Trump’s Tax Bill Would Dampen, But Not Quash, the Clean Energy Buildout

Jun 05, 2025 by Bloomberg(Bloomberg) -- The current version of President Donald Trump’s centerpiece tax and spending bill would winnow the amount of renewable energy capacity the US adds over the next decade, according to a report released Wednesday by BloombergNEF.

Wind, solar and storage capacity overall would drop by 10% by 2035 relative to a baseline scenario, the research firm finds. The bill would also result in 3.8 million more tons of carbon emissions from the country’s power sector by 2050.

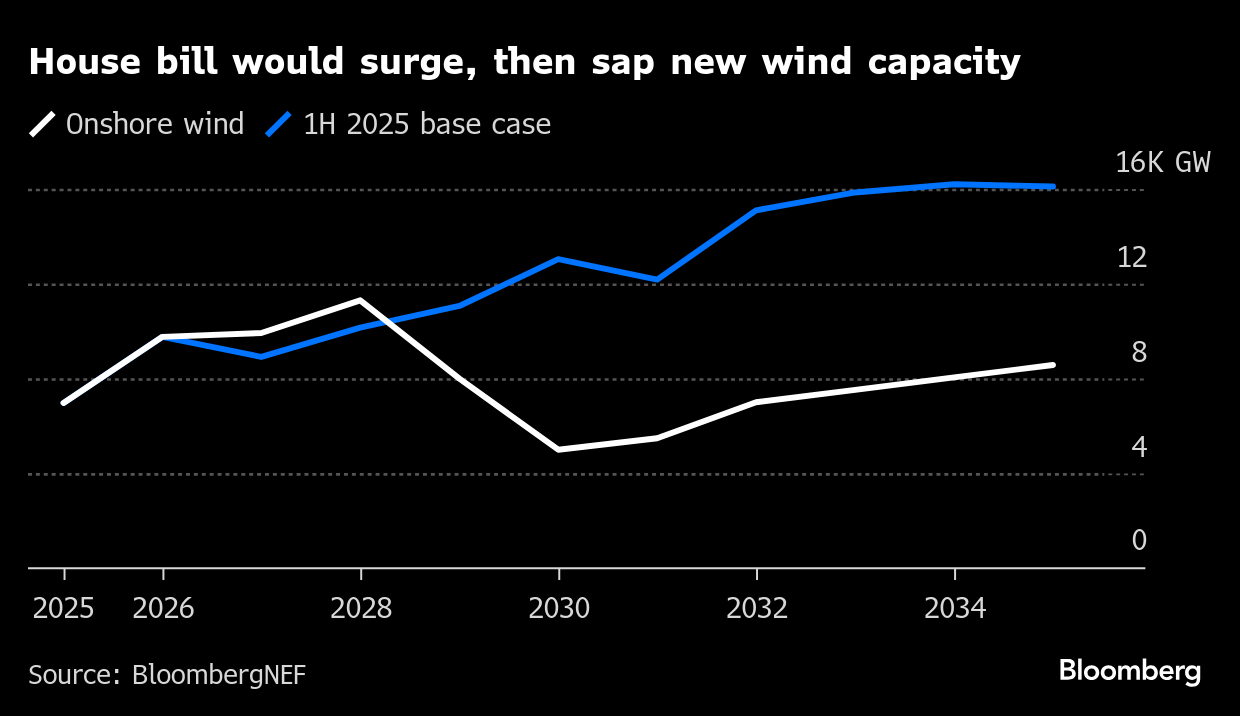

The impact on wind power would be most severe, with new capacity shrinking by 35% and no offshore wind additions after 2028. Solar and energy storage capacity stand to fare better, falling 5% and 7%, respectively.

Initially, there would be a short-term rush to get projects under construction to claim tax credits before they expire. Then, in 2029, the new capacity would fall off, BNEF says.

On a longer-term horizon, though, the forecast for the renewables sector improves. New capacity for wind and solar collectively would only be 1% lower in 2050. That’s due in part to the rise in power demand from data centers and EV adoption.

The “One Big Beautiful Bill,” passed by the House of Representatives last month, has now gone to the Senate, where changes are expected. The final House version of the legislation includes a swift phaseout of the clean electricity tax credits in former President Joe Biden’s Inflation Reduction Act.

For new, non-nuclear clean power projects, the credits would only be available if a project begins construction within 60 days of the bill becoming law and if it also starts operating before the end of 2028. A 30% credit for residential solar would expire at the end of this year.

Building less new clean energy “would have negative effects on the US power system,” the BNEF authors write. “In most regional power markets, renewables can be added to the system more quickly than other generation sources like gas-fired power plants. In addition, it is very challenging to simply build a new gas plant given the market shortage of turbines.”

One result would be higher electricity prices for US households and businesses, said Derrick Flakoll, a BNEF senior policy associate and an author of the report.

“If you get rid of the tax credits, you are increasing the capital costs that utilities will have to pay to get new power,” Flakoll said. “That’s going to be passed down to the consumers, who are going to have higher rates.”

©2025 Bloomberg L.P.

By