Trump’s Spending Cuts Force Clean Techs to Explore US Exit

May 13, 2025 by Bloomberg(Bloomberg) -- Clean-tech companies that were eligible for support under former President Joe Biden are now considering leaving the US as the Trump administration pulls the plug on financing, according to the former head of the program that vetted the firms.

As director of the Loans Programs Office at the US Department of Energy when Biden was president, Jigar Shah helped select roughly 400 companies with development plans to receive grants and loans upwards of $100 million each.

Shah, who last year was included in Time magazine’s list of the most influential people for his contribution to advancing the clean-energy transition, said that since the inauguration of Donald Trump in January, many of the companies that benefited from Biden-era programs are now looking to shift all or part of their business outside the US.

Against that backdrop, Shah said in an interview that he’s been talking to officials in Brussels about re-domiciling companies in Europe. About two-thirds of the businesses are currently headquartered in the US, he said. Among clean-tech industries represented are nuclear power generation, suppliers for heat pumps and batteries, carbon capture and storage, and hydrogen.

In response to a Bloomberg request for comment, a spokesperson for the DOE said a department-wide review is underway to ensure all activities follow the law, comply with applicable court orders and align with the Trump administration’s priorities.

For the European Union and the UK, this moment represents a “once-in-a-lifetime opportunity” to lure viable companies in key growth sectors, Shah said. Each firm has been through an “extraordinarily difficult” selection process to gain access to credits under the previous administration, he said.

It’s the latest sign that Trump’s efforts to gut his predecessor’s green agenda may turn out to be a boon for other countries. Europe has already made clear it’s keen to attract many of the scientists and industry experts who have lost their jobs due to Trump’s cuts. Toward that end, European Commission President Ursula von der Leyen just unveiled a €500 million ($563 million) package of incentives, and French President Emmanuel Macron said his country will allocate a further €100 million.

To attract US companies, European governments will need to ensure there’s access to financing and critical infrastructure, said Victor van Hoorn, director of Cleantech for Europe, which has been lobbying for greater support for the industry.

Companies “will need to have sufficient comfort that two key ingredients – financing and speed – are going to be present,” Van Hoorn said. Companies will want to know whether “they have public support instruments that are clear, understandable and fast in decision-making,” he said.

Currently, many European clean-tech producers are facing financial difficulties amid a drop in prices for batteries and wind turbines, analysts at Jefferies Financial Group Inc. said in a May 7 note to clients. On top of that, they’re having trouble competing with rivals from China where production now exceeds demand, the analysts said.

However, Europe’s overarching commitment to the green transition means the bloc is continually looking for ways to help industries it sees as key to supporting that policy goal.

A spokesperson for the European Commission said the EU’s executive arm is working on a new state-aid program to ensure clean-tech companies can build up sufficient manufacturing capacity. A public consultation on the draft framework ended on April 25, and the commission will now review responses before adopting the new plan in June.

Shah says his experience shows that private investors tend to follow once government support is established. “We crowded in $100 billion of private-sector capital to match our money in both 2023 and 2024, into sectors that they previously said they had no interest in investing in,” he said.

Shah, who co-founded San Francisco-based investment firm Generate Capital, announced plans last month to form an advisory-services firm to help green startups. Shah said his work with the 400 companies vetted under Biden’s DOE is separate from that venture, and he’s not being compensated for representing them in Europe.

Countries “need to be quick about it” if they want to attract clean-tech businesses, not least because of the tough financial situation for some of the companies, including the possibility of bankruptcies, Shah said. And if clean techs with viable business models go bust, investors, including those from China, will be able to buy their intellectual property at a steep discount, he said.

Right now, companies hit by Trump’s policies are losing money and are “nervous and confused,” Shah said. So they’re asking, “Is there another place that I could go?’”

What BloombergNEF Says...

