Stocks Fall Late on US Downgrade as Yields Climb: Markets Wrap

May 17, 2025 by Bloomberg(Bloomberg) -- Stocks dropped in late hours and bond yields climbed after the US was downgraded by Moody’s Ratings amid concerns about the increase in government debt that threatens America’s status as the world’s safe haven.

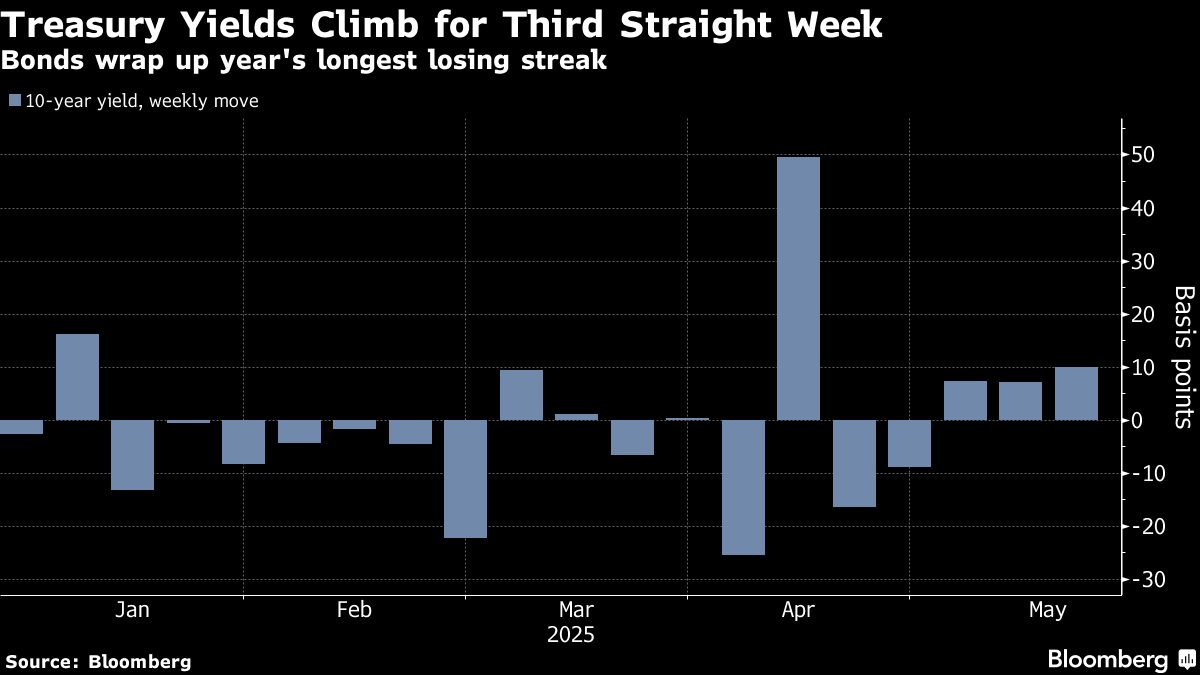

The $606 billion SPDR S&P 500 ETF Trust tracking the equity benchmark fell about 1% after the close of regular trading. Treasury futures slid to session lows after the Moody’s statement, with the market notching its third straight week of losses — the longest slide this year.

Moody’s lowered the US credit score to Aa1 from Aaa on Friday, joining Fitch Ratings and S&P Global Ratings in grading the world’s biggest economy below the top, triple-A position. The one-notch cut comes more than a year after Moody’s changed its outlook on the US rating to negative. The credit assessor now has a stable outlook.

“Being asked why Moody’s would downgrade the US now,” said Andrew Brenner at NatAlliance Securities. “Moody’s is trying to send a message to Congress to get their act together.”

A key House committee on Friday failed to advance House Republicans’ massive tax-and-spending bill after hard-line conservatives bucked Donald Trump and blocked the bill over cost concerns. Negotiations will continue through the weekend, with the committee planning to meet again late Sunday night.

