Barclays’ Cau Says European Stocks Cushioned for Mild Downgrades

Apr 16, 2025 by Bloomberg(Bloomberg) -- European equities are pricing in lackluster earnings and economic stagnation, which could help the market maneuver through reporting-season adversity, according to strategists at Barclays Plc.

The team led by Emmanuel Cau said equity valuations indicate no earnings growth while consensus estimates forecast a 6% rise in corporate profits in 2025. This mismatch will “cushion against mild downgrades, but valuations and earnings have downside in case of recession,” the strategists wrote in a note on Wednesday.

With the Stoxx Europe 600 index down 11% from February highs amid uncertainty about the trade war and its impact on the economy, the first-quarter reporting season may “not move the needle much, as markets remain predominantly driven by tariffs headlines and rates gyrations,” said Cau.

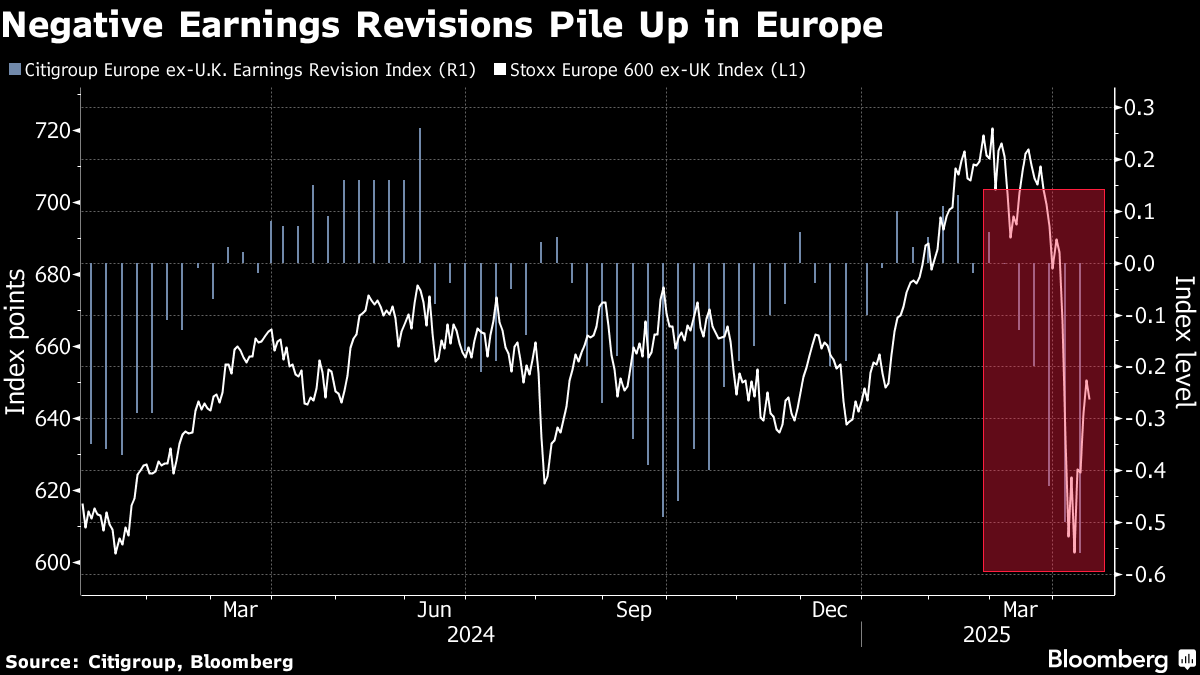

The foggy outlook for Europe has triggered downward earnings revisions as US tariffs deflated investor optimism around Germany’s decision last month to unleash public spending, which was seen as a vital boost for reviving growth across the continent.

“As first-quarter reporting progresses and guidance potentially turns weaker, we expect to see consensus numbers taking a turn lower,” Cau said. “The good news is that price action in equities has moved ahead.”

