AI Infrastructure Trade Roars Back as Tech Giants Boost Spending

Jun 09, 2025 by Bloomberg(Bloomberg) -- Shares of companies that provide infrastructure for artificial-intelligence development are soaring after a tumble earlier this year, as spending from Big Tech restores investor confidence in the volatile sector.

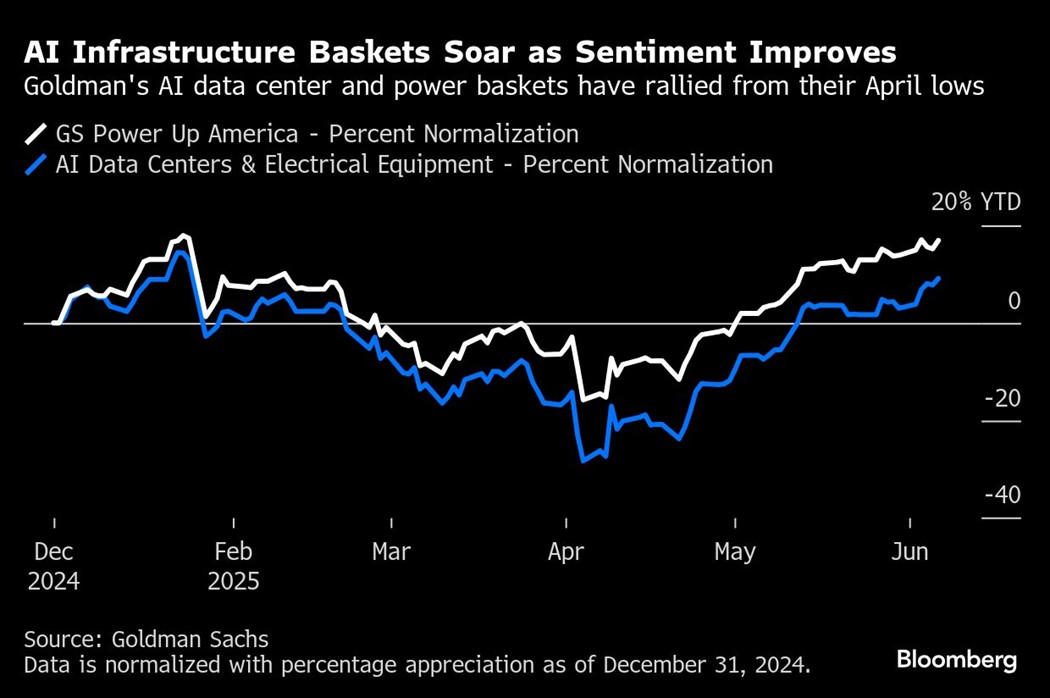

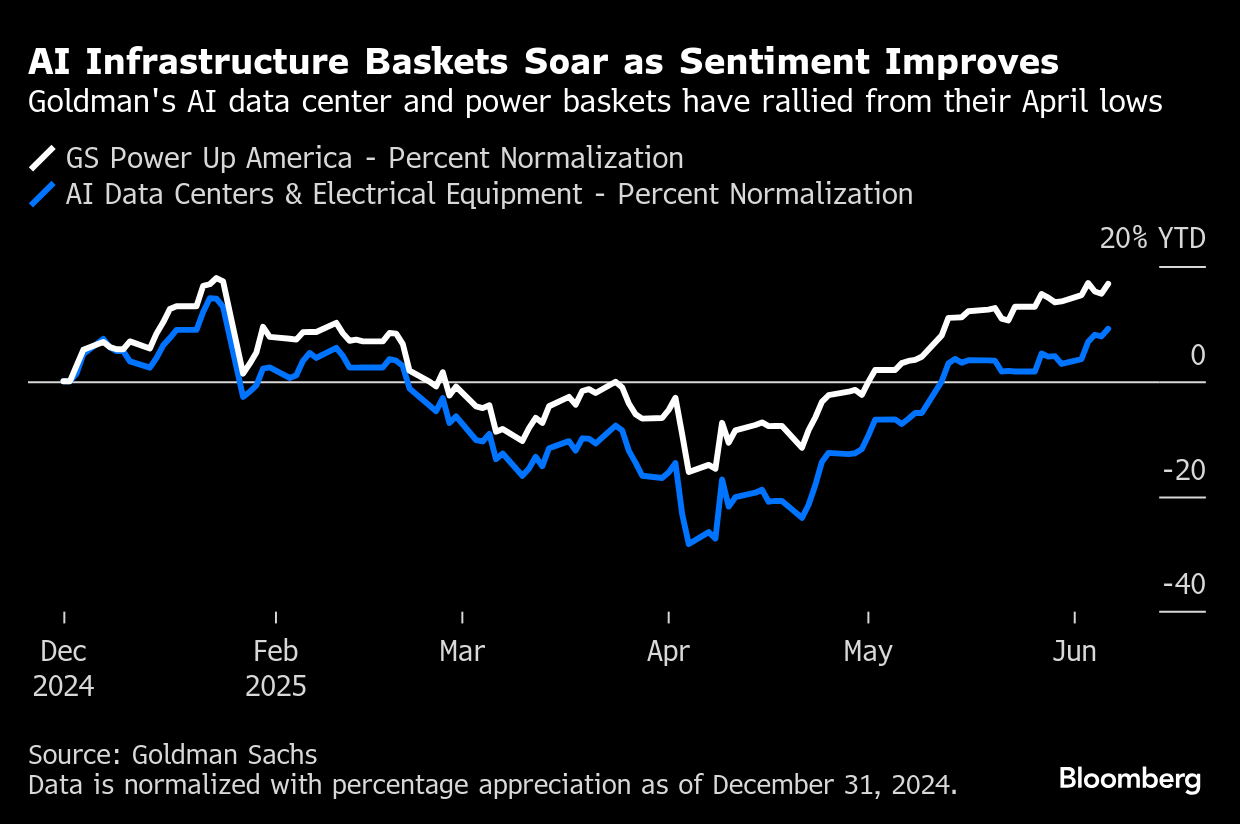

Two baskets tracked by Goldman Sachs Group Inc. — one tracking AI data centers and electrical equipment stocks and another that follows shares of companies that supply power for data centers — are up 52% and 39% from their April lows, respectively. Individual standouts include Vertiv Holdings Co., which has notched a 94% gain since April 4, as well as Constellation Energy Corp., up 75% in that same period.

Helping drive those moves is evidence that the world’s largest technology companies — including Amazon.com Inc., Alphabet Inc., Microsoft Corp. and Meta Platforms Inc. — are continuing to spend big on artificial intelligence, assuaging doubts over whether money will continue flowing to the firms that are essential to AI infrastructure. Forecasts for capital expenditures to support AI demand are up by 16% since the beginning of the year, according to Bloomberg Intelligence’s Robert Schiffman.

“Earnings season reminded investors that generative-AI doesn’t run on buzzwords — it runs on concrete, copper and gigawatts,” said Dave Mazza, chief executive officer of Roundhill Financial Inc.

Shares of AI infrastructure companies enjoyed a blistering run last year as excitement over the business potential of artificial intelligence sparked a spending spree on data centers to fuel the development of programs like OpenAI’s ChatGPT and Anthropic’s Claude.

A strong start in 2025 unraveled as worries over competition from China’s DeepSeek startup and broader uncertainty over global trade led investors to question whether the billions of dollars of investment was justified. Concerns that tech giants such as Microsoft were walking away from data center projects exacerbated the selloff.

