South Africa Budget Under Added Scrutiny Given Trump Aid Tensions

Feb 19, 2025 by Bloomberg(Bloomberg) -- South Africa’s finance minister is under pressure to chart an economic course that navigates the hazards unleashed by Donald Trump’s trade war.

As Enoch Godongwana prepares to deliver his annual budget speech on Wednesday, investors will also look to him to expedite reforms needed to revive flagging economic growth while stabilizing the nation’s precarious finances.

Those steps are needed to ward off the potential threats posed by protectionist US policies, including higher inflation and lower exports. Added to that are concerns that Trump’s recent false claims about South Africa’s land policy and consequent withdrawal of aid signal potential changes to the country’s preferential-trade access to the world’s biggest economy.

“The rise in protectionism and disruption to global trade, including due to tariffs or retaliatory measures, represent downside risks to the global economy and to growth in South Africa,” Tidiane Kinda, the International Monetary Fund’s resident representative to South Africa, said in an interview. “Accelerating the implementation of reforms is critical to potentially help offset the more pronounced external headwinds.”

Trump’s decision to freeze aid to South Africa because of its new land-expropriation laws and “aggressive positions towards the United States and its allies” — including accusing Israel of genocide in the International Court of Justice — has led to a 7.5 billion-rand ($407 million) shortfall for its longstanding HIV programs.

“The US impact on the budget may cause some reshuffling of budgetary items in order to make space or compensation of the withdrawal of USAID,” said Frank Blackmore, lead economist at KPMG South Africa. “Policy is haunted by the Trump administration; it is clear that President Trump wants to be consequential.”

These pressures could make it difficult for the National Treasury to achieve its debt-stabilization goal by the end of March 2026.

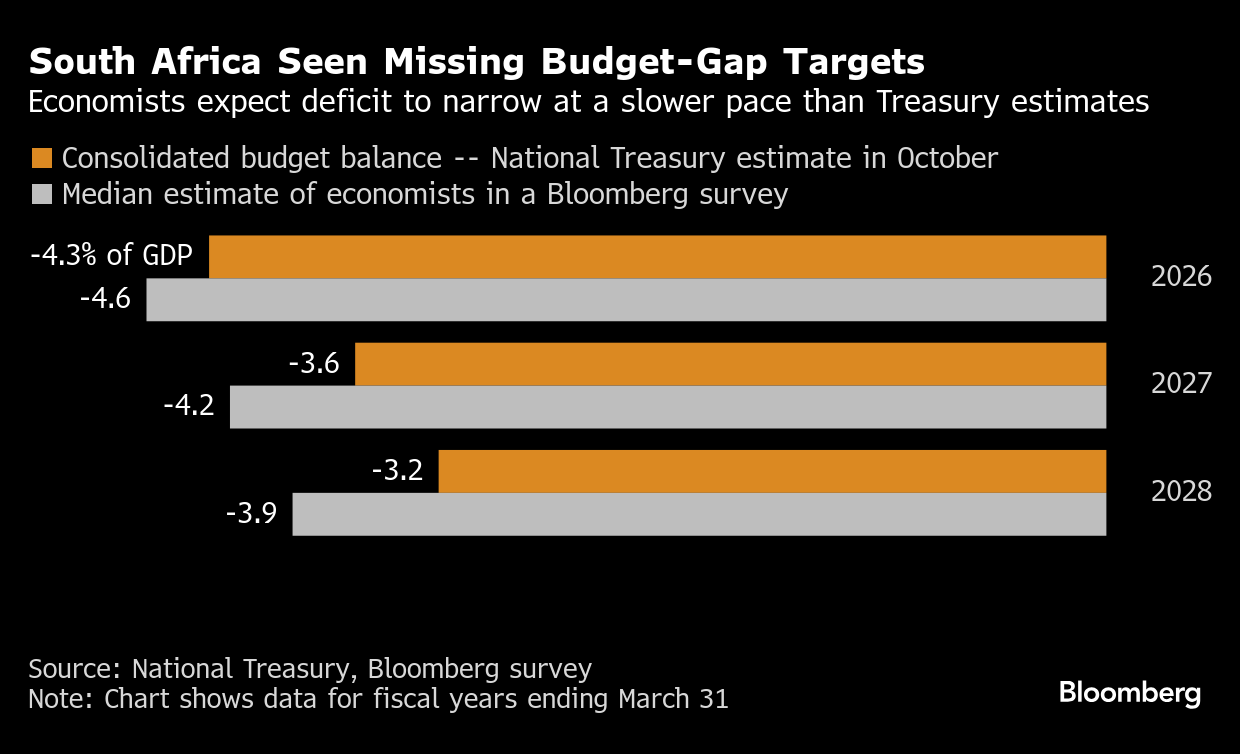

The median estimate of eight economists in a Bloomberg survey is for debt to gross domestic product to peak in 2026-27 at 76.3% and for the Treasury to miss its consolidated budget-deficit targets over the next three years.

The country’s path toward fiscal consolidation is now in the context of “a very uncertain world” said Arthur Kamp, chief economist at Sanlam Investments. “What’s more important is what are we putting in place to deal with these uncertainties, and that’s far more difficult.”

Even so, markets are taking the budget in their stride. The rand was steady and government bonds gained on Wednesday. Overnight implied volatility for the rand versus the dollar rose, though the six-month measure remained close to the lowest in almost seven years. A sale of government debt on Tuesday attracted strong demand, with dealers placing orders for more than four times the amount on offer.

The IMF recommends speeding up reforms at state-owned enterprises including power utility Eskom Holdings SOC Ltd. and rail-and-port operator Transnet SOC Ltd., arguing that would have a powerful positive effect on the entire economy. It foresees the economy growing 1.5% in 2025, compared with its 1.1% forecast for last year.

Most economists polled by Bloomberg expect Godongwana to allocate Transnet funds with strict conditions.

For Transnet, “the government will likely provide some government guarantees to support the entity’s borrowing and then steer it toward blended-finance options, which would include other funding sources too,” said Elna Moolman, head of South Africa macroeconomic research at Standard Bank Group Ltd.

The finance minister is also expected to raise the value-added tax rate on goods and services, along with measures to offset the impact of the increase on the poor, Business Day reported on Wednesday. An increase of as much as two percentage points in the VAT rate — currently at 15% — has been discussed, News24 reported.

The Democratic Alliance, the second-biggest party in South Africa’s ruling coalition, has said it will oppose any tax increases. Its leader, John Steenhuisen, plans to brief the media after Godongwana’s speech to discuss its “resolute position” on the budget process, the party said in a notice.

President Cyril Ramaphosa will convene a special cabinet meeting in advance of the budget speech, according to people familiar with the matter who asked not to be identified because they’re not authorized to speak to the media.

Godongwana is also expected to unveil more details on funding models to encourage the private sector to invest in infrastructure projects. Earlier this month, Ramaphosa said the nation will spend more than 940 billion rand on infrastructure over the next three years and is engaging financial institutions and investors to unlock a further 100 billion rand in funding.

Sign up here.

(Updates market moves, bond-auction results in 10th paragraph.)

©2025 Bloomberg L.P.

By