While European stocks have suffered from the trade war, the euro is near a three-year high against the dollar, rallying at the fastest pace in a decade. The spike in the single currency is “adding to earnings headwinds, but it remains manageable at current levels,” according to the strategists.

Cau saw some room for earnings to beat the lowered expectations, although on the whole, outlooks aren’t likely to provide much visibility due to continued uncertainty.

On Wednesday, Heineken NV — one of the beer brands grappling with US tariffs — gained after its volumes fell less than anticipated and guidance outweighed currency concerns. Meanwhile, ASML Holding NV fell after warning about tariff impact and reporting weak orders.

LVMH shares dropped after the luxury group published disappointing sales on Tuesday as the escalating trade war hit demand for high-end goods in China and the US.

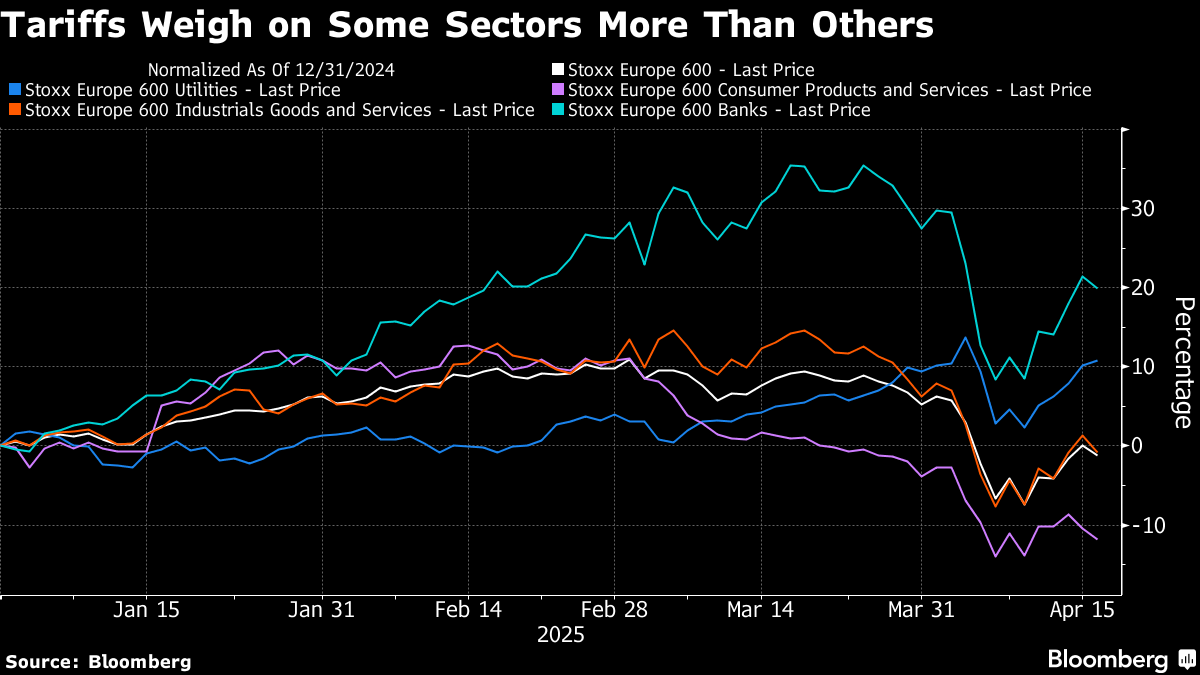

Cau said that there could be significant downside in case of a full-blown recession. Although cyclicals have underperformed in the pullback, they still trade at a valuation premium and haven’t fully priced in the risk of a deeper economic downturn.

Barclays analysts are most positive on earnings for utilities, energy firms, banks and insurers, real estate, software and defense sectors. They are “more cautious” on transport, luxury, construction materials, tech hardware, chemicals and mining.

©2025 Bloomberg L.P.

By