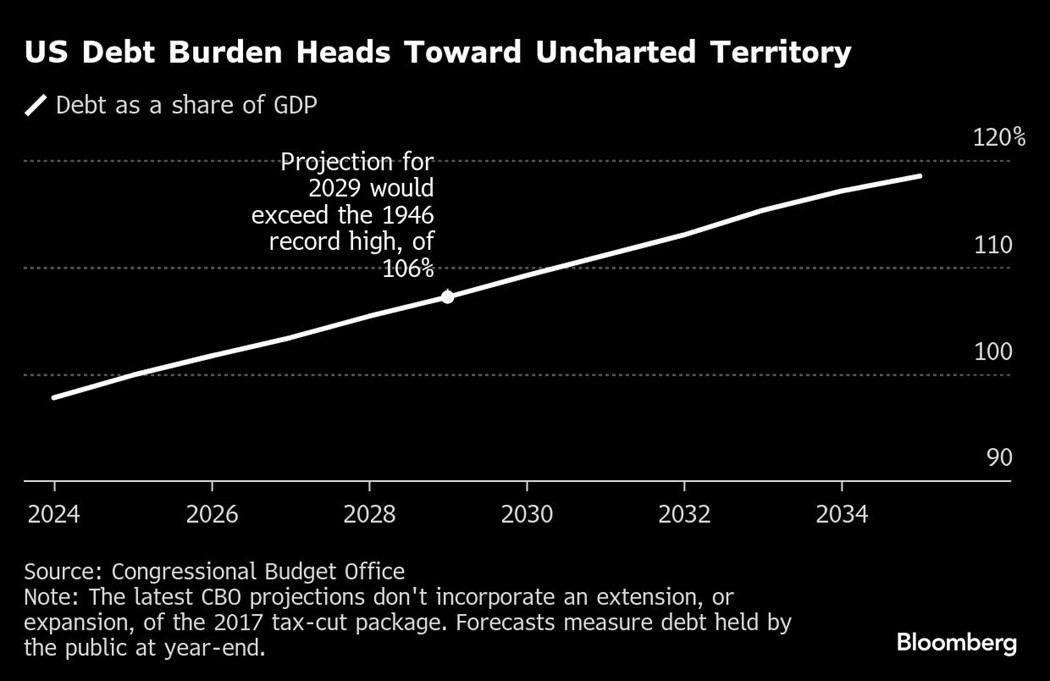

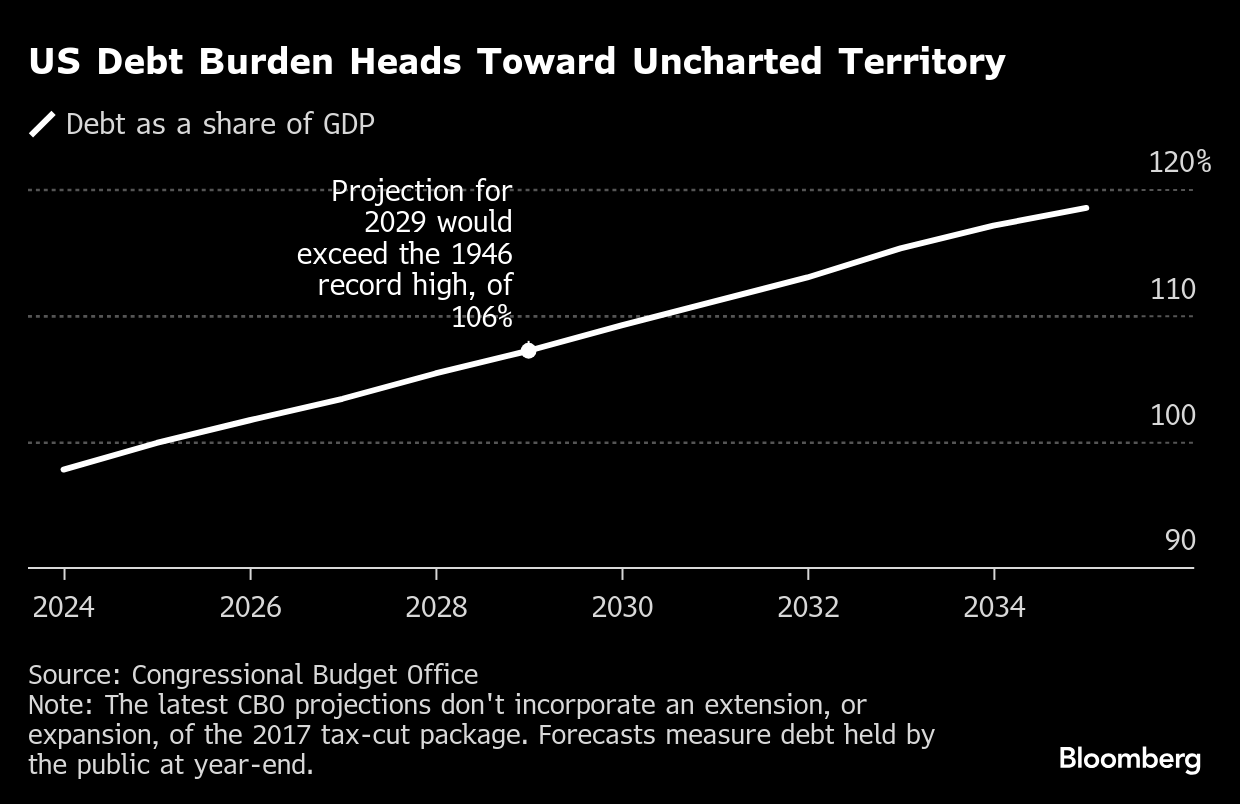

Long-term Treasury yields have already been moving higher, with 30-year rates creeping toward 5% as the tax-cut plan adds to investor concerns about the surging debt load. The US deficit has been in excess of 6% of gross domestic product for the past two years, an unusually high burden outside of economic recessions or world wars.