Investor sentiment broadly improved when President Donald Trump said he was pausing most of the tariffs he had rolled out in early April, fueling a rally that pushed the S&P 500 Index near an all-time high hit in February.

The latest earnings season helped cement investor confidence, as big tech companies indicated they were continuing to lay money out on AI development. Among these was Meta, which signaled that the hundreds of billions in AI-spending it had flagged earlier in the year was still on track.

“The largest hyperscalers — Amazon.com, Alphabet, Microsoft and Meta — benefit from massive cash hoards and access to low-cost capital as they continue increasing capital spending to support future AI demand,” BI’s Schiffman wrote.

Meanwhile, recent corporate deals also suggest spending remains intact. Amazon, for instance, plans to invest $10 billion in North Carolina to expand its data center infrastructure to support AI and cloud computing technologies.

Of course, investor confidence in AI could take another hit if the trade war once again heats up and sparks concerns that an ebb in global economic growth will see companies pull back on AI spending.

“If the economy falls into a recession, margins will be under pressure, companies will be forced to layoff workers and cut spending on AI,” said Max Gokhman, deputy chief investment officer at Franklin Templeton Investment Solutions, adding that such a scenario wasn’t his base case.

So could intensified competition from DeepSeek, which stunned the AI world in January by rivaling the systems of much-larger US developers despite being built at what it said was a fraction of the cost.

The Chinese startup said last month that its upgraded artificial-intelligence model can perform mathematics, programming, and general logic better than the previous version, while hallucinating less.

For now, however, enthusiasm for infrastructure companies is high, with support from the White House providing an additional tailwind. Trump earlier this year unveiled Stargate, an OpenAI data center that includes some of the biggest US tech companies, and plans to spend $500 billion on AI infrastructure over the next four years.

“Demand for AI infrastructure is only getting higher,” Gokhman said.

©2025 Bloomberg L.P.

By