European Gas Rebounds as Prospects of Higher Demand Buoy Market

May 08, 2025 by Bloomberg(Bloomberg) -- European natural gas prices rose, snapping earlier losses, as improving prospects for energy demand and algorithmic fund buying helps buoy the market ahead of a vote on more relaxed fuel-storage rules.

Benchmark futures rose as much as 2.6% on Thursday, erasing earlier losses. While recent volatility has reflected concerns about the ongoing trade war and the impact it will have on energy demand, signs of progress that some trade deals might be clinched are alleviating concerns.

In tandem with those moves, algorithm-focused funds known as commodity trading advisers — which normally provide an early look at the mood of the market — turned more bullish on their positions on European gas. Traders are also focusing on a European Union vote on fuel stockpiling rules, which aims to lower a target for filling gas storage sites by Nov. 1 to 83%.

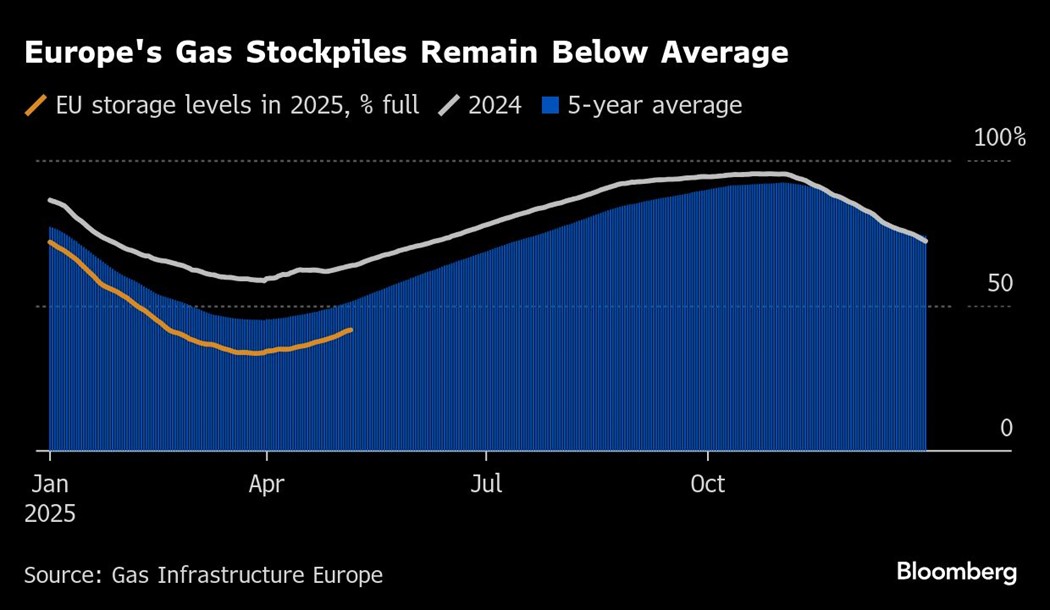

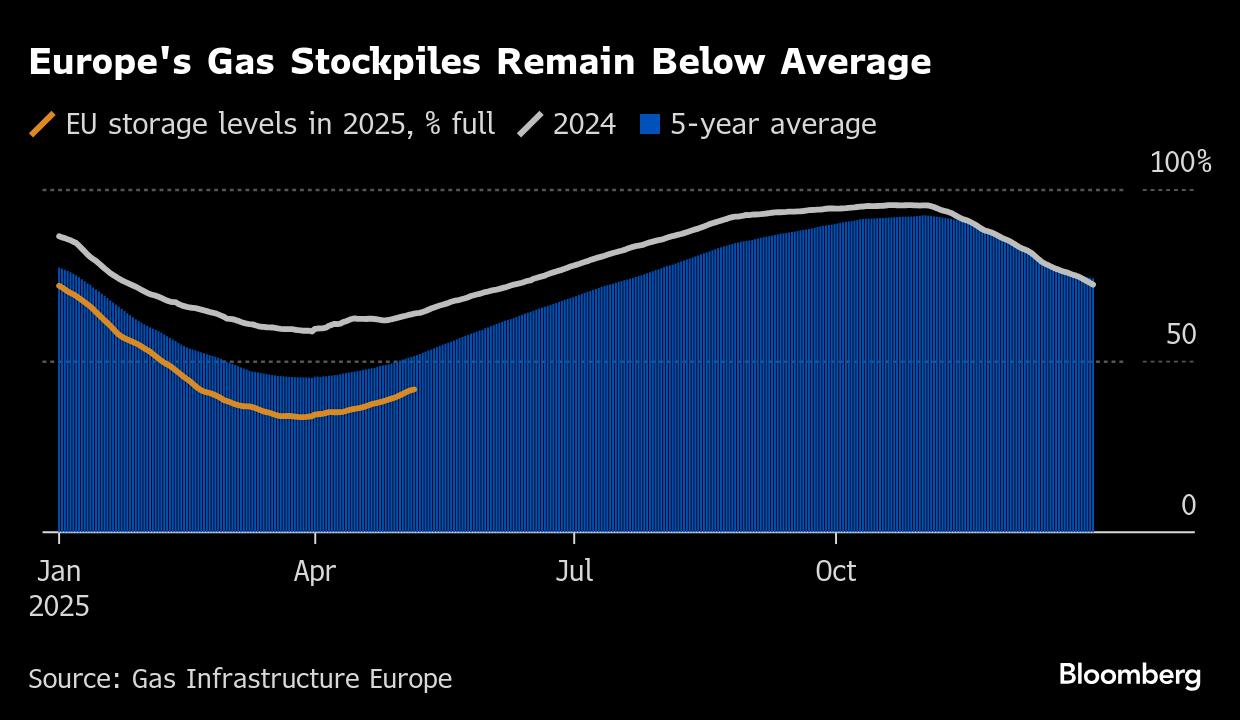

The discussion has been closely watched by Europe’s gas market participants after a colder winter left inventories more depleted than usual, sparking speculation about how feasible it will be to replenish them in time for the next heating season. While concerns about the US-led trade war and its impact on energy demand have pushed prices lower, the global supply balance for the fuel remains fragile and the task to refill storage sites will be challenging.

The EU is also working on plans to phase out Russian energy by 2027, which caused prices to jump earlier this week. The region will need to keep expanding other sources of supply to make up for lost flows from Russia, which accounted for about 40% of its gas needs prior to the full-scale invasion of Ukraine.

Larger purchases of US liquefied natural gas are one alternative, which is being discussed as part of trade negotiations with the country. President Donald Trump is expected to announce a trade agreement with the UK at a news conference Thursday morning in Washington, according to people familiar with the matter.

In the meantime, competition with other buyers of gas still risks sending prices higher, with summer heat waves in parts of Asia frequently triggering demand spikes. LNG imports into northwest Europe have slowed down compared to the first week of April, particularly to the UK, after a recent price slump helped revive some buying activity in Asia.

Dutch front-month futures, Europe’s gas benchmark, rose to € a megawatt-hour by 12:21 p.m. in Amsterdam.

©2025 Bloomberg L.P.

By