Stock Futures Rise, Pound Rallies on Trade Deal: Markets Wrap

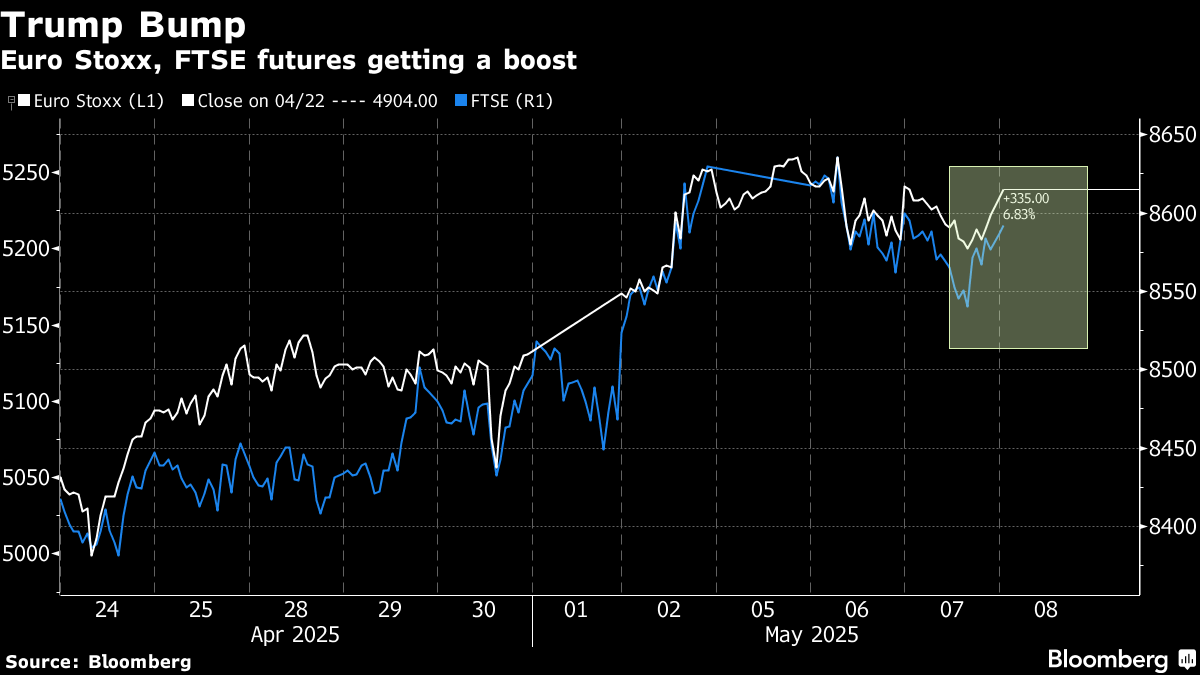

May 08, 2025 by Bloomberg(Bloomberg) -- Stock-index futures and Asian shares rose as President Donald Trump revealed plans to unveil a “major” trade deal Thursday, boosting optimism that the US was making headway in negotiations. The pound extended gains.

Contracts for the S&P 500 and European stocks rose 0.8% after Trump announced the deal in a Truth Social post, without disclosing the name of the country. The administration is expected to announce an agreement with the United Kingdom, according to people familiar with the matter. Asian shares rebounded from losses of as much as 0.5% to advance 0.3%. Bitcoin jumped 2.7% to $ 99,355, the highest level in three months. Treasuries fell and gold rose.

“The details of the deal will be critical as a possible template for negotiations with other countries,” said Rajeev De Mello, global macro portfolio manager at Gama Asset Management. “It’s a positive for UK equity markets and for the sterling, and possibly for other very close friends of the US.”

Market turbulence has calmed significantly since the early weeks of April, partly thanks to Trump’s trade concessions, but also owing to a string of US economic reports that gave confidence to bulls. One key area of focus is how the talks with China will pan out this weekend in Switzerland after the US president slapped levies of more than 100% on Chinese imports and the Asian country retaliated with similar moves.

In his social media post, Trump said the upcoming deal will be with representatives of a big and highly respected country. “The first of many,” he wrote.

Formal negotiations for a deal between the US and UK commenced during Trump’s first term as president. A free trade deal was the “inevitable next step” in the US-UK relationship, the then International Trade Secretary Liz Truss had said.

After Trump returned to power this year, he was touting this deal about five weeks before the reciprocal tariff announcement on the so-called “Liberation Day.”

Macro Strategist Mark Cudmore says:

A US-UK accord won’t help investors ascertain how broader tariff-related trade negotiations will go. In fact, the lesson might be an outright negative, because it will highlight quite how long these deals take, and that will be anticlimactic for a market that’s betting on US trade conditions ameliorating rapidly. So this is , and we will continue to wait for the first signs of success from Trump’s aggressive tariff tactics, which will disappoint expectant US stock investors.

The president had earlier said he was unwilling to preemptively lower tariffs on China in order to unlock more substantive negotiations with Beijing on trade. Stocks got a lift Wednesday after China and the US announced plans to do trade talks in Switzerland this weekend.

The US had previously said it’s made “significant progress” toward a India bilateral trade deal following talks between Vice President JD Vance and Indian Prime Minister Narendra Modi. Trump had also said there was “big progress” in talks to strike a deal for Japan.

Traders have stayed cautious after Federal Reserve Chair Jerome Powell assuaged concerns about the US economy while warning that the risks of higher unemployment and faster inflation have risen. The Fed held its rate on Wednesday. How long the good news will last as Trump’s trade policies play out is the biggest question confronting central bankers.

“The Fed is not really sure where tariffs are going to land, which is important, and when they land they’re not really sure what the consequences are going to be on growth versus inflation,” said William Dudley, the former New York Fed president, on Bloomberg Television. “This is not just about the central scenario, it’s also about risk management. Try not to do the wrong thing so that you can respond effectively as things actually unfold.”

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.8% as of 1:40 p.m. Tokyo time

- Japan’s Topix was little changed

- Australia’s S&P/ASX 200 rose 0.3%

- Hong Kong’s Hang Seng rose 1.1%

- The Shanghai Composite rose 0.4%

- Euro Stoxx 50 futures rose 0.9%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.2% to $1.1328

- The Japanese yen rose 0.1% to 143.64 per dollar

- The offshore yuan was little changed at 7.2330 per dollar

Cryptocurrencies

- Bitcoin rose 2.6% to $99,309.28

- Ether rose 6% to $1,907.24

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.29%

- Australia’s 10-year yield declined three basis points to 4.24%

Commodities

- West Texas Intermediate crude rose 0.9% to $58.61 a barrel

- Spot gold rose 0.8% to $3,392.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.

By