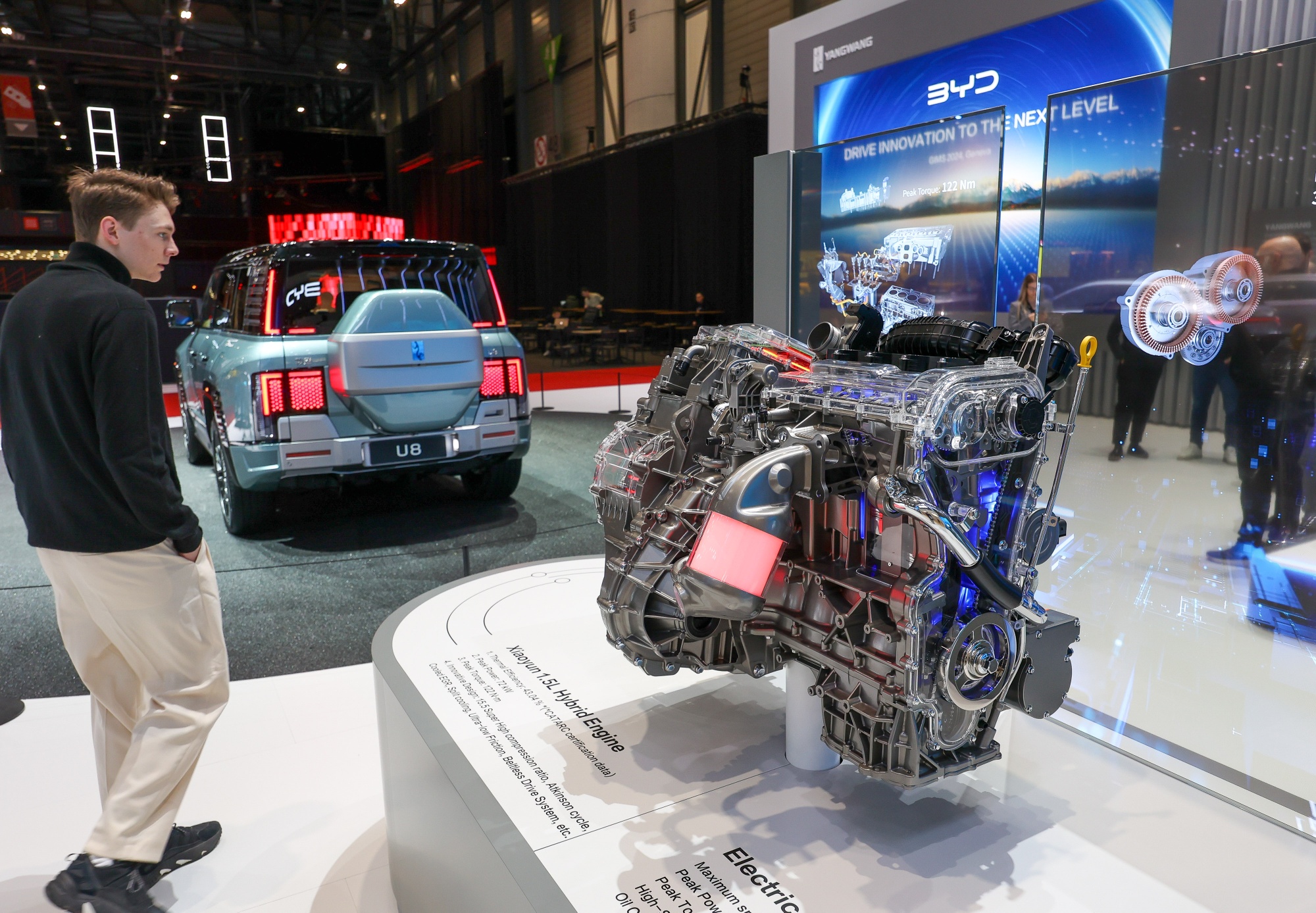

Chinese Automakers Crank Up Sales of Cars With Combustion Engines in Europe

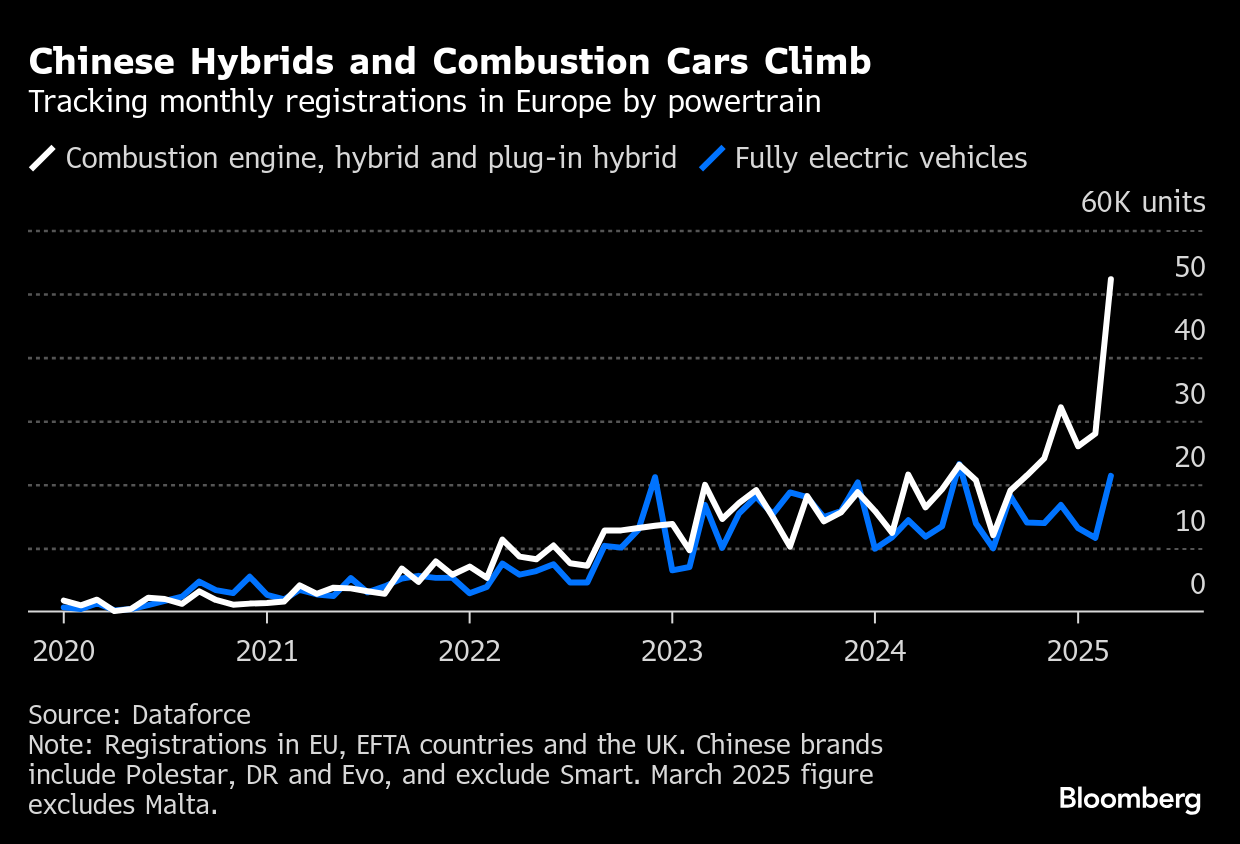

May 08, 2025 by Bloomberg(Bloomberg) -- Chinese electric vehicles are losing momentum in Europe, but the nation’s automakers are selling more cars than ever in the region by throttling up deliveries of hybrids and combustion engine-powered models.

