Traders’ Guide to Navigating South Korea’s Presidential Vote

Jun 01, 2025 by Bloomberg(Bloomberg) -- South Korea’s presidential vote is putting the spotlight on energy, brokerage and domestic-focused shares in the country’s outperforming $1.8 trillion equity market.

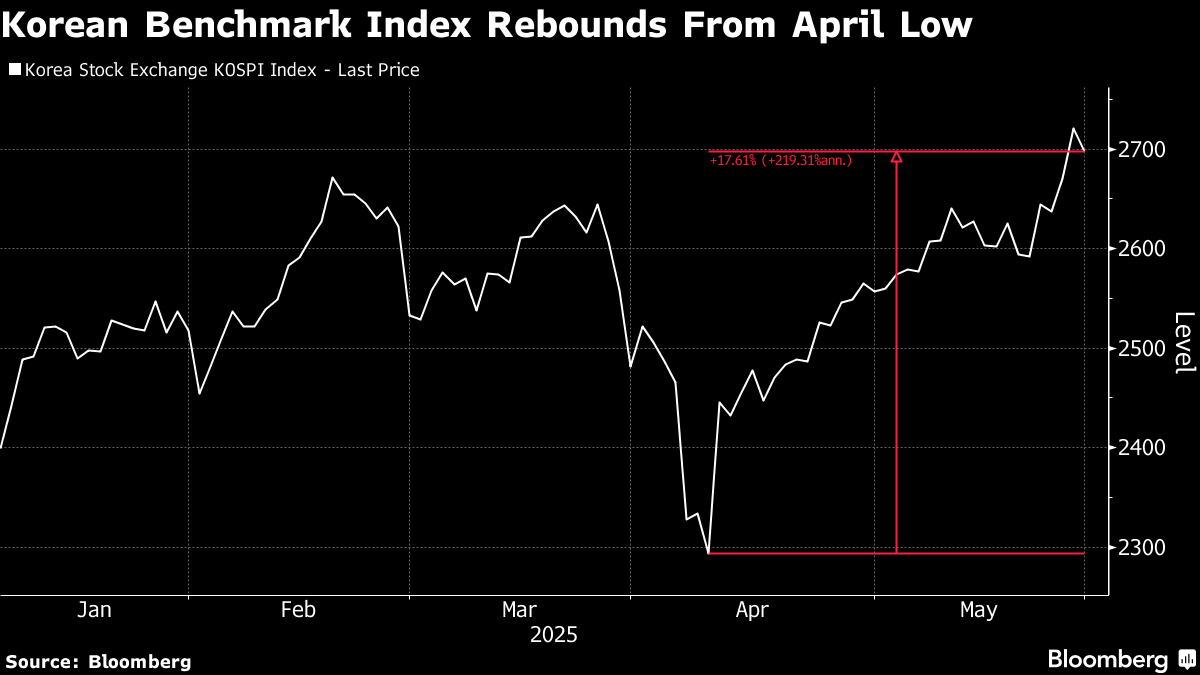

The nation’s benchmark Kospi has outpaced a regional gauge over the past week ahead of Tuesday’s election, which will cap six months of political upheaval following Yoon Suk Yeol’s shock martial law decree. A new administration will likely mean fresh stimulus measures and the rollout of an extra budget, boosting bond yields. Political certainty could help the stock market.

“There will be re-rating of Korean stocks regardless of the results,” said Kim Ki Baek, a portfolio manager at Korea Investment Management Co. Tax changes and corporate governance laws are main factors for such optimism. The benchmark is up 12% this year, beating its Asian peers.

Front-runner and Democratic Party candidate Lee Jae-myung has vowed to almost double the Kospi’s advance to around 5,000 points and renew efforts to heighten corporate boards’ accountability to shareholders. His rival, Kim Moon-soo of the People Power Party, has also pledged to support the market through tax breaks for long-term shareholders and lower levies on dividend incomes.

Here are the assets and sectors that could be most impacted by the election:

Brokerage Stocks

Lee’s promise to aid equities could further bolster the nation’s brokerage stocks on expectations for bigger trading volume. A gauge of Korean securities firms is on track for its best year ever after skyrocketing 49%.

Potential winners include Mirae Asset Securities Co. and retail-focused Kiwoom Securities Co., although some investors may take profits after the stocks’ recent advances.

“Those who are betting on the index’s gain are heading to brokerage shares, as they will get bigger commissions as more investors trade stocks,” said Han Sang-Kyoon, chief investment officer at Quad Investment Management Co.

‘Value-up’ Winners

A plan by Lee to institutionalize the cancellation of treasury stock, or a firm’s repurchased shares that haven’t been retired, could spur an increase in valuations for many conglomerates. That’s because some investors perceive large firms as using treasury shares to advance agendas that hurt minority shareholders.

While it’s not clear if treasury share cancellations will become mandatory, there will likely be a penalty for holding large quantities, Quad’s Han said. He sees upside for LS Corp., SK Inc. and Samsung C&T Corp., given their sizable treasury stock and limited insider ownership.

A Kim presidency may pressure shares of large holding companies as he has advocated for less comprehensive corporate reform.

Energy

A Kim victory could help nuclear shares extend advances, given he has supported the use of such energy as a cheap and safe source of power generation. That could also weigh on renewable energy stocks like HD Hyundai Energy Solutions Co.

Meanwhile, Lee has called for expanding sources of renewable energy and has pledged to shut down all coal-fired power plants by 2040. He also opposes building new nuclear reactors.

Domestic Consumption

Both candidates are largely expected to roll out stimulus measures after the election, which could shore up domestic demand for retailers. Lotte Shopping Co. and Hyundai Department Store Co. are up more than 48% in 2025, on course for their biggest annual surges in more than a decade on buoyant consumer sentiment.

Foreign funds have also favored Korean banks such as KB Financial Group Inc. Enhanced shareholder returns and upbeat consumer attitudes have driven a 22% jump in a sector gauge this year.

Yiping Liao, a portfolio manager at Franklin Templeton Emerging Markets Equity, said she’s positioned in “inexpensive domestic stocks.” Korean banks “are already demonstrating that they are improving their shareholder returns and I find the valuations to be quite reasonable as well,” she added.

Bonds

Lee and Kim have both repeated calls for large fiscal stimulus, with Kim recently saying that a fiscal blueprint worth 30 trillion won ($21.7 billion) was needed.

Should Lee be elected, investors are likely to price in the probability of a supplementary budget later in 2025 and anticipate significant spending for 2026, BNP Paribas Rates and FX Strategist Chandresh Jain said in a note, adding this would further steepen the local yield curve.

If Kim wins, investors could unwind bets on curve steepening, while outright rates would rally on expectations of further easing from the Bank of Korea, Jain said. On Thursday, the central bank trimmed its interest rate by a quarter percentage point and flagged the likelihood of more cuts.

©2025 Bloomberg L.P.

By