Dollar Snaps Two-Day Decline, Stock Futures Dip: Markets Wrap

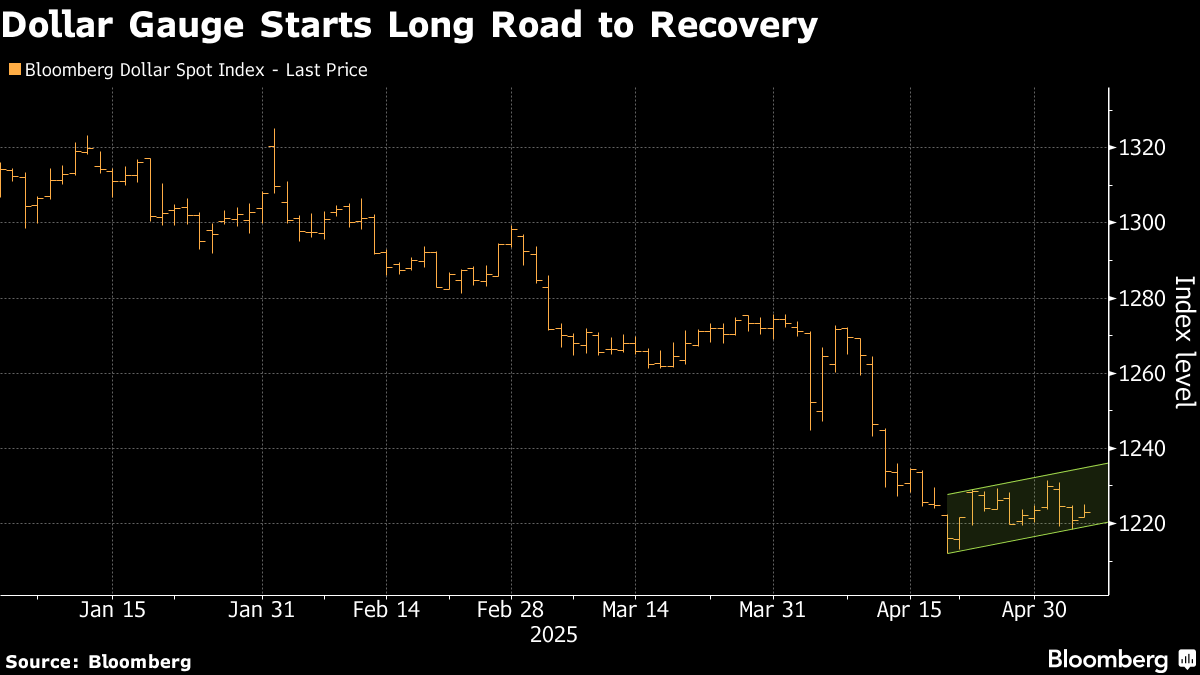

May 06, 2025 by Bloomberg(Bloomberg) -- The dollar edged up on stronger US economic data, helping ease outsized moves in Asian currencies caused by optimism about trade deals with the US.

