Elliott Urges RWE to Boost Buybacks After Building 5% Stake

Mar 24, 2025 by Bloomberg(Bloomberg) -- Elliott Investment Management LP called on RWE AG to ramp up buybacks after amassing a stake of close to 5% in the German utility.

RWE has faced intense pressure from investors due to a falling share price and its focus on a huge investment program. The firm last week signaled it was keeping the option open for further share purchases — after already announcing a €1.5 billion ($1.6 billion) buyback last November — but hasn’t yet specified any details.

“We share the market’s disappointment with the lack of clarity regarding the company’s commitment to enhance shareholder returns,” Elliott said in a statement. “There is a compelling opportunity to significantly increase and accelerate the ongoing share buyback program.”

Bloomberg reported in November that Elliott, one of the world’s most aggressive activist investors, had built up a sizable stake in RWE and was pushing management to consider a buyback. The hedge fund has been snapping up stakes in several large energy companies — such as BP Plc — to push for changes as transition efforts lose support.

“We are in continuous dialog with our investors and other financial market participants, including Elliott,” RWE spokesperson Stephanie Schunk said in an email, adding that the company doesn’t comment on details of discussions with specific investors.

An increasingly uncertain environment for renewables investments has forced RWE to put some of its previous spending plans on hold. Last week, it shaved €10 billion from its planned investment on green technologies by the end of the decade — particularly citing risks in the US following President Donald Trump’s election.

RWE has been criticized by activist investors for several years. The firm has one of the largest renewable energy portfolios in Europe and previously ruled out buybacks to focus on long-term growth, as well as rejecting suggestions to quickly separate its lignite and clean-energy units.

“The reluctance of RWE management to frame and execute on a value enhancing strategy comes to haunt the company now,” said Benedikt Kormaier, managing director of Enkraft Capital, a vocal long-time RWE shareholder.

He urged the utility to do more than just increase capital returns to shareholders and focus on its core strengths in European power generation.

Meanwhile, RWE’s capital expenditure cuts and offshore wind disposals could allow for further share purchases totaling €2.5 billion from 2025 to 2027, according to Ahmed Farman, an analyst at Jefferies International Ltd. In a high case, buybacks could reach as high as €4 billion if there are further capex cuts and disposals, he wrote in a report last week.

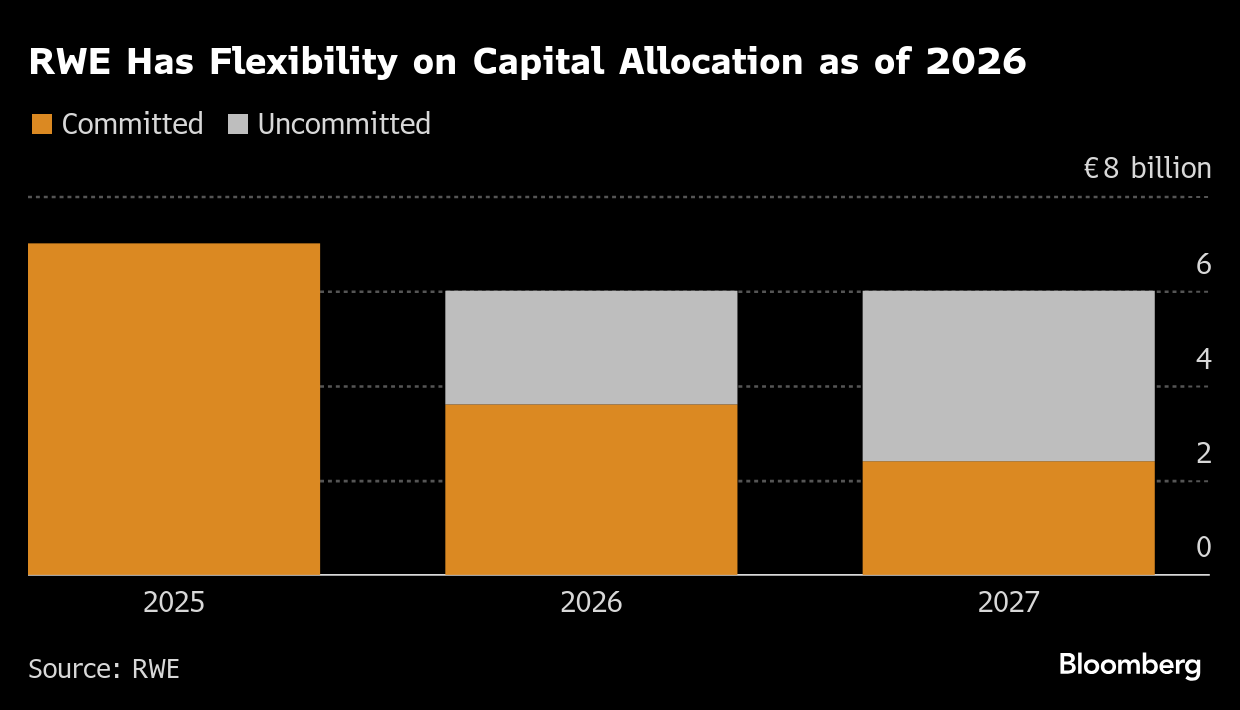

RWE signaled in its earnings presentation to investors last week that it will have greater flexibility on spending from next year onwards. “We will decide on the optimal capital allocation for the flexible part early next year, when we have clarity on future US and German investments,” said spokesperson Schunck.

In Monday’s statement, Elliott welcomed RWE’s decision to reduce its 2025-2030 spending program, while also implementing stricter investment criteria and accelerating a strategy to divest stakes in projects. RWE’s shares jumped as much as 3.8% following the release.

(Updates throughout text with shareholder quote, stock moves and RWE comment.)

©2025 Bloomberg L.P.

By