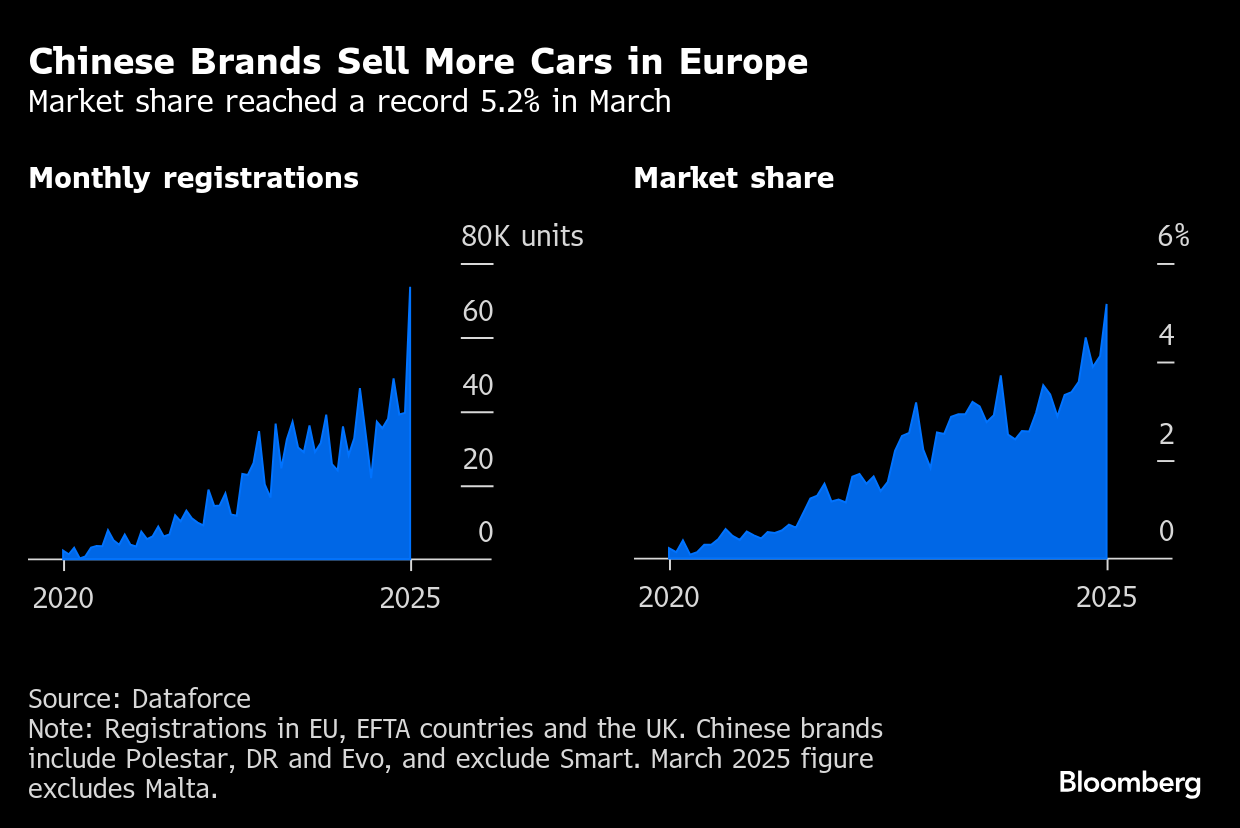

The number of Chinese-brand cars registered across Europe hit record levels in the first three months of the year, exceeding 150,000 vehicles, according to figures provided by Dataforce, which tracks auto sales. The monthly total hit an all-time high in March.

