale SA. As US financial conditions ease on rate-cut bets and slower balance sheet runoff, it may eventually boost inflows into Asian and emerging markets stocks, he said.

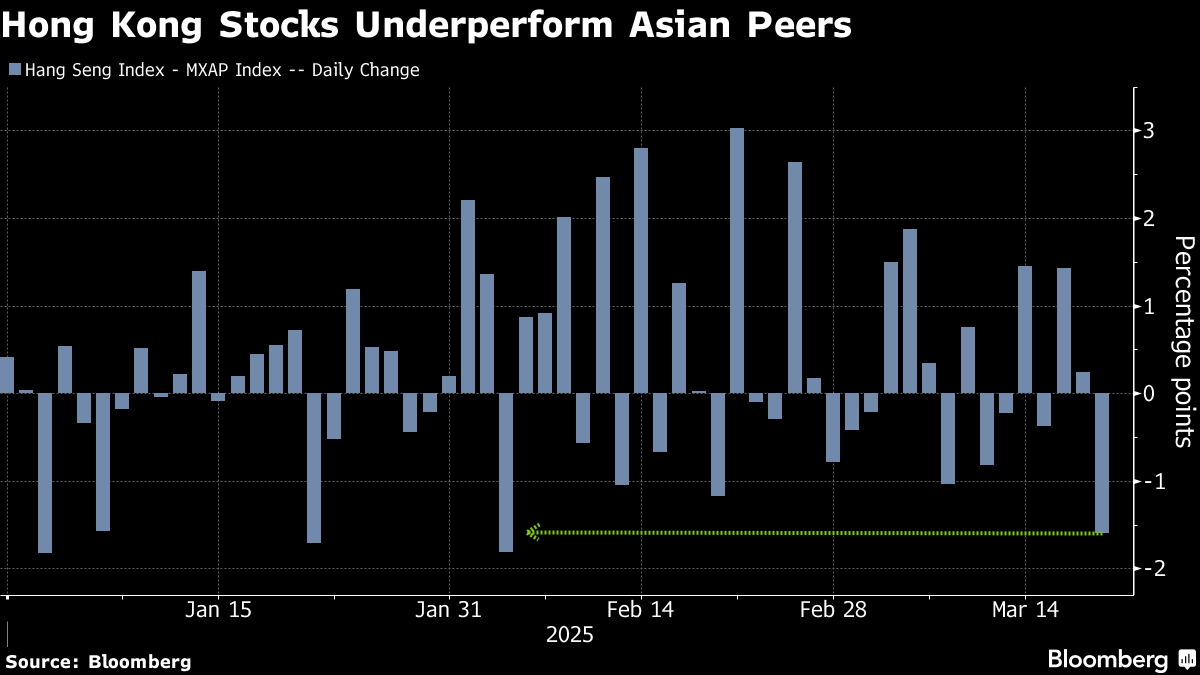

Chinese shares bucked the positive equity trend, with the mainland benchmark CSI 300 Index falling for the first time in three days. Technology companies were among the biggest losers following their recent rally. In Hong Kong, the Hang Seng Index slipped as much as 1.7%.

“The risk-reward for China looks slightly less reasonable,” Sundeep Gantori, an analyst at UBS Global Wealth Management in Singapore, said on Bloomberg Television. “The risk-reward looks much better for US tech after the recent correction. It doesn’t mean there is no upside for China. We see decent upside perhaps low teens and maybe 10% for the rest of the year.”

Tencent Holdings Ltd. shares dropped even after the firm on Wednesday posted its fastest pace of revenue growth since 2023. In South Korea, Samsung Electronics Co. rose after the company pledged to strengthen its position in the high-bandwidth memory chip market in response to shareholder criticism.

Geely Automobile Holdings Ltd. said full-year profit beat analyst estimates after the carmaker increased sales and reduced costs to better compete in the challenging Chinese market.

The Fed kept its benchmark on hold Wednesday as economists expected, and Chair Jerome Powell was measured in his assessment of how the President Donald Trump’s actions might shape the economy. Powell cited the potential for the impact of tariffs on inflation to be “transitory.”

Powell’s calibrated tone on recession risk – stating it was “not high” – soothed nerves among stock investors. The central bank’s move to trim growth assessments also added fuel to the bond rally, with traders and the Fed now aligned on the rate-cut outlook this year.

Following the decision, Trump said the Fed should cut rates, splitting with the US central bank as officials weigh the economic cost of his tariff push. He urged Powell to “do the right thing,” in a post on Truth Social.

Chinese banks held their benchmark lending rates for a fifth straight month in the absence of more monetary easing. Later Thursday, the Bank of England is forecast to leave interest rates unchanged, while the Swiss National Bank is tipped to cut them by 25 basis points, according to consensus forecasts.

Oil prices inched higher after gaining on Wednesday following a US government report that allayed concerns about near-term demand destruction. Gold rose to a fresh record amid Fed’s warning of slower US growth.

Copper marched past the threshold of $10,000 a ton after weeks of global trade dislocation triggered by Trump’s push for tariffs on the crucial industrial metal.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.4% as of 2:04 p.m. Tokyo time

- Nikkei 225 futures (OSE) rose 0.3%

- Australia’s S&P/ASX 200 rose 1.1%

- Hong Kong’s Hang Seng fell 1.2%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0898

- The Japanese yen rose 0.2% to 148.38 per dollar

- The offshore yuan fell 0.1% to 7.2389 per dollar

Cryptocurrencies

- Bitcoin rose 0.4% to $85,693.67

- Ether fell 0.7% to $2,020.91

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.24%

- Japan’s 10-year yield advanced one basis point to 1.515%

- Australia’s 10-year yield declined five basis points to 4.37%

Commodities

- West Texas Intermediate crude rose 0.5% to $67.52 a barrel

- Spot gold rose 0.1% to $3,052.26 an ounce

This story was produced with the assistance of Bloomberg Automation.

(An earlier version of this story was corrected to delete an extra ‘not’ in paragraph after Fed Decision subhead)

©2025 Bloomberg L.P.

By