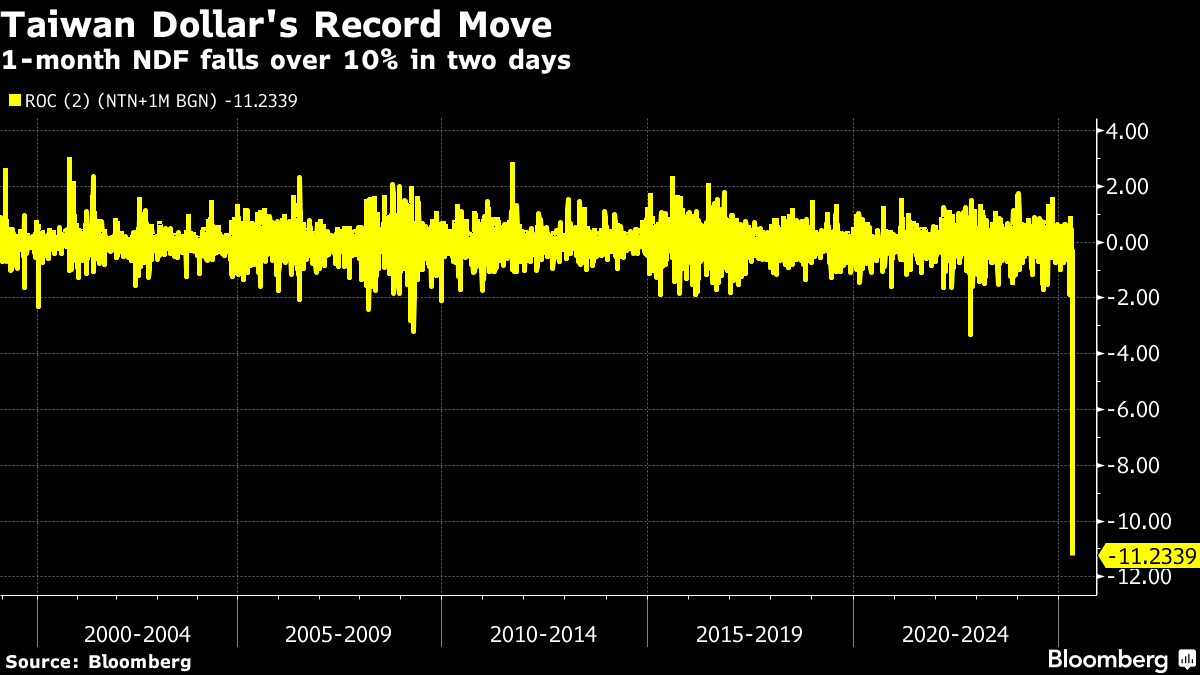

A gauge of the greenback rose 0.1% after data showed activity at US service providers accelerated in April, prompting traders to price in slightly less easing by the Federal Reserve. The Taiwanese dollar gained 0.3% following its biggest surge since the 1980s on Monday. The yen weakened slightly while the Malaysian ringgit depreciated 0.8%. Oil climbed from the lowest close in four years while gold steadied after a 3% surge in the prior session.

Equity-index futures for the S&P 500 dropped 0.3% after the index halted its longest rally in about 20 years. There’s no cash trading in Treasuries during the Asian day as Japan is closed for a holiday.

President Donald Trump’s aggressive trade talk has rattled markets since he took office in January, undermining the dollar’s traditional haven role in times of stress and leading investors to allocate away from US assets. Expectations of trade deals to lower US tariffs have led to a surge in Asian currencies recently, prompting central bankers from Taiwan to Hong Kong to respond by intervening in the market.

“A bit of calmness before another leg in the trade storm,” said Rodrigo Catril, strategist at National Australia Bank Ltd. in Sydney. “Forex markets, especially Asia forex markets, are taking a breather as we wait for new US trade information.”

Activity at US service providers accelerated in April after a slumping in the prior month. This suggests the services sector is holding up even as manufacturing contracts on the heels of higher US duties. Treasury yields ended Monday higher, their third straight increase, after stronger-than-expected Institute for Supply Management’s services report.

Meanwhile, the spread between the Taiwan dollar spot rate and one-year non-deliverable forwards on the Taiwan dollar-US dollar currency pair swelled to around 3,000 pips on Monday, the widest level in at least two decades. The deep inversion of a popular Taiwan-dollar derivative suggested selling pressure on the US currency has plenty of room to run.

The Taiwan dollar has been turbocharged by exporters rushing to convert their holdings of US dollars to the island’s currency and signs life insurers may have been hedging their greenback-denominated portfolios.

Meanwhile, Hong Kong authorities spent a record amount in an attempt to defend the foreign-exchange peg. The authorities said they continued to purchase US dollars.

“I would be cautious about leaning in too much into this appreciation as central banks in Taiwan, Malaysia and especially Hong Kong have significant means to buy dollars if they need to,” said Leah Traub, a portfolio manager and head of the currency team at Lord Abbett & Co.

In late US hours, Ford Motor Co. pulled its financial guidance and said auto tariffs will take a toll on profit. Palantir Technologies Inc. dropped more than 9% in late trading Monday after its results failed to live up to investors’ loftiest expectations for a company whose stock has led the S&P 500 in gains this year.

Attention will soon shift to Wednesday’s Fed decision after bond traders dialed back rate-cut bets that had steadily mounted as Trump’s trade war unleashed havoc in financial markets.

“Uncertainty rules amid a trade war and the ever-changing landscape of tariffs, but with the hard data on consumer spending and employment still hanging in there, the Fed will remain firmly planted on the sidelines,” said Greg McBride at Bankrate.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.3% as of 1:42 p.m. Tokyo time

- Australia’s S&P/ASX 200 was little changed

- Hong Kong’s Hang Seng rose 0.7%

- The Shanghai Composite rose 0.9%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1322

- The Japanese yen was little changed at 143.72 per dollar

- The offshore yuan fell 0.2% to 7.2141 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $94,474.53

- Ether fell 0.2% to $1,805.51

Bonds

- Australia’s 10-year yield advanced six basis points to 4.32%

Commodities

- West Texas Intermediate crude rose 1.6% to $58.04 a barrel

- Spot gold rose 0.8% to $3,359.49 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By