S&P 500 Wavers After $6 Trillion Run on Trade Risk: Markets Wrap

May 09, 2025 by Bloomberg(Bloomberg) -- Wall Street is ending the week on a more cautious note, with stocks and bonds fluctuating as the world’s two largest economies get ready to kickstart their trade negotiations.

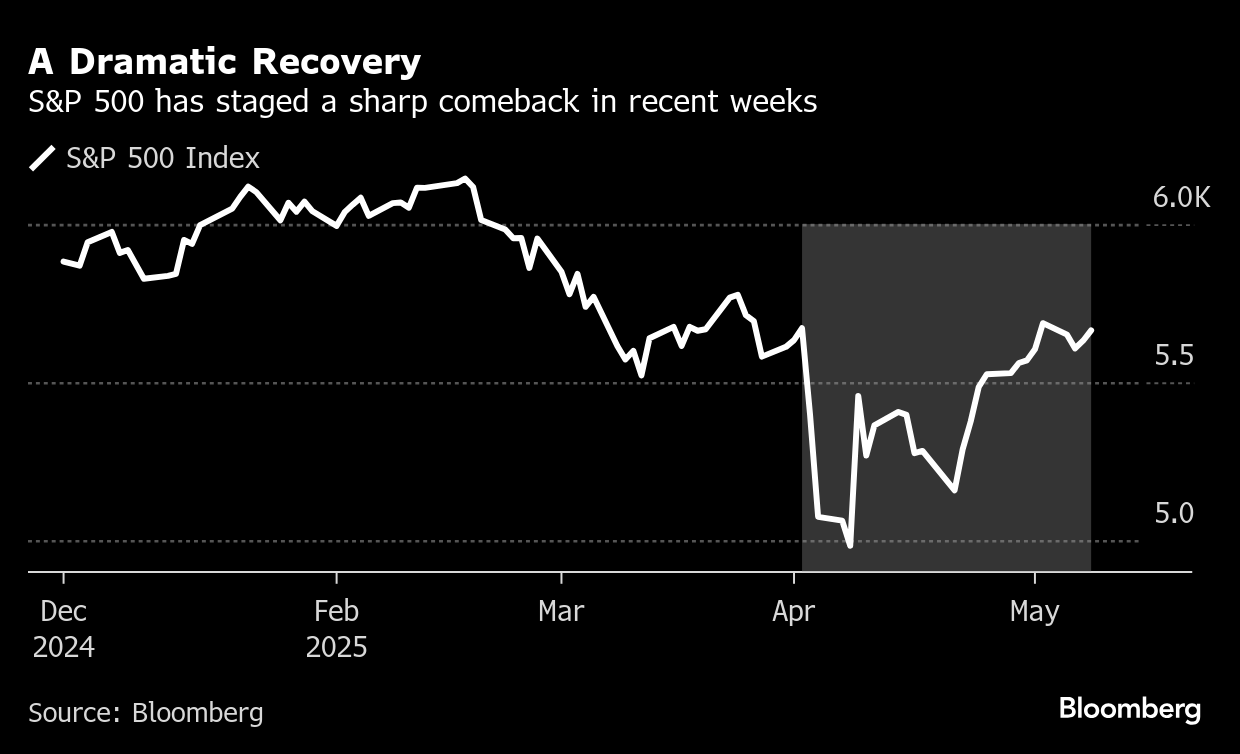

Investors refrained from making riskier bets on speculation that while talks between Chinese and American officials could represent a diplomatic icebreaker, they would unlikely result in a comprehensive agreement at this stage. Following a rapid $6 trillion surge in the S&P 500 from the brink of a bear market, action has been more muted in recent days. The gauge was little changed Friday amid volume that was 30% below the average of the past month.

Traders around the world have been eager for any signs of easing in the tariff war that has roiled markets and raised risks of a global economic downturn. President Donald Trump floated an 80% tariff on China ahead of negotiations due to begin Saturday as he urged the nation to do more to open its markets to US goods.

“Markets continue to be reactive to trade headlines,” said Mark Hackett at Nationwide. “We are likely in a sideways period of volatility until we begin to get tangible, calculable outcomes. Nobody knows the ultimate outcome, so this is the time to remain informed and vigilant, but not reactive or emotional.”

In the absence of relevant economic data, investors waded through a raft of remarks from central bank officials.

Federal Reserve Governor Adriana Kugler said that policymakers should hold rates for now amid a stable economy and tariff uncertainties. Her colleague Michael Barr warned trade policies could put officials in a difficult position by generating inflationary pressures and higher unemployment. Fed Bank of Richmond President Tom Barkin said not all firms can raise prices on tariffs.

The S&P 500 wavered. The Nasdaq 100 was little changed. The Dow Jones Industrial Average slid 0.2%. Across the Atlantic, Germany’s DAX Index became the first major European gauge to surpass its March peak, recouping all declines sparked by Trump’s trade war.

The yield on 10-year Treasuries fell one basis point to 4.37%. The Bloomberg Dollar Spot Index slid 0.2%, while still poised for its best week since March.

Even as the US takes steps toward trade negotiations, the stunning American stock rebound is likely over, according to Bank of America Corp.’s Michael Hartnett. He doesn’t see further gains as investors “buy the expectation, sell the fact.”

