Stock Selloff Moderates in Asia, Futures Pare Loss: Markets Wrap

Mar 11, 2025 by Bloomberg(Bloomberg) -- A global selloff in stocks eased in Asian hours as futures on US equity indexes, Treasury yields and cryptocurrencies all recovered from sharp declines at the start of the trading day.

The mood in financial markets remained nervous after Wall Street investors tempered their bullish views amid concerns that tariffs and government spending cuts will torpedo growth in the world’s largest economy. Asian shares fell to a five-week low Tuesday after the Nasdaq 100 had its worst day since 2022.

The markets later stabilized, with equity-index futures for the S&P 500 gaining as much as 0.3% after losing more than 1% in early Asian trading. Contracts for Nasdaq 100 and European stocks both advanced as well. Shares in Hong Kong and China also trimmed their declines. Yields on 2-year Treasuries recovered after slumping to the lowest level since October and a gauge of the dollar slipped.

Two months into the presidency of Donald Trump, global market sentiment has turned downbeat as investors become increasingly concerned about US economic growth after a tariff war, spending cuts and a shakeup of decades-old geopolitical relationships. Some investors see the shift in mood as an opportunity to purchase shares, especially in Hong Kong and China, where the there’s anticipation that the government will come out with measures to stimulate the economy.

“The handful of people I managed to speak to this morning, most are still looking for opportunities to buy if markets correct,” said Kok Hoong Wong, head of institutional equities sales trading at Maybank Securities. “HK/China could be an interesting candidate for this.”

Despite the global risk-off mood, mainland Chinese investors bought an unprecedented amount of Hong Kong stocks on Monday, continuing to boost their holdings amid a tech-driven rally this year. The stocks have been on a tear this year, thanks to the emergence of an artificial-intelligence model from startup DeepSeek that was considered a game-changer in the industry.

China may be relatively more resilient given the policy divergences amid the National People’s Congress meeting, said Marvin Chen, a strategist at Bloomberg Intelligence.

Earlier, Australian stocks touched the lowest in seven months and the Nikkei-225 Index sank to the lowest since September.

Get the Markets Daily newsletter

Investors have been increasing hedges by shorting futures and options, and that often exacerbates selling, said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management. Even after Monday’s rebound, De Mello said he remains wary.

“I remain cautious as investor sentiment has turned increasingly risk-averse,” he said.

Citigroup Inc. strategists downgraded US stocks to neutral from overweight while upgrading China to overweight, saying US exceptionalism is at least on pause. Citi raised China to overweight as the country looks attractive even after the rally.