Jamie Dimon, chief executive officer of JPMorgan Chase & Co., said in a Bloomberg Television interview this week that the US deficit and debt load would be an issue.

“It creates risk of inflation to me. It creates risk of higher long-term rates,” Dimon said at JPMorgan’s annual Global Markets Conference in Paris. That might slow growth and create a stagflation scenario, he added.

Even higher short-term yields risk causing a hit to the fiscal outlook given US debt managers have hoisted sales of bills in recent years.

About one-third ($9.3 trillion) of all existing debt held by the public is scheduled to mature between April 1, 2025 and the end of March 2026, according to Peter G. Peterson Foundation. More than $3.1 trillion of the debt set to roll over during that period was last issued two or more years ago, so it will likely need to be reissued at higher rates than before, it said.

“For those looking for a signpost to tell us when to stop adding to our national debt, they should look no further than Moody’s downgrade,” said Michael A. Peterson, CEO of the Peter G. Peterson Foundation. “We have plenty of options on the table to fix this, and it can be done quickly, with leadership.”

Running a wider fiscal deficit requires foreigners to buy an ever-expanding amount of US Treasuries and an ongoing rise of America’s foreign liabilities, George Saravelos at Deutsche Bank AG wrote this week.

“This we believe is no longer sustainable,” he said.

Before the Moody’s downgrade, equities had climbed in regular hours Friday as the Financial Times reported the US and the European Union broke an impasse to enable tariff talks, fueling the risk-on tone that had been sparked by the recent cooling in trade tensions with China.

Traders were able to look past data showing US consumer sentiment unexpectedly fell while inflation expectations hit multi-decade highs.

Since the US-China truce, banks across Wall Street have been watering down calls for a recession. The optimism around trade deals has propelled American stocks ahead of most global equity benchmarks this week.

The shift came after a period in which money managers grew skeptical about the US equity market and started to pull away from growth stocks and rotate into defensive names, due to escalating concerns from trade wars to economic growth and geopolitical tensions.

In the first three months of the year, hedge funds boosted positions in health-care stocks while reducing exposure in the technology sector.

