Asian Stocks Gain Before Chinese Tech Earnings: Markets Wrap

May 14, 2025 by Bloomberg(Bloomberg) -- Asia’s benchmark stock index rose, led by the tech sector, as investors awaited earnings from some of the largest Chinese technology firms this week.

An index of regional tech shares advanced for a fourth day after US chipmakers rallied Tuesday when Nvidia Corp. and Advanced Micro Devices Inc. said they would supply semiconductors to a Saudi Arabian artificial-intelligence firm for a $10 billion data-center project. US equity futures were little changed.

China’s most valuable company, Tencent Holdings Ltd. will announce earnings Wednesday, and Alibaba Group Holding Ltd. will report the following day. The results may reveal how the sector’s two largest companies are coping with the uncertain geopolitical outlook, and give a guide as to whether Chinese tech stocks may resume their rally.

“A good run of tech earnings from China would certainly offer a catalyst to spur further gains,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc in Hong Kong. “As macro risks recede, investors will again pay more attention to earnings and prospects for renewed strength in tech.”

Tencent shares climbed 2% in Hong Kong, while Alibaba’s rose 1.6%. Taiwan Semiconductor Manufacturing Co. jumped more than 2% in Taipei, the biggest contributor to gains in the MSCI Asia Pacific Index.

“This will be an exciting quarter for large tech,” said Kok Hoong Wong, head of the institutional equity sales trading at Maybank Securities Pte. “With DeepSeek exploding onto the scene in February, it will be interesting to see how development since has filtered into earnings and what their guidance will be, especially from Alibaba.”

Sony Group Corp. shares swung to a gain after the company said it would buy back up to ¥250 billion ($1.7 billion) of shares over the next year. The announcement came as the company reported full-year operating profit that missed analysts’ estimates.

Chinese shipping and port stocks advanced on optimism the de-escalation of trade war between US and China will trigger a rebound in shipping demand and freight rates. Ningbo Marine Co., Nanjing Port Co. and Ningbo Ocean Shipping Co. all rose by the 10% daily limit.

The US dollar was broadly weaker with the Bloomberg Dollar Spot Index falling 0.1%. The Australian dollar strengthened after a government report showed wage growth in the nation was stronger than expected in the first quarter. Taiwan’s dollar led gains in Asian currencies.

The Treasury 10-year yield was little changed at 4.47%.

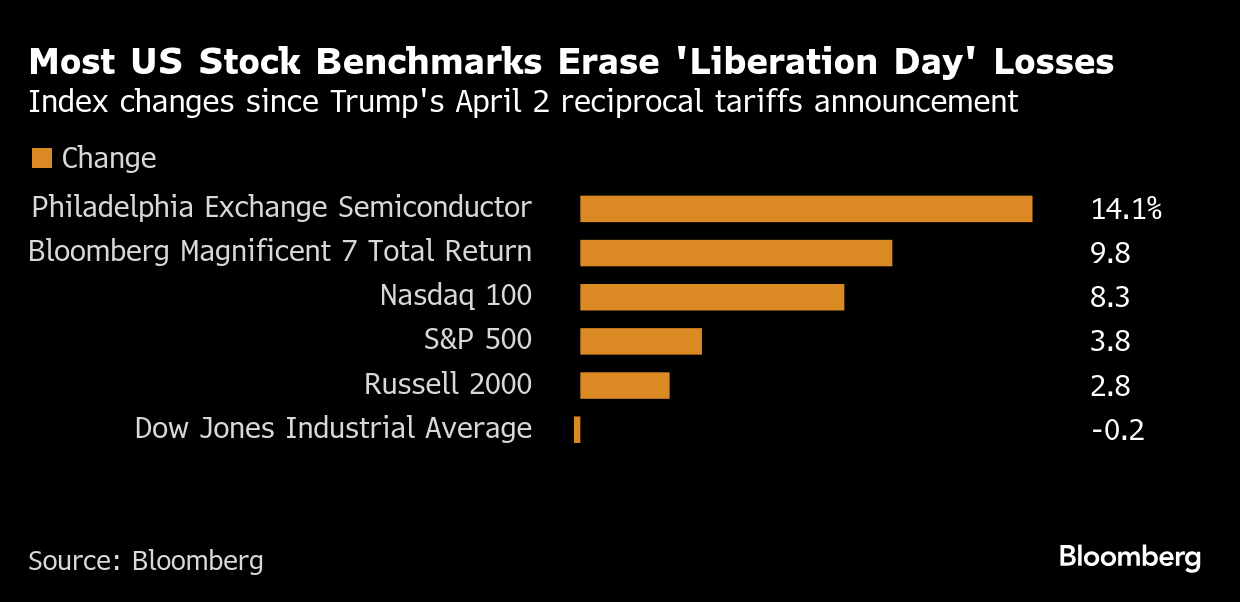

Erasing Losses

US benchmark stock indexes erased their 2025 losses Tuesday on signs trade tensions are easing and after a report showed US inflation was softer than economists forecast. The S&P 500 closed 0.7% higher, while the Nasdaq 100 climbed 1.6% and the Bloomberg Magnificent Seven index of megacaps added 2.2%.

The Trump administration plans to overhaul regulations on the export of semiconductors used in AI, tossing out a Biden-era approach that had drawn objections from America’s allies. The US is also weighing a deal that would allow the United Arab Emirates to import more than a million advanced Nvidia chips, people familiar with the matter said.

The easing of trade tensions and a surprisingly positive US earnings season have spurred optimism after a period of doubt about Corporate America’s ability to meet high profit expectations. The stock market is “gonna go a lot higher,” President Donald Trump said, citing an “explosion of investment and jobs” as he said Saudi Arabia would commit to investing $1 trillion in the US.

Oil steadied after the biggest four-day rally since October, spurred by trade-war optimism and Trump’s increasingly hostile rhetoric on Iranian supply. Gold held a small gain after US inflation data was weaker than expected, spurring traders to shore up bets on Federal Reserve interest-rate cuts.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:44 p.m. Tokyo time

- Nikkei 225 futures (OSE) fell 0.4%

- Japan’s Topix fell 0.6%

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng rose 1.4%

- The Shanghai Composite rose 0.2%

- Euro Stoxx 50 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1193

- The Japanese yen rose 0.4% to 146.93 per dollar

- The offshore yuan fell 0.2% to 7.2129 per dollar

Cryptocurrencies

- Bitcoin fell 0.8% to $103,792.04

- Ether fell 1% to $2,664.16

Bonds

- The yield on 10-year Treasuries was little changed at 4.46%

- Japan’s 10-year yield advanced one basis point to 1.445%

- Australia’s 10-year yield advanced five basis points to 4.48%

Commodities

- West Texas Intermediate crude fell 0.5% to $63.38 a barrel

- Spot gold fell 0.7% to $3,227.07 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By