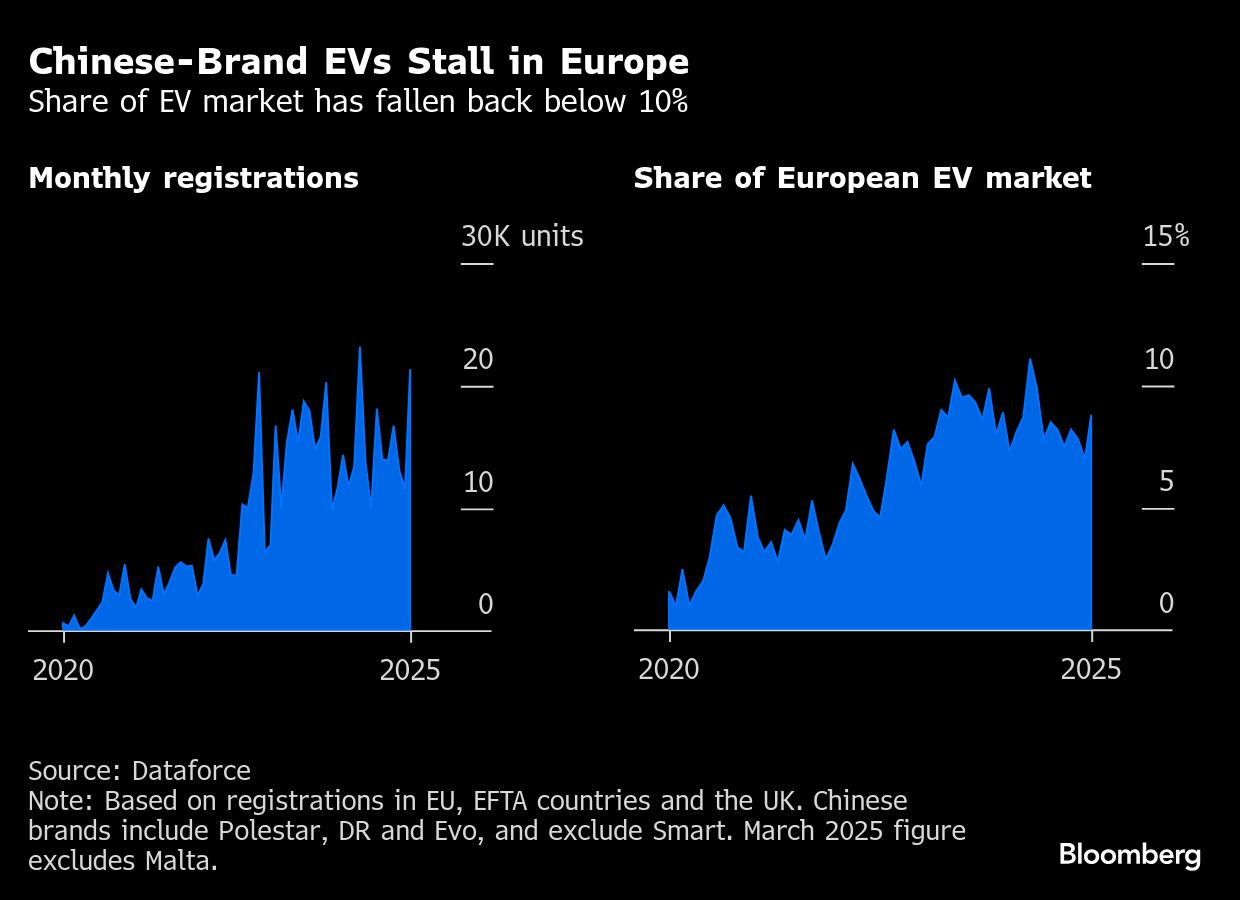

EVs were just 30% of registrations in the first quarter, the smallest portion since at least the start of 2020.

Until recently, Chinese automakers had prioritized selling EVs in Europe, spurred by the region’s ambitious targets to lower carbon emissions and the desire to lead in the emerging segment of a global industry. That changed when the European Union imposed higher tariffs on Chinese-made EVs last year, after determining that generous subsidies from Beijing had created an unfair advantage for its battery-powered car industry.

With multiyear gains in EV sales at a plateau, Chinese carmakers have turned to more conventional drivetrains to pick up the slack.