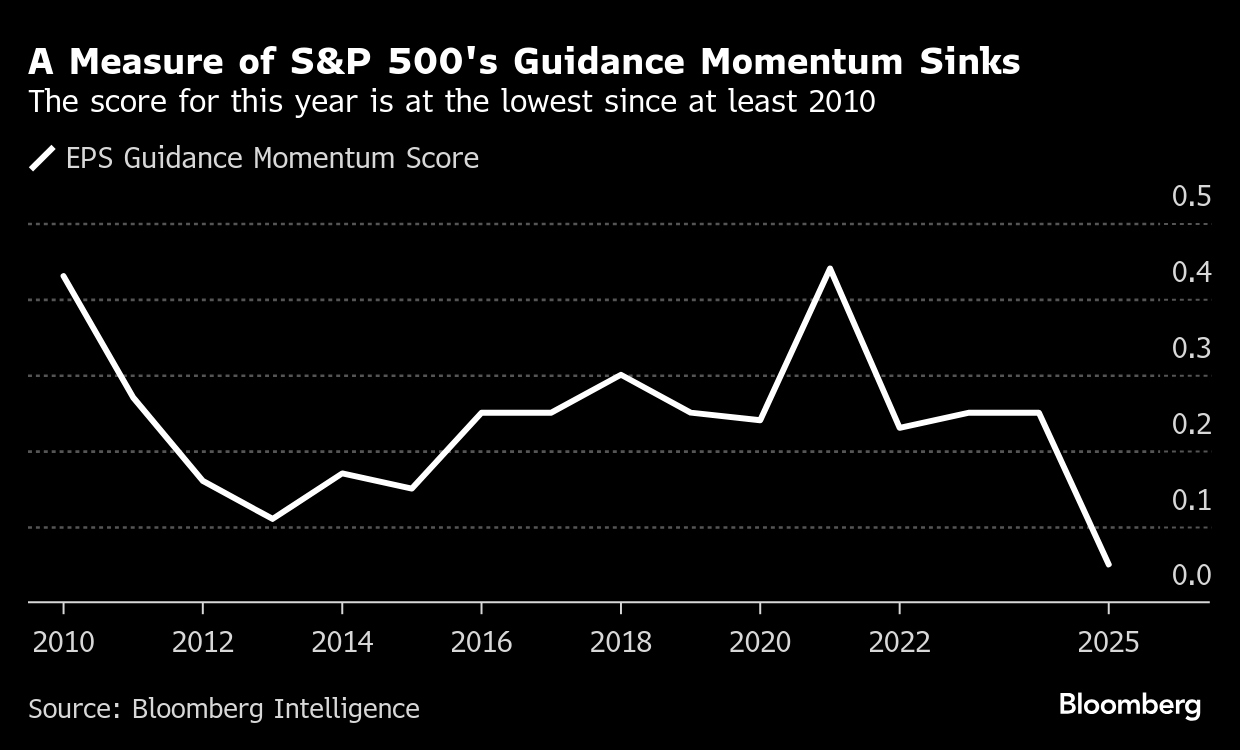

The furious comeback in US equities from the depths of last month’s rout is poised to come to a halt, according to Morgan Stanley’s Lisa Shalett.

The chief investment officer of the bank’s wealth management division says decelerating revenue growth from the Magnificent Seven megacap companies and waning earnings momentum more broadly will limit further market upside after a double-digit recovery in the S&P 500 from April’s lows.

“I think we’re going to stall out here,” Shalett said Friday in an interview with Bloomberg Surveillance. “It’s hard to justify the numbers.”

One thing is clear as the first-quarter earnings season draws to a close: The uncertain outlook for the global economy is superseding better-than-feared results even as stocks rally on signs of easing trade tensions.

In the US, a measure that reflects the proportion of S&P 500 members that raised their earnings outlook compared to those that held or reduced, the so-called profit guidance momentum, fell to the lowest level since at least 2010, according to an analysis from Bloomberg Intelligence’s equity strategists Gina Martin Adams and Wendy Soong. That is in spite of S&P 500 companies delivering double the profit growth that was expected in the first quarter, according to BI.

“There is little question that the trade agreement between the US and China is a bullish development as it lowers the odds of a recession,” said Matt Maley at Miller tabak. “Now, we have to figure out just how much this will actually improve the outlook enough to justify today’s level in the stock market and/or a further rally over the coming months.”

Corporate Highlights:

- The US Justice Department is considering an agreement that would allow Boeing Co. to avoid a criminal charge for two fatal crashes of its 737 Max jets, according to lawyers representing family members of the victims.

- CoreWeave Inc. surged 22% to a record high after Nvidia Corp. reported a larger-than-anticipated stake in the cloud-computing provider.

- Applied Materials Inc. tumbled after giving a lackluster forecast for the current period, highlighting the potential cost of the US trade dispute with China.

- Charter Communications Inc. has agreed to combine with closely held Cox Communications in a cash-and-stock deal that would unite two of the biggest US cable providers.

- Coinbase Global Inc.’s rally has been unconquerable this week, as even a one-two punch of negative headlines did little to stop the crypto exchange operator’s climb ahead of its inclusion in the S&P 500.

- Binance and Kraken are among major crypto exchanges that have been targeted by the same type of social-engineering hack that was recently disclosed by Coinbase Global Inc., according to people familiar with the situation.

- Billionaire Michael Novogratz said Galaxy Digital Holdings Ltd. is talking with the US Securities and Exchange Commission about tokenizing its own stock as well as other equities using its digital-asset platform.

- Apple Inc. and Epic Games Inc. sparred over whether the iPhone maker was obstructing access to the hit game the latest tussle in a long-running feud over Apple’s control of game distribution revenue.

- The Federal Trade Commission wrapped up its case Thursday for breaking up Meta Platforms Inc. as an illegal social-media monopoly, with the company now set to lay out its defense in the ongoing antitrust trial.

- OpenAI is rolling out a new artificial intelligence agent for ChatGPT users that’s designed to help streamline software development as the company pushes into a crowded market of startups and large tech firms offering AI tools for coders.

- Novo Nordisk A/S is replacing Chief Executive Officer Lars Fruergaard Jorgensen as the drugmaker wrestles with increased competition for its Wegovy obesity shots that transformed the weight-loss industry and made the Danish company the star of corporate Europe.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average rose 0.8%

- The MSCI World Index rose 0.5%

- Bloomberg Magnificent 7 Total Return Index rose 0.5%

- The Russell 2000 Index rose 0.9%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.1150

- The British pound fell 0.2% to $1.3276

- The Japanese yen fell 0.2% to 145.94 per dollar

Cryptocurrencies

- Bitcoin rose 0.5% to $104,015.59

- Ether rose 2.1% to $2,591.41

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.48%.

- Germany’s 10-year yield declined three basis points to 2.59%

- Britain’s 10-year yield declined one basis point to 4.65%

Commodities

- West Texas Intermediate crude rose 1.2% to $62.35 a barrel

- Spot gold fell 1.4% to $3,193.18 an ounce

©2025 Bloomberg L.P.

By