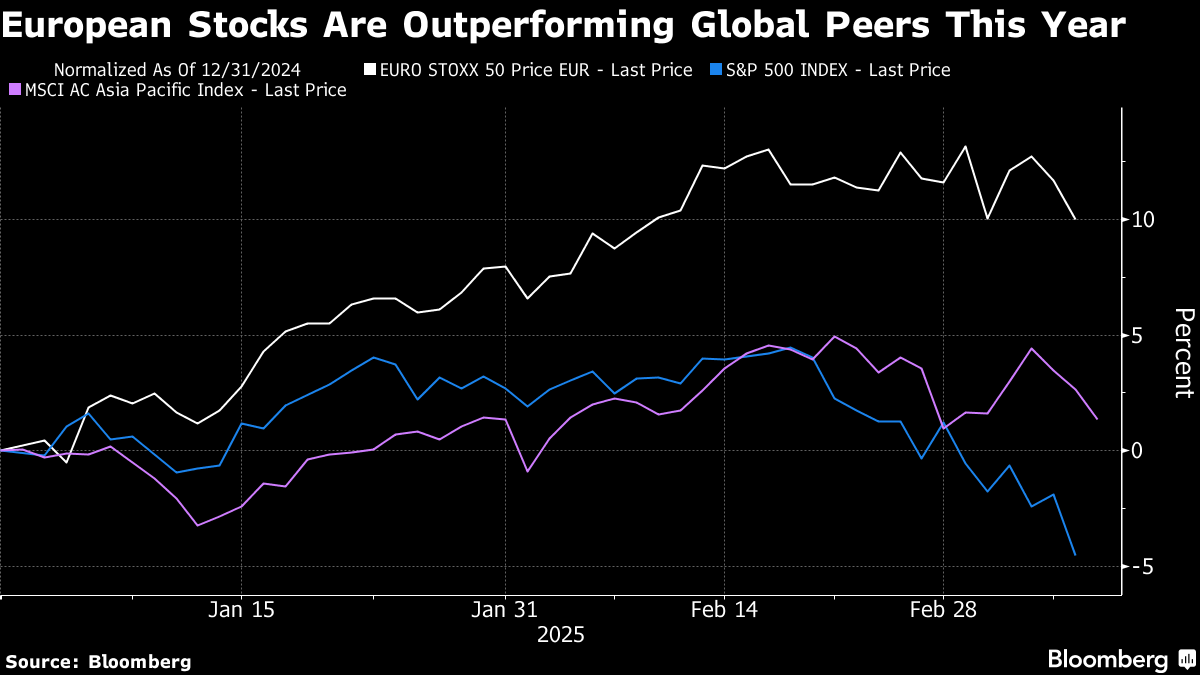

Earlier, HSBC strategists raised their rating on European equities, excluding the UK, to overweight from underweight as they expect euro-zone fiscal stimulus to be “a potential game-changer.”

In the US Monday, the S&P 500 dropped 2.7%. The Nasdaq 100 lost 3.8%. In the megacap space, Tesla Inc. sank 15% while Nvidia Corp. drove a closely watched gauge of chipmakers to the lowest since April. About 10 high-grade companies delayed US bond sales.

“The selloff felt like a liquidation of any overweight/crowded positions, combined with a buyers’ strike,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group. “Regarding the buying strike, why buy now when Trump is not concerned with the stock market and Powell said he’s not in a rush?”

Here’s what Markets Live Strategist Garfield Reynolds says:

“The US-centered selloff spreading across global equity markets may be getting extra spice from the perception that central bankers aren’t about to rush to the rescue this time round. Investors have to take into account the potential that monetary settings will remain at levels that in many economies are still seen as being at least somewhat restrictive for a while yet.”

Most Group-of-10 currencies rose against the greenback on Tuesday, with only the Australian and New Zealand dollars down in the session. The Swiss franc and Japanese yen, traditional havens, outperformed. The euro continues to attract buyers with its surge in the region’s growth prospects.

In commodities, oil fell for a second day, tracking a plunge in equity markets and other risk assets on concerns tariffs and other measures will stunt growth in the world’s largest economy. Gold was steady. Cryptocurrencies slid further as fears over a selloff in US equities eclipsed Trump’s recent efforts to buttress the industry.

Key events this week:

- Japan GDP, household spending, money stock, Tuesday

- US job openings, Tuesday

- Canada rate decision, Wednesday

- US CPI, Wednesday

- Eurozone industrial production, Thursday

- US PPI, initial jobless claims, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 1:15 p.m. Tokyo time

- Japan’s Topix fell 1.9%

- Australia’s S&P/ASX 200 fell 0.7%

- Hong Kong’s Hang Seng fell 0.9%

- The Shanghai Composite fell 0.5%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.2% to $1.0857

- The Japanese yen was little changed at 147.17 per dollar

- The offshore yuan rose 0.2% to 7.2466 per dollar

Cryptocurrencies

- Bitcoin rose 0.7% to $79,823.74

- Ether fell 0.4% to $1,860.68

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.18%

- Japan’s 10-year yield declined 5.5 basis points to 1.515%

- Australia’s 10-year yield declined six basis points to 4.38%

Commodities

- West Texas Intermediate crude fell 0.1% to $65.96 a barrel

- Spot gold rose 0.3% to $2,897.67 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By