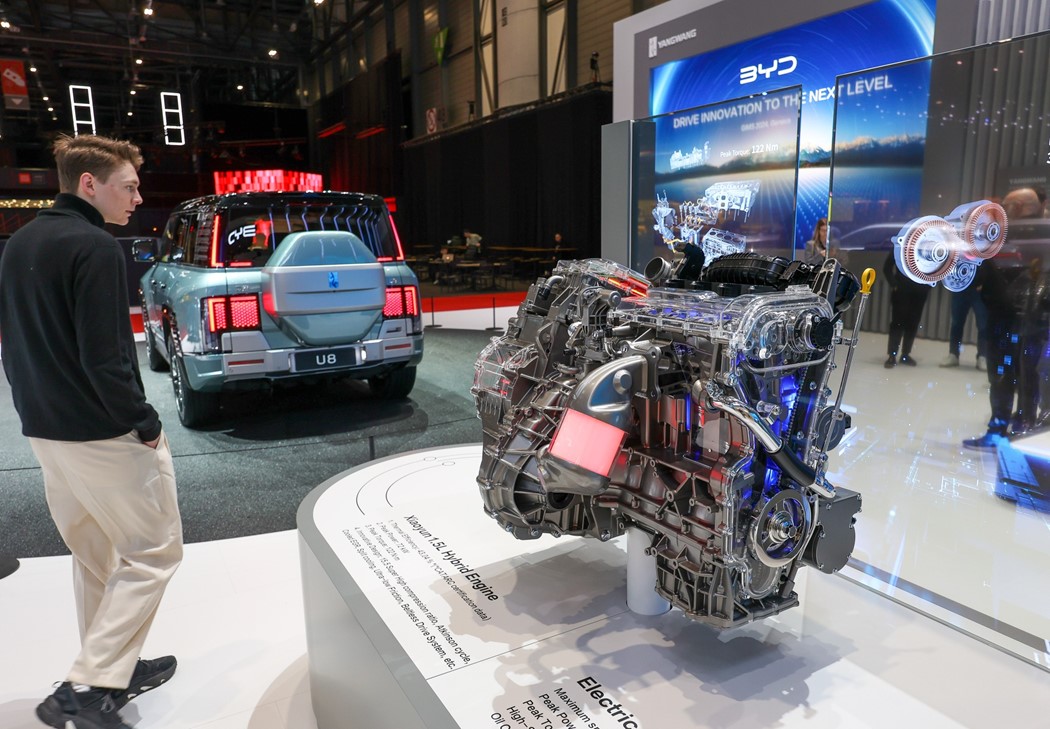

EV powerhouse BYD Co., for instance, is for the first time selling significant numbers of plug-in hybrids in the EU and the UK. SAIC Motor Corp.’s MG sold almost 47,000 hybrid, plug-in hybrid and combustion engine-powered cars in EU countries in the first quarter, according to Dataforce. That was more than double its early 2024 tally, while EV sales fell by half.

One reason for the shift to fossil fuel-burning models has been the added EV levies, which raised import duties to as high as 45% in the case of state-owned SAIC.

But there’s also been a broader pickup in demand for hybrids while EV uptake has slowed, and Chinese manufacturers are adjusting along with their European counterparts, said Benjamin Kibies, a senior automotive analyst at Dataforce.

“The Chinese have accelerated and intensified their efforts to introduce other fuel types,” Kibies said. “Tariffs are part of the puzzle.”

The trend has been underway since the second half of last year, when the EU started setting the higher duties. The added tariffs apply to all EVs made in China and are intended to level the playing field for European manufacturers and their suppliers.

While the moves thwarted Chinese brands from seizing more of the EV market, they also risk undermining the bloc’s environmental goals. Concerns that the surcharges would slow adoption of electric cars by making Chinese imports more expensive largely have come to pass, even if the duties are only part of the equation.

Manufacturers led by Volkswagen AG and Stellantis NV now face intensified competition across their model lineups. In March, Chinese automakers reached 5.2% of all European auto sales, passing the 5% mark for the first time.

MG’s sales of combustion engine and hybrid cars more than doubled in Spain in the first quarter, and rose from minuscule levels to more than 5,500 units in France. In Italy, the British sports-car brand that’s been Chinese-owned since the mid-2000s registered a 57% rise in these categories.

BYD too is seeing more demand for its hybrid models in Europe this year, regional chief Maria Grazia Davino said at an industry event last month in Stuttgart, Germany.

“In the near future we’ll have two pillars,” she said. “One is electric.”

