India’s Swelling Coal Stockpiles Test State-Owned Mining Giant

Jun 10, 2025 by Bloomberg(Bloomberg) --

Recent rains may have provided the world’s most populous nation some relief from scorching summer heat, but they shattered state-owned mining giant Coal India Ltd.’s hopes of denting record-high inventories.

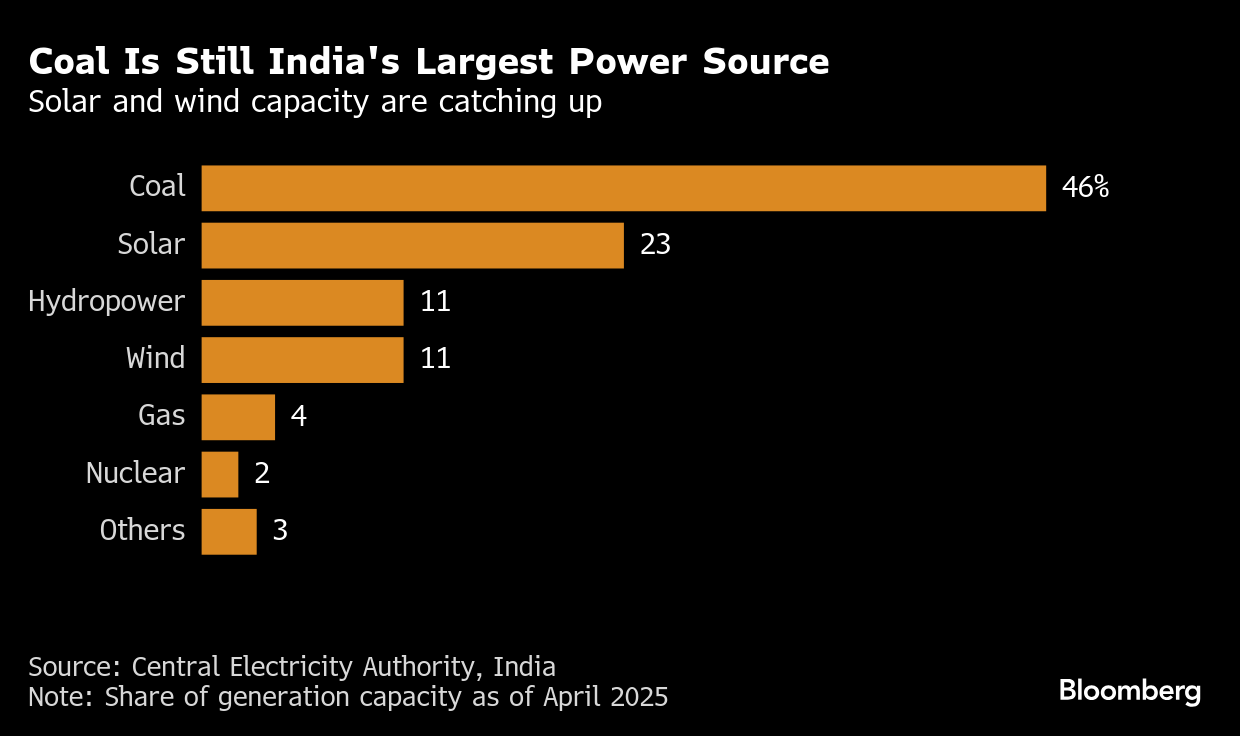

The early onset of monsoon rains and frequent showers in parts of the country have kept India’s electricity demand in check and coal stockpiles high. Combined with increased competition from cleaner sources of electricity, as well as other miners, Coal India is unlikely to return to the massive profit margins it enjoyed just a few years ago.

“Coal India’s growth window is narrowing,” said Rupesh Sankhe, senior vice president for research at Elara capital India Pvt Ltd. “With more and more renewable energy coming on stream, energy storage projects coming up and a renewed push for nuclear, demand for coal will increasingly be under pressure.”

The Kolkata-based miner has been sitting on an unsold inventory of more than 100 million tons since the start of the fiscal year in April. Meanwhile, coal stockpiles at power stations, the company’s biggest customers, are up almost a third from a year earlier at more than 58 million tons, the highest level in records going back 17 years.

That reduces the premiums Coal India can charge in auctions — a key driver of its earnings. In 2022, when a post-pandemic rebound in the economy led to coal shortages, customers paid premiums of more than 300% above baseline prices. That margin has fallen to 43% and could potentially slip to 30%, Marketing Director Mukesh Choudhary said on an investor call last month.

Soft demand and ample supply is weighing on the outlook. India’s coal-fired generation fell 6% from a year earlier in the first two months of this fiscal year. Meanwhile, peak electricity consumption this year is still more than 10% short of a projection in February, and more than 5% below last year’s maximum. Unless heat waves this month push power use drastically higher, it would be the first annual decline in at least two decades.

Meanwhile, a raft of players are mining the fuel to run their own plants as well as pushing some of their production into the market.

NTPC Ltd., India’s largest power producer and coal user, is seeking to almost double its own production to 50 million tons this fiscal year. The company has also sought to source more fuel from non-state companies.

Those producers are grabbing an increasing portion of the nation’s coal output. They mined 198 million tons in the year through March, or about a fifth of the total.

That will weigh on Coal India’s sales. While Sankhe expects the miner’s volumes to rise as much as 5% annually for the next three to four years, he forecasts a decline thereafter. The company’s profit has peaked, since the increased competition will weigh on auction prices and offset the higher volumes, he said.

©2025 Bloomberg L.P.

By