European Utilities Rush to Hedge Against Acute Wind Drought

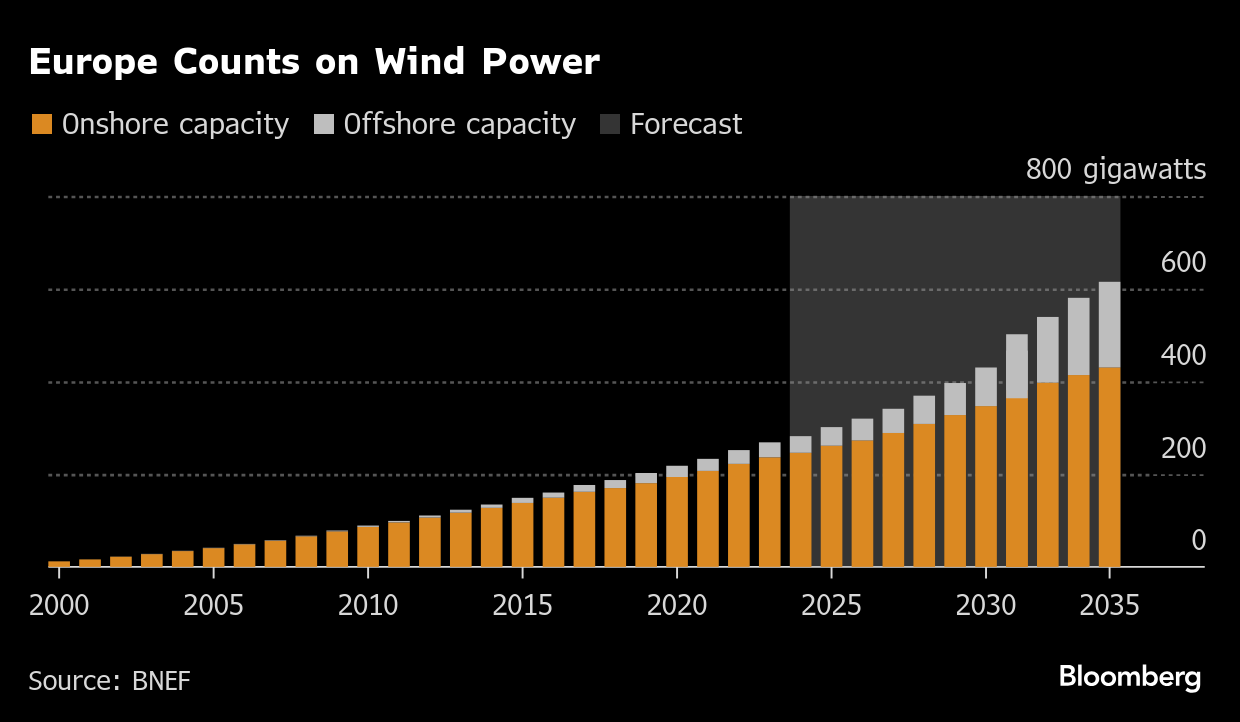

May 27, 2025 by Bloomberg(Bloomberg) -- After spending about $380 billion over the past decade to nearly double wind power capacity in Europe, utilities are now turning to an obscure and little-known market to protect themselves against a prolonged bout of calm weather.