About $24.8 billion was redeemed from US stocks in the past four weeks, the biggest in two years, according to the note from BofA citing EPFR Global data.

Billionaire Barry Sternlicht said the economy will likely weaken even though the stock market has bounced back from Trump’s major tariff announcement in early April.

“The markets have recovered, shockingly, to pre-Liberation Day highs, but that doesn’t really feel right,” Sternlicht said Friday on an earnings call for Starwood Property Trust Inc., where he is chairman and chief executive officer. “Things like travel are clearly off.”

With talks between the US and China about to start, trillions of dollars are hanging in the balance for American companies. The average member of the S&P 500 made 6.1% of its revenue from selling goods in China or to Chinese companies in 2024, according to an analysis from Bloomberg Intelligence’s Gina Martin Adams and Gillian Wolff.

“The bottom line is that if the US has to decouple completely from China, it would result in a significant decline in earnings for S&P 500 companies no longer selling products to Chinese consumers,” Torsten Slok, chief economist at Apollo, wrote.

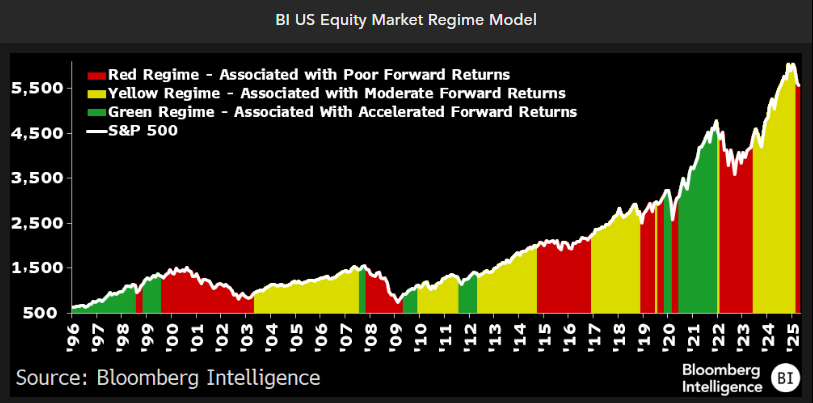

Meantime, a stock-market indicator has entered a phase historically associated with the worst return prospects for the S&P 500 after trade fears gripped financial markets and dimmed Corporate America’s outlook for profit growth.

The Equity Market Regime Model, a Bloomberg Intelligence model that tracks the benchmark stock gauge and clusters periods into three phases — accelerated growth (green), moderate growth (yellow) and decline (red) — fell into the cautious red zone in March and April, according to data compiled by BI’s Adams and Wolff. The seven prior instances have been associated with a 5.6% average drop in the S&P 500 in the next 12 months.

Corporate Highlights:

- US prosecutors and regulators investigating a $32 million deal between CrowdStrike Holdings Inc. and a technology distributor are probing what senior company executives may have known about it and are examining other transactions made by the cybersecurity firm, according to two people familiar with the matter.

- Semiconductor Manufacturing International Corp., China’s leading chipmaker, warned sales could fall as much as 6% this quarter because of production disruptions.

- Taiwan Semiconductor Manufacturing Co.’s revenue jumped 48% in April, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect.

- Expedia Group Inc. cut its full-year outlook for gross bookings and revenue after it saw weaker-than-expected domestic and inbound travel demand in the US at the start of the year.

- Lyft Inc. reported better-than-expected gross bookings in the first quarter, drawing a sharp contrast with the disappointing results issued by its much-larger ride-hailing rival Uber Technologies Inc. earlier this week.

- Pinterest Inc.’s second-quarter revenue guidance topped estimates at the midpoint, further easing concerns of an advertising slowdown.

- Coinbase Global Inc.’s first-quarter revenue jumped while profit declined as the largest US crypto exchange navigated the volatile price swings of the digital asset market.

- DraftKings Inc. rose as investors looked past a disappointing first quarter hurt by a March Madness basketball tournament that went especially well for gamblers.

- Sweetgreen Inc. cut its annual guidance, citing a sharp decline in consumer sentiment following the announcement of new tariffs in the US.

- Illumina Inc. cut its full-year adjusted profit guidance for the second time in three months as it grapples with the impact of tariffs and China banning imports of its gene-sequencing machines.

- IAG SA announced its biggest order yet for widebody jets, doubling down on long-haul demand with a $10 billion fleet investment that aims to help sustain its earnings momentum.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 2:43 p.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World Index was little changed

- Bloomberg Magnificent 7 Total Return Index rose 0.3%

- The Russell 2000 Index fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.3% to $1.1258

- The British pound rose 0.5% to $1.3314

- The Japanese yen rose 0.4% to 145.28 per dollar

Cryptocurrencies

- Bitcoin rose 0.7% to $103,326.31

- Ether rose 7% to $2,338.55

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.37%

- Germany’s 10-year yield advanced three basis points to 2.56%

- Britain’s 10-year yield advanced two basis points to 4.57%

Commodities

- West Texas Intermediate crude rose 1.7% to $60.93 a barrel

- Spot gold rose 1% to $3,337.95 an ounce

©2025 Bloomberg L.P.

By