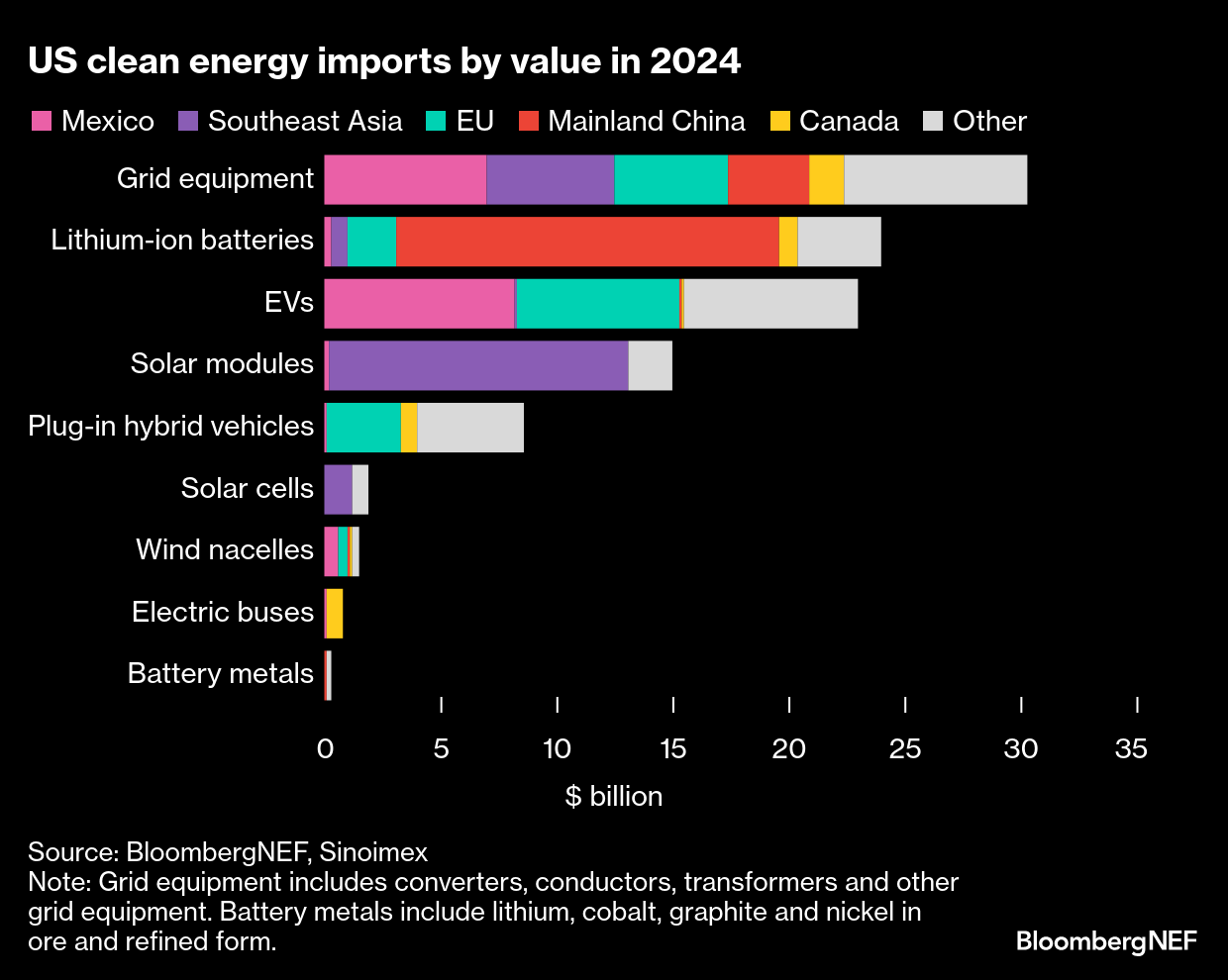

A temporary tariff truce between the US and China would provide much-needed relief to the importers of large-scale batteries — which are increasingly critical to building out lower-carbon US power generation — but would have limited impact on the wider clean energy universe. Some manufacturers of clean energy goods will also be relieved, as much of the pipeline of US battery and solar factories would rely on Chinese inputs.

Click here for the full report by BNEF’s Antoine Vagneur-Jones.

(Adds comment from Shah on private capital in 13th paragraph.)

©2025 Bloomberg L.P.

By