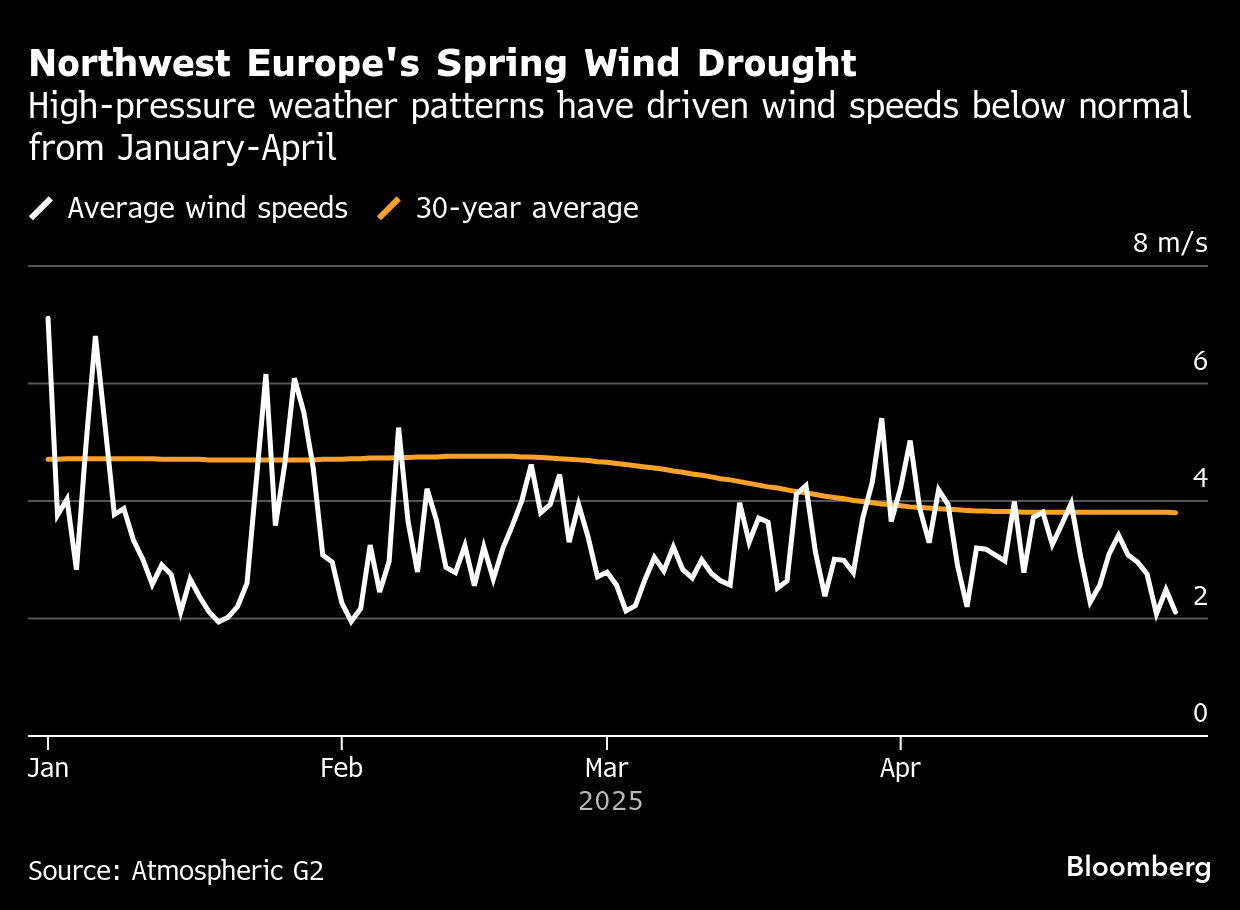

The wind drought is a reminder that no matter how much you build, actual generation will always be dictated by how much it blows. Wind speeds across Europe during February to April likely had their biggest drop from long-term averages since 1940, according to data from the University of Maine’s Climate Change Institute.

As a result, utilities are turning to the weather derivatives market and they are striking more wind hedging deals for this summer than in the past, said Senior Structurer Pierre Buisson at reinsurer Munich Re. He’s worked on four to five major requests recently, more than usual, and the focus has now turned to the summer months, he said.

“Interest in wind hedging has grown significantly over the last two to three years, and the current wind drought has added more fuel to the fire,” said Ralph Renner, a former power trader and head of origination at Parameter Climate, who advises companies on hedging.

In Germany, for instance, wind power output was 30% lower in the first quarter than a year earlier, boosting the activities of coal and gas plant operators, according to a report published Tuesday by the Working Group on Energy Balances.

Operators are buying contracts that offer protection against lower-than-expected wind output. So, if a utility expects to produce a certain amount of terawatt-hours of wind power during a set period, but falls short due to insufficient wind speeds, it will receive compensation from their counter party — Munich Re, Swiss Re AG or other similar firms.

Weather derivatives have been around for decades to protect against adverse weather patterns. They are common in other industries too, from farming to sporting events, travel and entertainment.

While most commodities and energy markets have over the past few decades become more transparent amid pressure from regulators, the weather derivatives market has remained opaque. There is no data available on how widespread wind hedging is and firms active in the market have declined requests to provide more details.

The European Energy Exchange AG, the world’s biggest electricity bourse, and Nasdaq Inc. both launched wind contracts on their platforms in the last decade but failed to gain traction. The deals are typically signed directly between utilities and the firm offering the hedging contract.

The region’s biggest wind producers all added wind capacity last year. Iberdrola SA reported a small gain in output in the first quarter, while production at Orsted AS dropped. For RWE AG, Germany’s biggest power producer, offshore wind output plunged by as much as a third. They all declined to comment on wind hedging.

“Companies like RWE could lose tens of millions due to persistently weak wind speeds,” said Patricio Alvarez, a senior analyst at Bloomberg Intelligence.

Even with prices down from their peak, European power remains costlier than before the energy crisis, making it expensive for companies to replace shortfalls in output. That “is a major challenge for energy companies,” said Pierre Hug, head of weather and energy for Europe at Swiss Re Corporate Solutions. He highlighted increasing demand for his services.

Swedish utility Vattenfall AB, with wind parks across northwest Europe, saw output drop by 20% in the first quarter. It’s not using wind hedging contracts specifically, but instead balances the output with other parts of its generation portfolio, said Catrin Jung, head of offshore wind at the firm.

“You can have 300,000 wind turbines and it won’t matter,” said Ivan Fore Svegaarden, chief executive officer at TradeWPower AS, a Norwegian forecaster for the energy industry. “It keeps getting calmer and calmer, drier and drier, lasts longer and shows up more often.”

The plunge is caused by high-pressure weather patterns which have been unusually frequent and long-lasting across Europe this year. It has created unseasonably dry, calm conditions.

“There’s concern that the low-wind trend may persist,” said Robin Girmes, a former RWE weather trader who advises utilities through his own firm RM Energy Weather GmbH.

While global warming is making the climate more unpredictable, there are no obvious meteorological explanations for this long streak of calm periods, said Nathalie Gerl, lead analyst for power at London Stock Exchange Group. Long-term forecast models are riddled with uncertainty, but a seasonal analysis from MetDesk Ltd. shows that periods of low wind speeds will last through the summer, potentially increasing hedging needs even further.

“Wind is hard to forecast and wind volatility is extremely large. This large volatility can have significant impacts on prices, making wind hedging particularly appealing,” said Renner of Parameter Climate.

Average daily wind speeds in Germany in April were the lowest since 1996, according to national forecaster Deutscher Wetterdienst.

“That’s certainly a setback for operators,” BI’s Alvarez said. “They’ve had to offset the shortfall by purchasing electricity on the market or ramping up fossil fuel fired generation — both of which tend to deliver lower margins.”

(Updates with German generation data in the fifth paragraph. An earlier story corrected a name in the 12th paragraph.)

©2025 Bloomberg L.P.

By