Most Asian Stocks Gain After US-China Trade Truce: Markets Wrap

May 13, 2025 by Bloomberg(Bloomberg) -- Most Asian stock markets rose, following a rally in US equities, on optimism the US-China trade truce marks the end to an all-out tariff war.

Japanese shares led gains in the region, with the Topix rising for a 13th day, while benchmark indexes also advanced in Australia and Taiwan. The Hang Seng Index slipped with US stock futures after both had jumped on Monday. Treasuries edged higher in Asia, while the dollar fell.

The broad return of risk appetite comes after trade negotiators from the world’s two biggest economies announced Monday a de-escalation in tariffs. In a carefully coordinated joint statement, the US slashed duties on Chinese products to 30% from 145% for a 90-day period, while Beijing dropped its levy on most goods to 10%.

“There’s very clearly upside risk for the broader risk asset spectrum now as markets will likely extrapolate a higher likelihood of further deals in the coming weeks,” HSBC Bank strategists including Max Kettner wrote in a note. “Things could easily turn out a bit bumpier in future trade negotiations — but clearly the US administration has altered its tone such that future episodes of weakness should be used as buying opportunities.”

Optimism over the US-China talks saw the S&P 500 Index close 3.3% higher Monday, above where it was when President Donald Trump announced sweeping tariffs on April 2. A surge in big tech shares put the Nasdaq 100 back into a bull market just about a month after it plunged 20% from a previous record high.

Still, the reverberations of Trump’s trade war are likely to keep affecting global markets for months. In Japan, Prime Minister Shigeru Ishiba said Monday his government won’t accept any initial trade agreement with the US that excludes an accord on autos.

In China, the sense of relief has started to fizzle as some investors saw the agreement reducing the prospect that Beijing will ramp up economic stimulus. Others start to recalculate the economic impact of the tariffs to come.

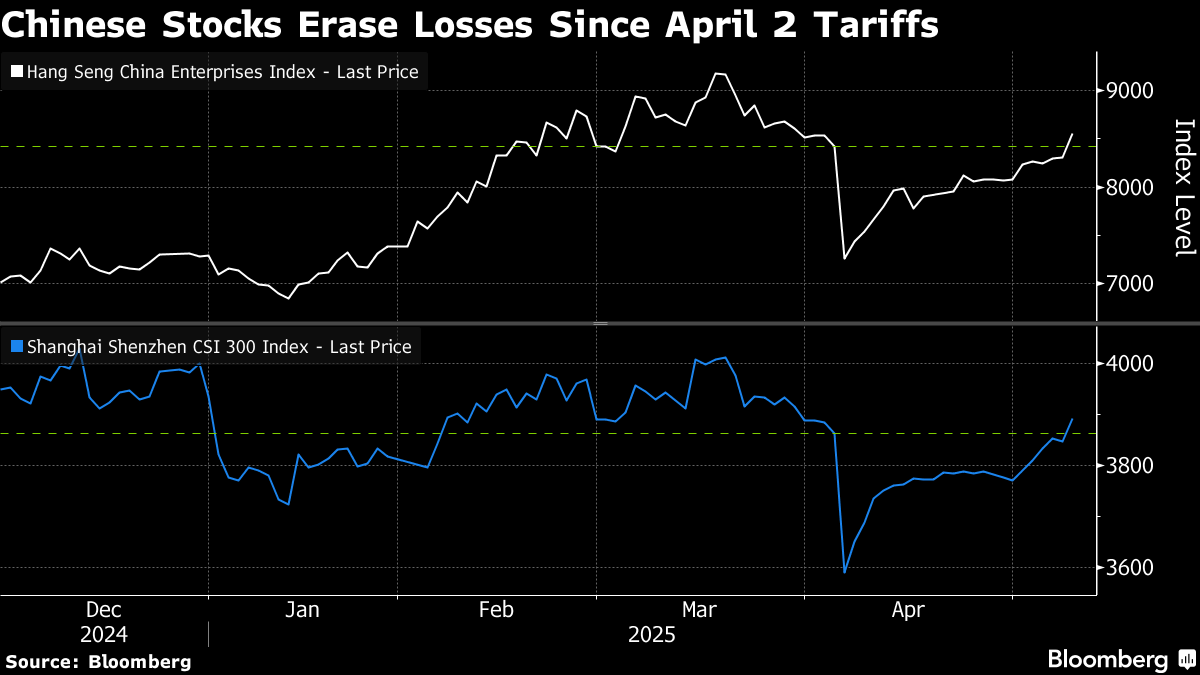

The Hang Seng China Enterprises Index dropped as much as 1.9% after surging 3% in Monday. The CSI 300 Index was little changed in its first reaction to the trade truce.

“The bigger picture remains complex,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore. “The uncertainty is no longer about what tariffs will be imposed, but about how these levels will hit earnings and economic momentum — especially heading into third quarter.”

The dollar weakened against all its Group-of-10 peers in Asian trade, retracing some of the gains it made on Monday following the US-China truce. The Bloomberg Dollar Spot Index slipped 0.2%. The yen and Swiss franc led gains.

Treasuries also reversed some of Monday’s move. The policy-sensitive US two-year yield fell three basis points after surging 12 basis points in New York amid speculation the tariff truce would bolster the world’s biggest economy.

Swaps that track upcoming Fed meetings showed just 56 basis points of easing is now priced in by December, down from nearly 75 basis points last week. Traders still see the first quarter-point cut in September.

Japanese government bond futures fell as demand for haven assets waned. Japan’s auction of 30-year government bonds saw a small improvement in demand as higher yields attracted some investors amid optimism over the US-China trade talks.

Gold was little changed after a selloff Monday as the de-escalation in US-China trade tensions hurt demand for havens. Oil paused after a three-day gain as attention moved away from the trade war and to the Middle East.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.4% as of 1:58 p.m. Tokyo time

- Nikkei 225 futures (OSE) rose 1.8%

- Japan’s Topix rose 1.3%

- Australia’s S&P/ASX 200 rose 0.3%

- Hong Kong’s Hang Seng fell 1.7%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.1115

- The Japanese yen rose 0.5% to 147.73 per dollar

- The offshore yuan rose 0.2% to 7.1858 per dollar

Cryptocurrencies

- Bitcoin was little changed at $102,733.07

- Ether fell 1.1% to $2,457.67

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.46%

- Japan’s 10-year yield advanced seven basis points to 1.460%

- Australia’s 10-year yield advanced seven basis points to 4.44%

Commodities

- West Texas Intermediate crude fell 0.2% to $61.84 a barrel

- Spot gold rose 0.4% to $3,250.55 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By