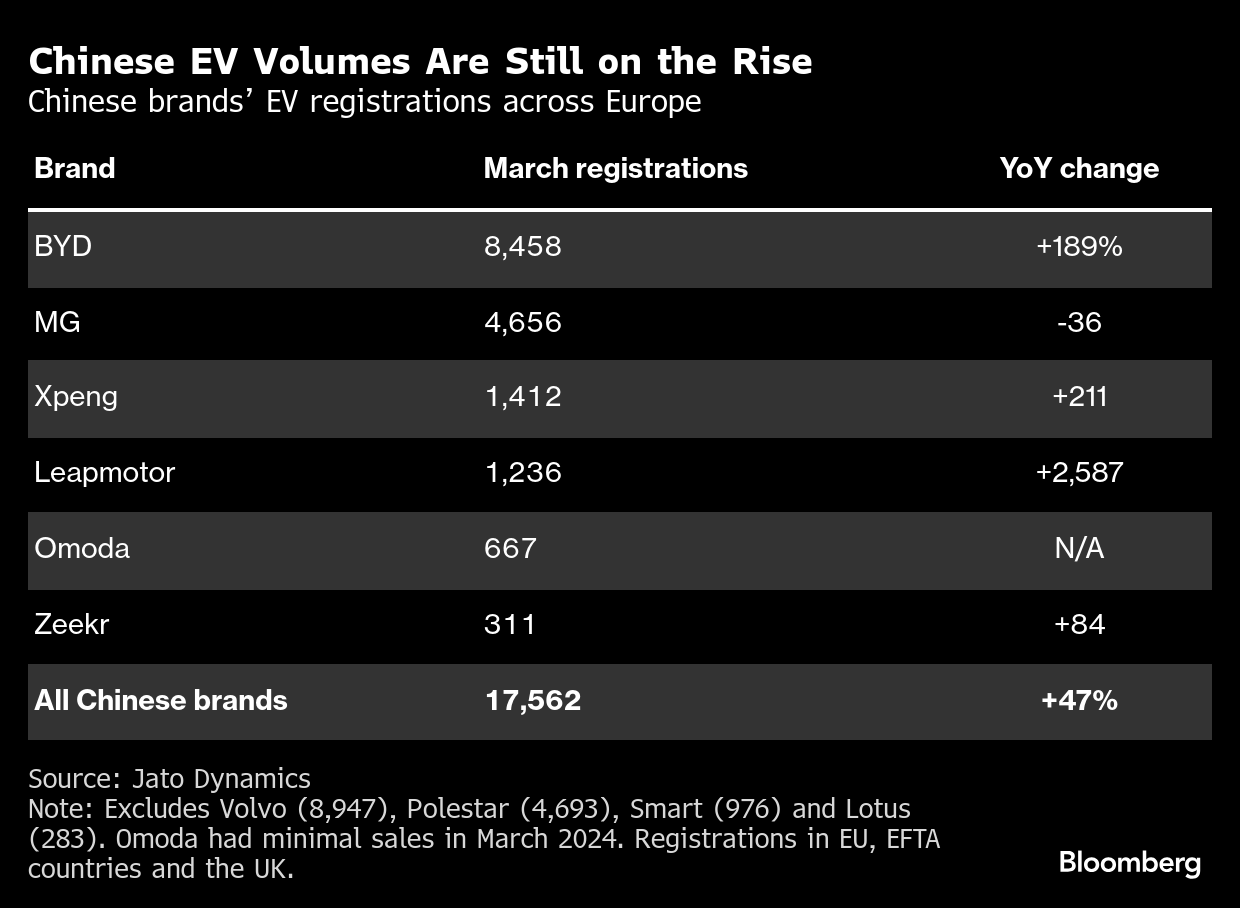

While EV market share gains have stalled, BYD and several other Chinese automakers continue to increase sales of battery-electric models. BYD’s EV registrations almost tripled across Europe in March from a year earlier, according to Jato Dynamics. Xpeng Inc. and Zhejiang Leapmotor Technology Co. also gained traction.

BYD is expanding its dealer network and building factories in Hungary and Turkey to make hybrids and EVs that won’t be subject to tariffs. It’s also considering a third plant in Europe and generally has refrained from using its cost advantages to undercut competitors, introducing higher-end models instead.

“We have no interest in destroying ourself and the industry by initiating the pricing spiral that goes, goes down,” Davino said.

(Updates with brand information in third to last paragraph, adds chart)

©2025 Bloomberg L.P.

By